Capacity Statistics - Oct 2022

CargoAi features the air cargo capacity statistics report for Oct 2022 with the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month. Stay tuned with CargoINTEL for in-depth analytics and breakdown of the global air cargo market and trends.

Highlights

- After two months of consistent decline of global capacity owing to slump in cargo volumes across the globe, stability in capacity could be observed in October 2022. The global capacity in October 2022 has remained verging around the September 2022 levels. This congruity in capacity for the second consequent month can be majorly attributed to the strengthening of demand from the Asia-Pacific region. The second-half of October showed double digit volume increase from Asia-Pacific by 11%, as per WorldACD.

- The rise in tonnages could be the probable result of some notable facts like the resurfacing of the markets after the China’s Global Week closure in the first week of October, easing down of some big markets like Hong Kong and Japan from the COVID restrictions, and a moderate seasonal increase in tonnages towards Q4 of the year.

- The global freighter capacity has reduced by 5% MoM in October 2022, whereas the belly capacity has seen an increase by 3%.

- The reported positive signs of increasing volumes from Asia-Pacific to Europe, North America and Middle-East are indicative of a corresponding increase in capacity in the last two months of Q4.

- As per WorldACD, the global rates have weathered an average hike by 3%. The rates from Asia Pacific and from Latin America have increased by 4%. The increase in rates from Latin America denotes the seasonal surge in demand, which collaterally justifies a 13% MoM rise in belly capacity in October. While the capacity from Asia-Pacific to North America has gone down by 9% MoM in October, the increased rates by 7% on this sector creates the scope for more freighter operation.

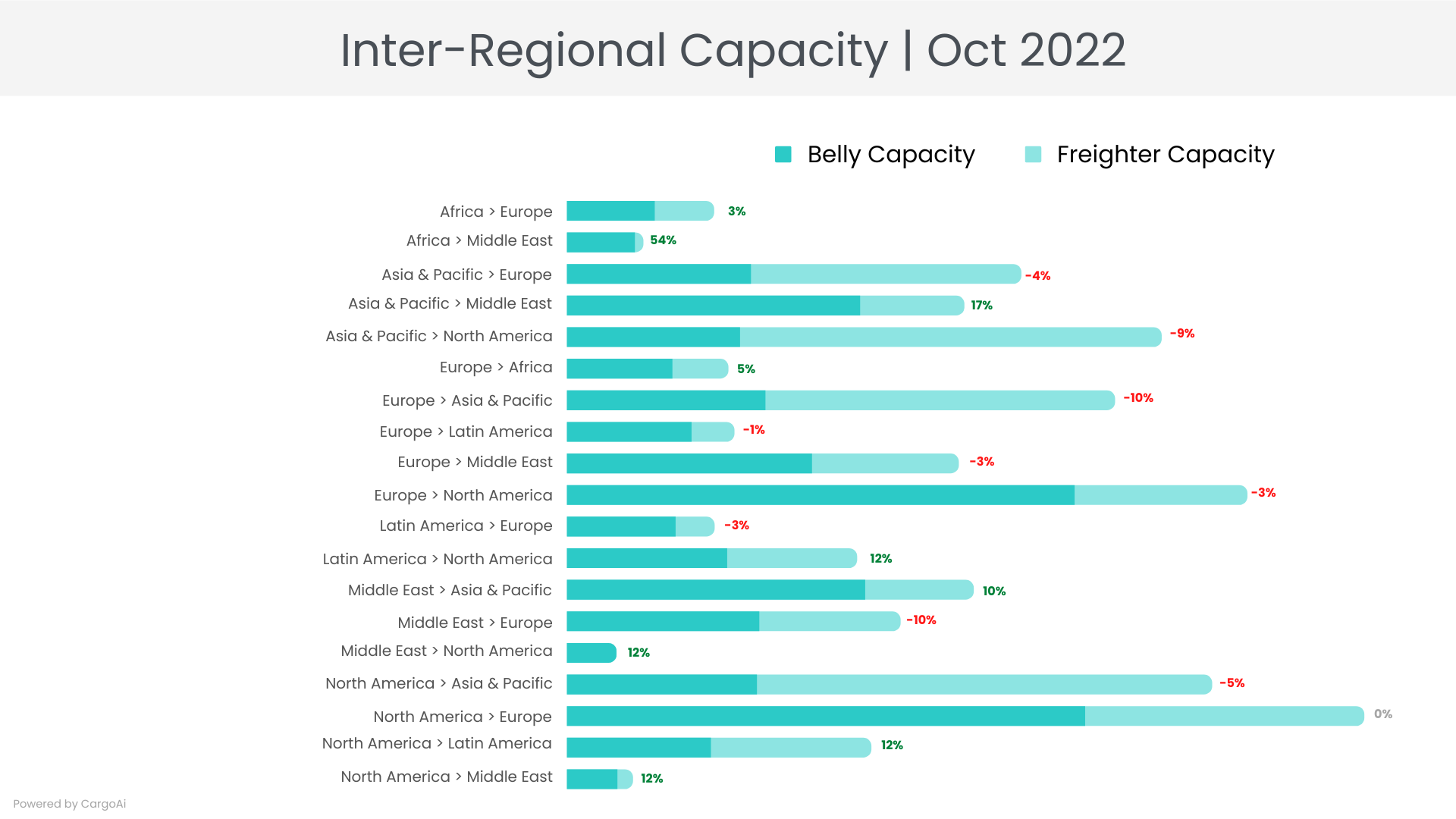

Top Inter-Regional Cargo Capacity

| Region | Capacity in Oct 2022 (100k tons) | Variance vis-a-vis Oct 2022 |

|---|---|---|

| Africa | 60.7 | 3% |

| Africa | 31.4 | 54% |

| Asia & Pacific | 187.9 | -4% |

| Asia & Pacific | 164.3 | 17% |

| Asia & Pacific | 246 | -9% |

| Europe | 66.6 | 5% |

| Europe | 226.7 | -10% |

| Europe | 69.1 | -1% |

| Europe | 162 | -3% |

| Europe | 281.5 | -3% |

| Latin America | 60.9 | -3% |

| Latin America | 119.9 | 12% |

| Middle East | 168.2 | 10% |

| Middle East | 137.9 | -10% |

| Middle East | 20.3 | 12% |

| North America | 266.9 | -5% |

| North America | 329.9 | 0% |

| North America | 125.8 | 12% |

| North America | 27.1 | 12% |

Observations

- From Asia-Pacific, although there is a growth in tonnages in October, the freighter capacity has gone down by 7% as compared to the previous month. On the other hand, the belly capacity has seen a MoM increase by 6% in October.

- While the freighter capacity has reduced from all regions in October vis-à-vis September, that from Africa has raised up by 34%. The most noteworthy positive variance is the steep increase in capacity from Africa to Middle-East by 54%.

- The underpinnings for this trend have to be the increasing demand for Africa bound cargo and the growing global investments in the African market. The operation of charter aircrafts and scheduled flights to carry mobile phones, pharma and e-commerce cargo have been increased by major African carriers like Astral Aviation, Kenya Airways, Ethiopian Airlines, coupled with the increase in capacity by the Middle-Eastern carriers.

- The capacity from Asia-Pacific to Middle-East has rose up by 17% in October as compared to September, as a result of the reinstating belly and freighter capacities of the major Middle-Eastern carriers. Other reasons are the increase in scheduled flights between North America and Australasia by United Airlines and American Airlines; and the commencement of new routes by airlines like Korean Air, Air Premia, Air Vistara to the aforesaid regions.

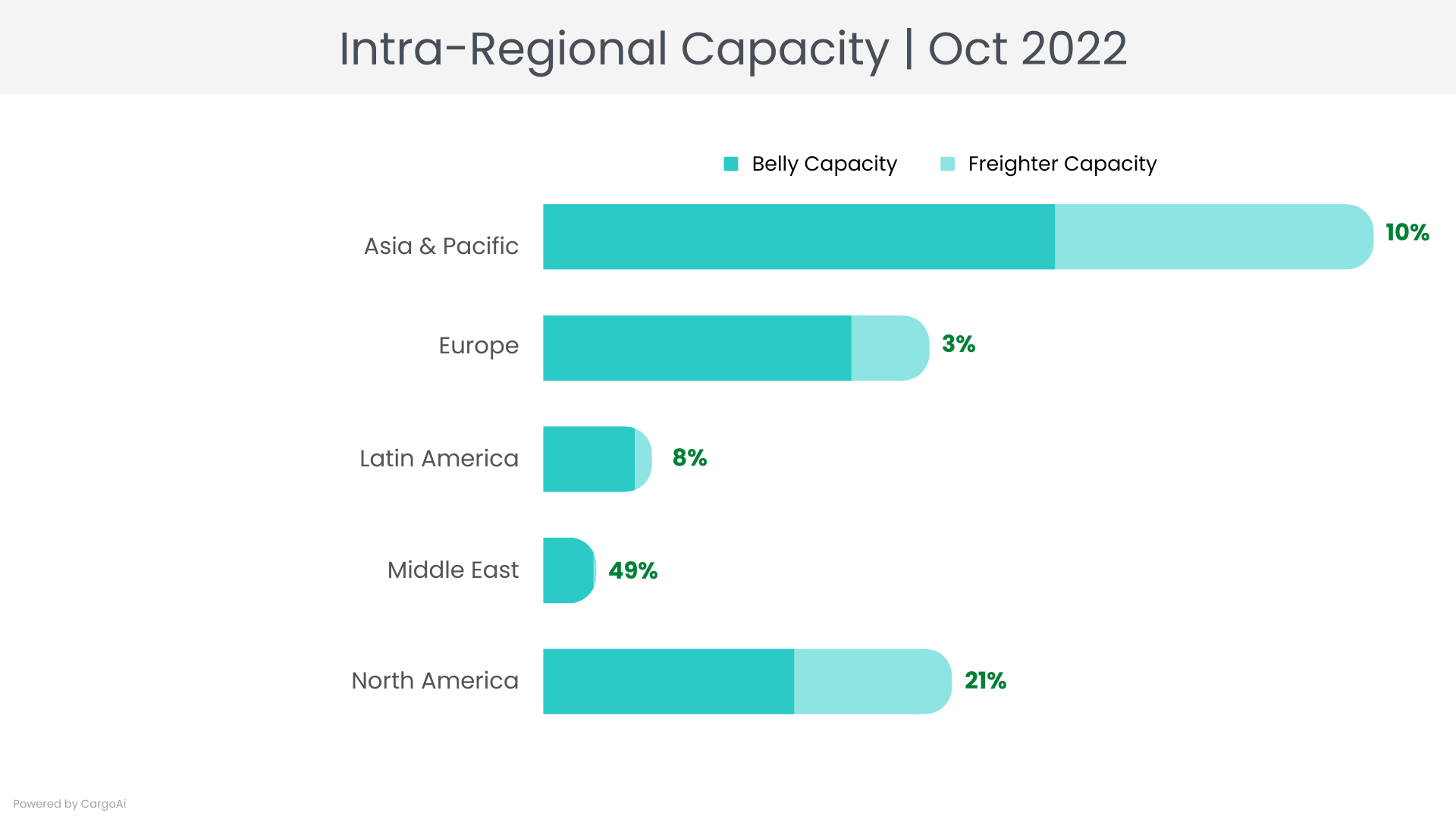

Top Intra-Regional Cargo Capacity

| Region | Capacity in Oct 2022 (100k tons) | Variance vis-a-vis Oct 2022 |

|---|---|---|

| Asia & Pacific | 2479.8 | 10% |

| Europe | 1152 | 3% |

| Latin America | 322.7 | 8% |

| Middle East | 156.6 | 49% |

| North America | 1219.5 | 21% |

Observations

- In October 2022, the capacities within the major regions of the world have increased significantly as compared to the previous month, attributed to the easing of COVID restrictions in several countries, and a seasonal worldwide increase in demand for cargo.

- The major growth in capacities is observed within Middle-East by 49%, North America by 21% and Asia-Pacific by 10%.

- The significant upsurge in capacity within Middle-East is a result of Qatar Airways’ new freighter routes to Saudi Arabia and added frequencies in the Gulf routes.

- The belly capacity within Europe has increased by 6% which is mainly due to the increased movement of passengers.

- The overall capacity within Latin America has also increased by 8%, due to the increase in demand in major sector like Mexico to Brazil.

- The North American carriers like Allegiant Air, American, Avelo, Breeze, Contour, Delta, Spirit and United launched 20 new routes in October 2022 within the region that consequently increased the belly capacity within the region.

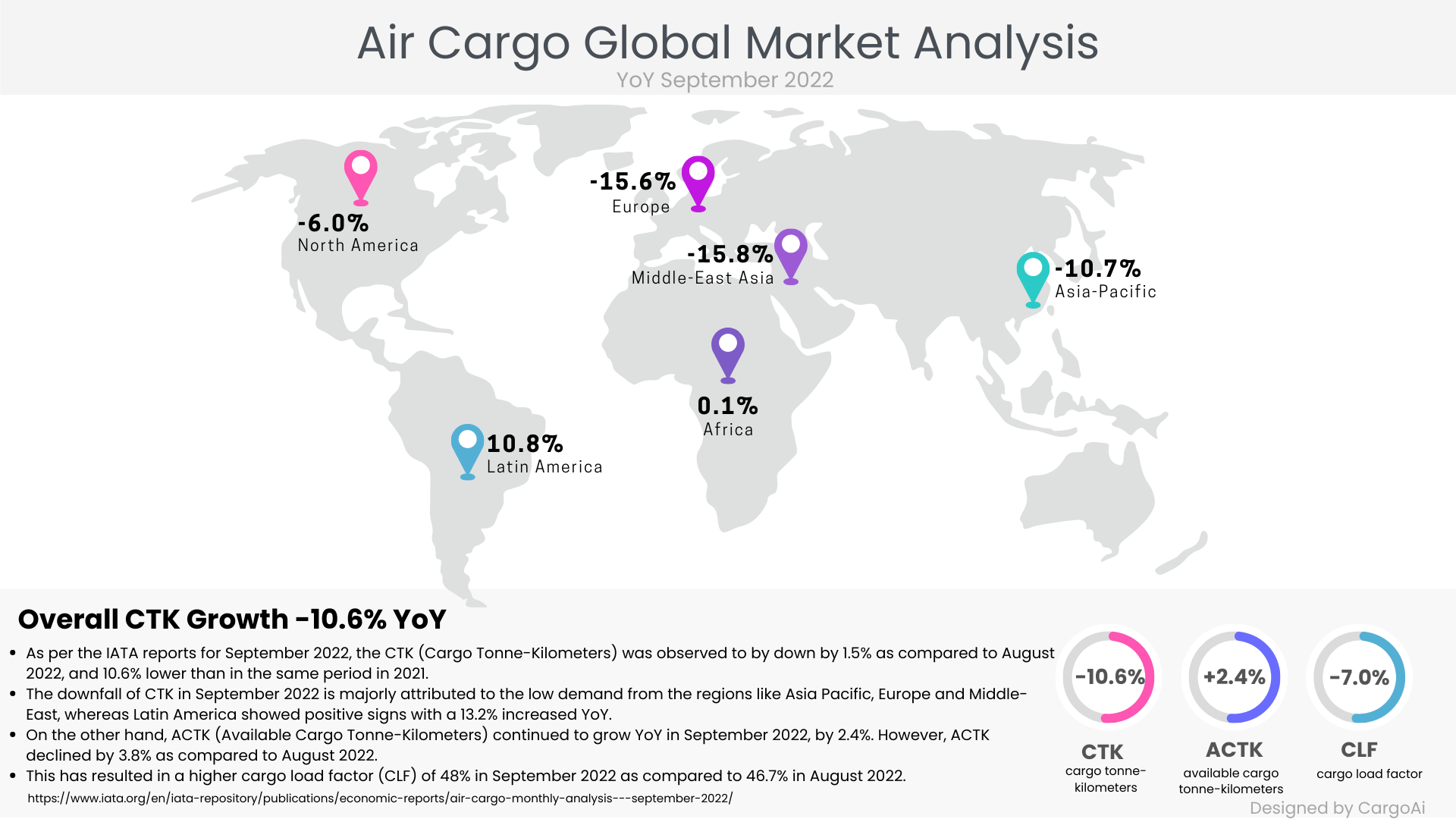

Air Cargo Global chargeable weight analysis

Observations

- An YoY comparison of worldwide rates shows a slump in rates by 17% in October 2022 as compared to October 2021, which reciprocates the increasing capacity and the subsequent competition. However, the rate levels are still much higher than pre-COVID era.

- Despite the positive signs for air cargo in Q4, the worldwide chargeable weight fails to catch-up to the 2021 levels. While there has been a 4% surge in capacity in October 2022 as compared to the same period in 2021, the global chargeable weight is still down by 15%. The major YoY variance is from Asia Pacific (-22%) and Middle-East (-26%).

- As per the IATA reports for September 2022, the CTK (Cargo Tonne-Kilometers) was observed to by down by 1.5% as compared to August 2022, and 10.6% lower than in the same period in 2021.

- The downfall of CTK in September 2022 is majorly attributed to the low demand from the regions like Asia Pacific, Europe and Middle-East, whereas Latin America showed positive signs with a 13.2% increased YoY.

- On the other hand, ACTK (Available Cargo Tonne-Kilometers) continued to grow YoY in September 2022, by 2.4%. However, ACTK declined by 3.8% as compared to August 2022.

- This has resulted in a higher cargo load factor (CLF) of 48% in September 2022 as compared to 46.7% in August 2022.

Resources:

- www.worldacd.com

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-monthly-analysis---september-2022/

- https://www.logupdateafrica.com/air-cargo/africas-air-cargo-industry-primed-for-growth-despite-all-odds-1346647

- https://www.routesonline.com/news/29/breaking-news/298738/50-new-routes-starting-in-october-2022/

- https://aircargoeye.com/qatar-cargo-responds-to-burgeoning-middle-east-air-trade-connectivity/

- https://airserviceone.com/last-month-in-north-america-monday-31-october-2022/

RECENT POSTS