Capacity Statistics - Nov 2022

CargoAi features the air cargo capacity statistics report for Nov 2022 with the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month. Stay tuned with CargoINTEL for in-depth analytics and breakdown of the global air cargo market and trends.

Highlights

- CargoINTEL observed certain stability in the global air cargo market in October 2022 signaling a sound start to Q4 of the year. However, the market in November 2022 is again cohering to the pre-October consistency of declining capacity.

- Some of the strongest regions worldwide have marked an acute decline in capacity, majorly attributed to the reduction in demand and volumes. The overall capacity recorded in November is 4% lower than in October.

- The globally indexed belly capacity has reduced to 1350K MT in November as compared to 1560K MT in October, by a considerable double-digit margin of -13%.

- Whereas, the freighter capacity registered in November indicates a rise by 7% to 1320K MT from 1225K MT in October.

- The reasons for the overall reducing capacity, is eminently the declining air cargo market towards the end of the year; paralleled with the reduction in chargeable weight caused by Thanksgiving in USA, the pertaining geo-political disruptions in Europe, and the COVID restrictions in China.

- As per WACD, despite the decreasing outbound tonnages from most major regions, the average yield has remained stable.

- Comparing the scenario YoY, the tonnages are down in November 2022 by -18% whereas the capacity is slightly up by 1%. The most notable YoY reductions are observed from Asia-Pacific (-29%), Middle East (-22%), North America (-20%) and Europe (-9%).

Top Inter-Regional Cargo Capacity

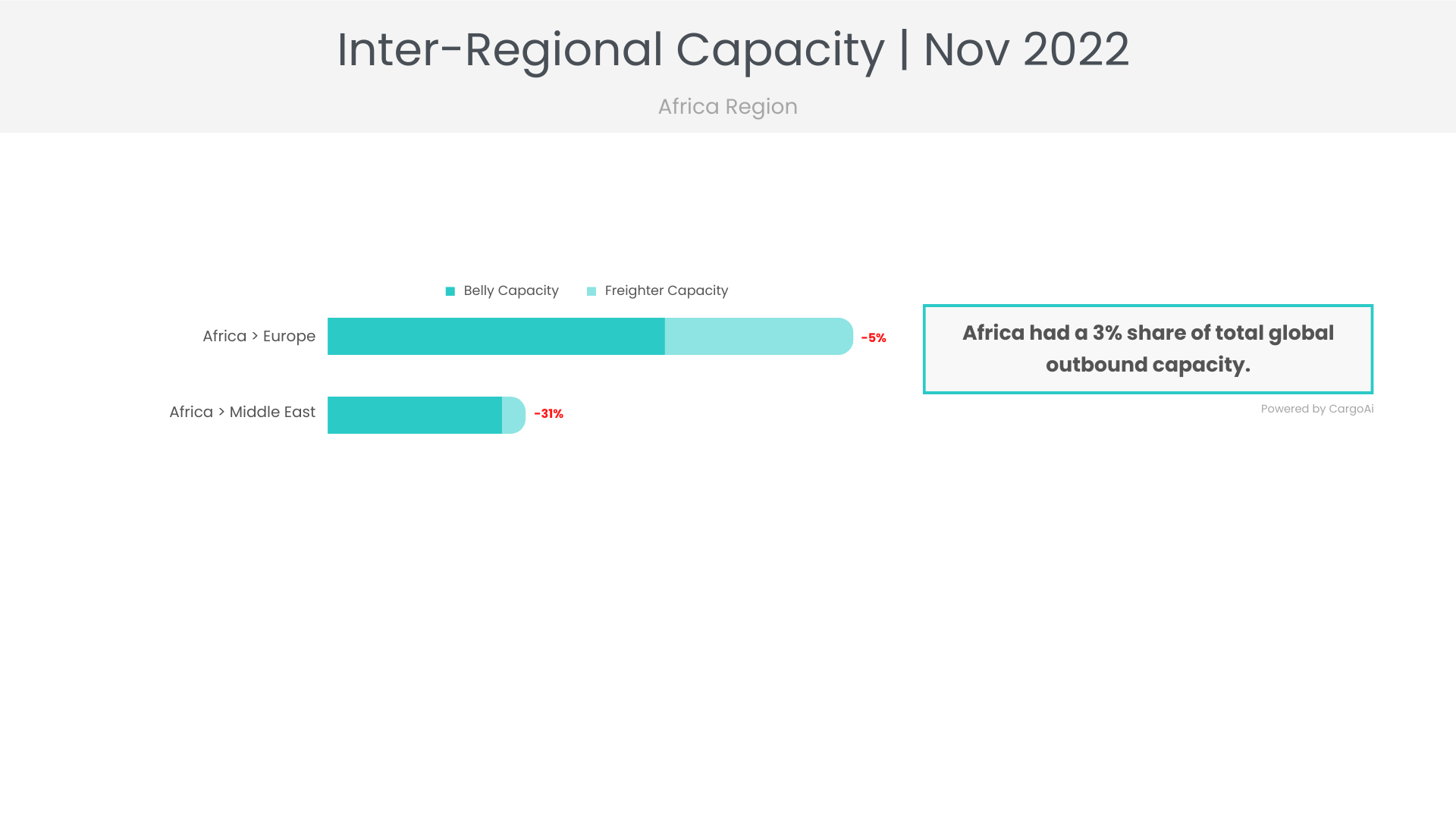

Africa Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Africa | 57.7 | 11% |

| Africa | 21.7 | 4% |

Observations

- The capacity from Africa to Europe and the way back has remained stable in November, whereas a sharp decline of 31% was observed from Africa to Middle-East.

- The belly capacity from Africa to Middle-East has reduced 32% to 19K MT in November from 27K MT in October. This could be attributed to the grounding and cancellation of more than 20 Kenya Airways flights due to the strike by pilots.

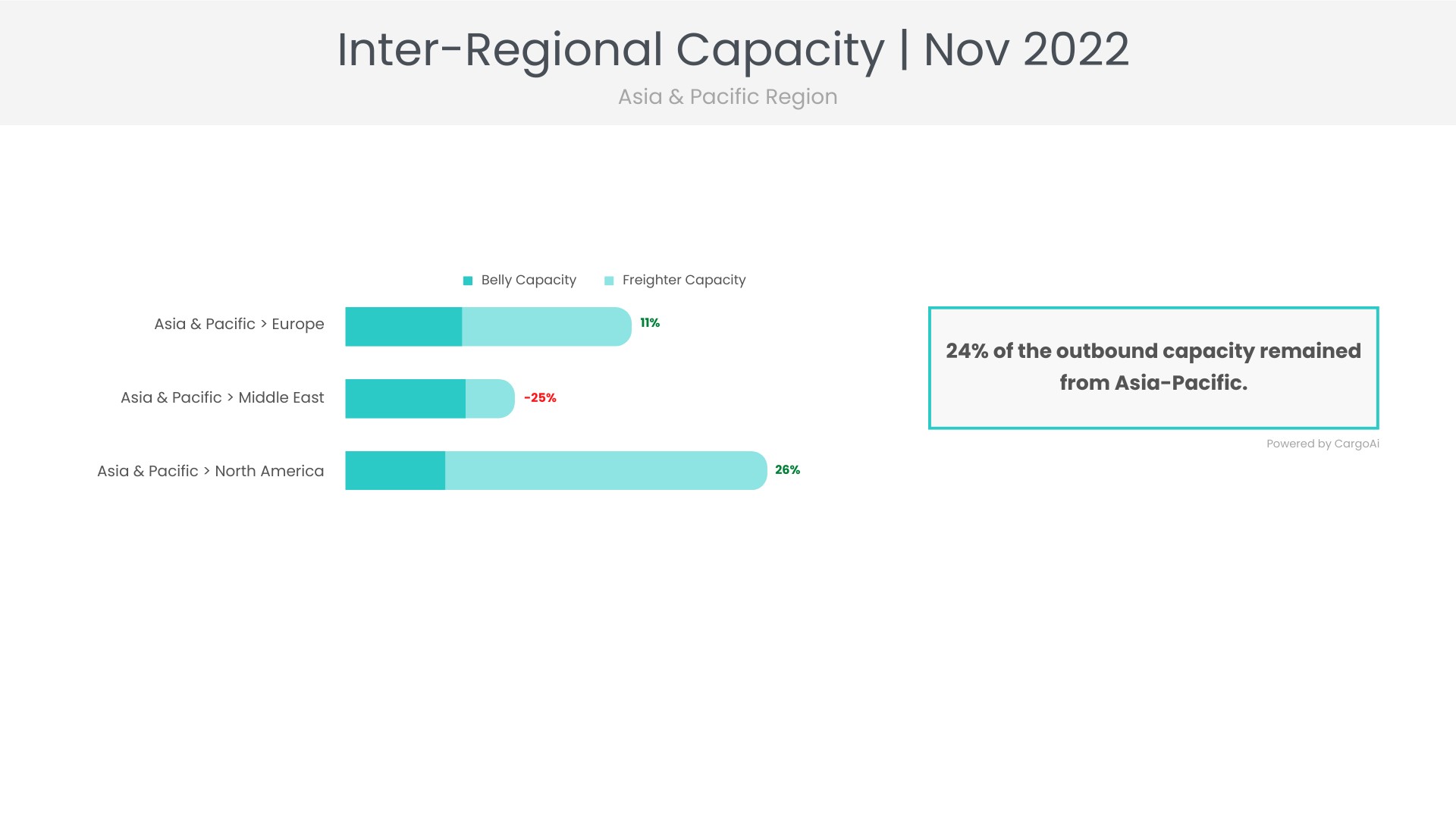

Asia Pacific Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Asia & Pacific | 209.4 | 16% |

| Asia & Pacific | 123.9 | 6% |

| Asia & Pacific | 309.1 | 23% |

Observations

- Despite the China COVID restrictions impacting the region’s outbound and inbound capacity and tonnages, the overall outbound capacity from Asia-Pacific to Europe has seen an increase of 11% from 188K MT to 210KMT.

- The outbound capacity increase from the South Asian countries is notable and has compensated for the slump from China.

- The overall capacity from Asia Pacific to North America is recorded 309K MT in November as compared to 246K MT in October, a sharp MoM increase by 26%. DHL and SIA’s six times weekly freighters movement on Singapore-Incheon-Los Angeles-Honolulu-Singapore route launched in November boosts the capacity addition.

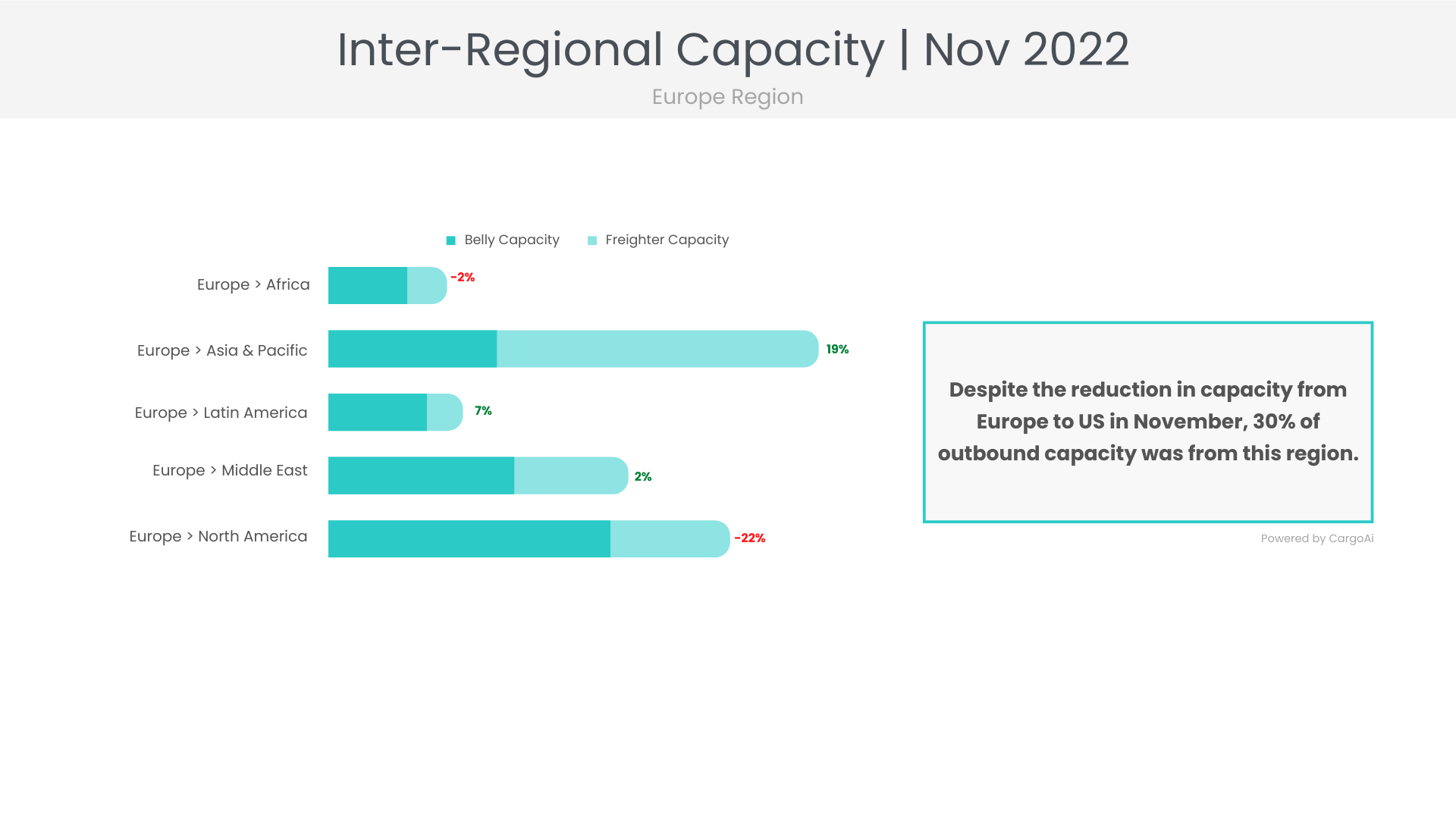

Europe Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Europe | 65 | 15% |

| Europe | 269.5 | 18% |

| Europe | 73.7 | 19% |

| Europe | 164.6 | 14% |

| Europe | 220.7 | -9% |

Observations

- The outbound capacity from Europe to Asia Pacific registered at 270K MT in November reciprocates the inbound capacity between the two regions, with an increase of 19% as compared to the previous month.

- The resuming of scheduled flight operations by carriers originating from both regions is a positive sign of reinstating capacity despite decreasing chargeable weight.

- Maersk Air Cargo’s expansion of network between China to US and Europe in the coming months will further bolster the inter-regional freighter capacity.

- Thanksgiving in November in USA has led to an acute decline of capacity by 22% in November MoM, between Europe and North America. The freighter capacity has slumped from 207K MT in October to 153K MT in November causing the major impact.

- Meanwhile, the capacity from Europe to Latin America has remained stable in November at 74 K MT as compared to 69 K MT in October.

Latin America Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Latin America | 65 | -34% |

| Latin America | 120.6 | 29% |

Observations

- The outbound and inbound capacity, tonnages and rates for Latin America have remained the most stable in November out of all the regions.

- The outbound capacity from Latin America to North America was recorded at 121 K MT in November vis-à-vis 120 K MT in October, despite the reduction in volumes owing to Thanksgiving in USA.

Middle East Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Middle East | 140.7 | 10% |

| Middle East | 138.3 | 3% |

| Middle East | 236.2 | -46% |

Observations

- There has been an abrupt cutback of capacity from Middle East to Asia Pacific by 16% in November following the COVID restrictions imposed again in China. The effect on passenger travel has swayed the belly capacity by -22%, from 123K MT in October to 96K MT in November.

- Meanwhile, by virtue of the consistent schedules of Middle-Eastern carriers, the capacity to Europe and North America has remained stable in November.

- The Middle-East inter-regional outbound and inbound capacity has also remained stable due to the high volume of passenger traffic in the light of big events in November, the FIFA World Cup in Doha and Formula One Abu Dhabi Grand Prix.

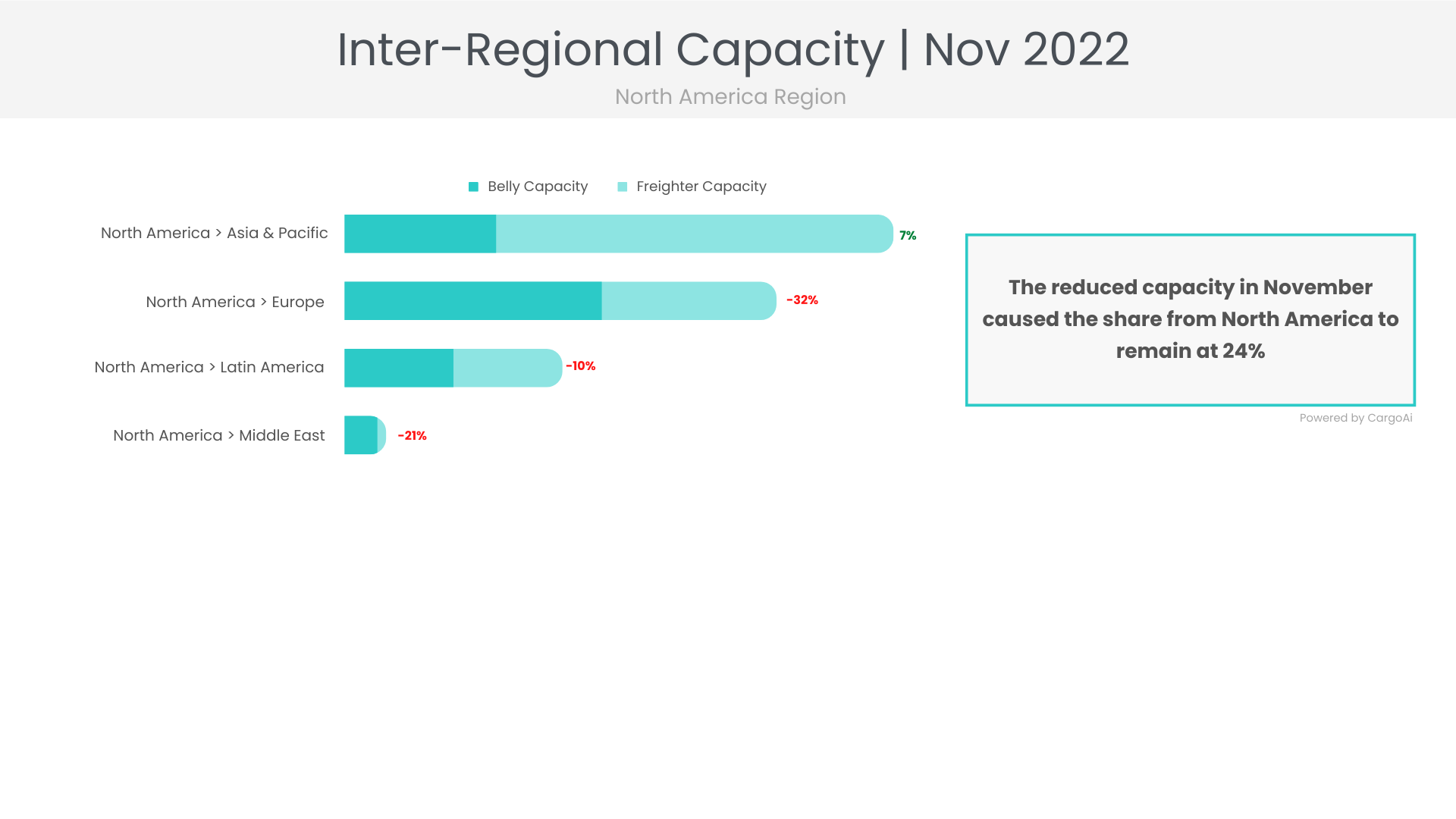

North America Region

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| North America | 286 | -47% |

| North America | 224.7 | 17% |

| North America | 113.4 | 20% |

| North America | 21.6 | 13% |

Observations

- The overall capacity from North America to all regions has sharply reduced in November by 14%, as a result of the Tropical Storm Nicole early November, Thanksgiving, and the trend of falling volumes towards the end of the year.

- The most critical reduction in capacity was observed from North America to Europe by -32%, to 225K MT in November from 330K MT in October.

- An increased in freighter capacity from North America to Asia Pacific was recorded from 188K MT in October to 207K MT in November, that could be attributed to the SIA-DHL freighter operation between the regions.

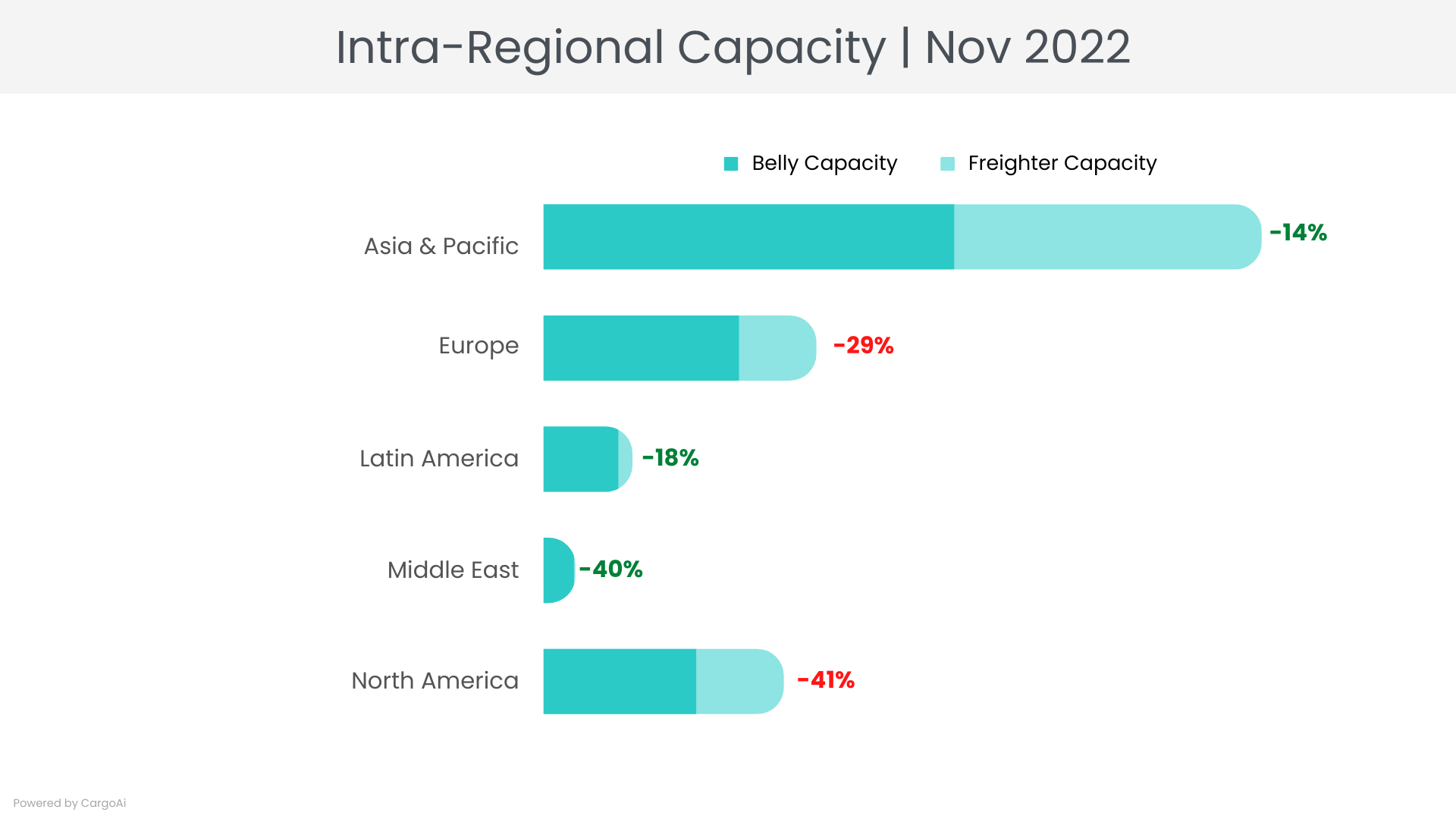

Top Intra-Regional Cargo Capacity

| Region | Capacity in Nov 2022 (100k tons) | Variance vis-a-vis Nov 2022 |

|---|---|---|

| Asia & Pacific | 2144 | 13% |

| Europe | 813.6 | -7% |

| Latin America | 264.5 | 7% |

| Middle East | 93.9 | 21% |

| North America | 716.8 | -4% |

Observations

- The intra-regional capacity within all major regions have reduced significantly in November as compared to the positive signs seen in the previous month, caused by the reducing demand and volumes.

- The capacity slumped within Asia-Pacific by 14% in November to 2144K MT from 2480K MT in October, as a result of the non-operation of flights by most widely used Chinese carriers within the region like Air China.

- The Tropical Storm Nicole in early November causing several flight cancellations, and the flight disruptions recorded during the Thanksgiving rush, led to major reduction in capacity within the region. CargoINTEL recorded a MoM reduction by 41% from 1220K MT in October to 717K MT in November.

- Europe region continues to suffer reduction in demand and cargo volumes due to the Ukraine war. The overall capacity recorded in November (814K MT) is down by 29% as compared October (1152K MT).

- The intra-regional capacity within Middle-East also recorded an all-time low during the year of -40% due to the decreasing volumes.

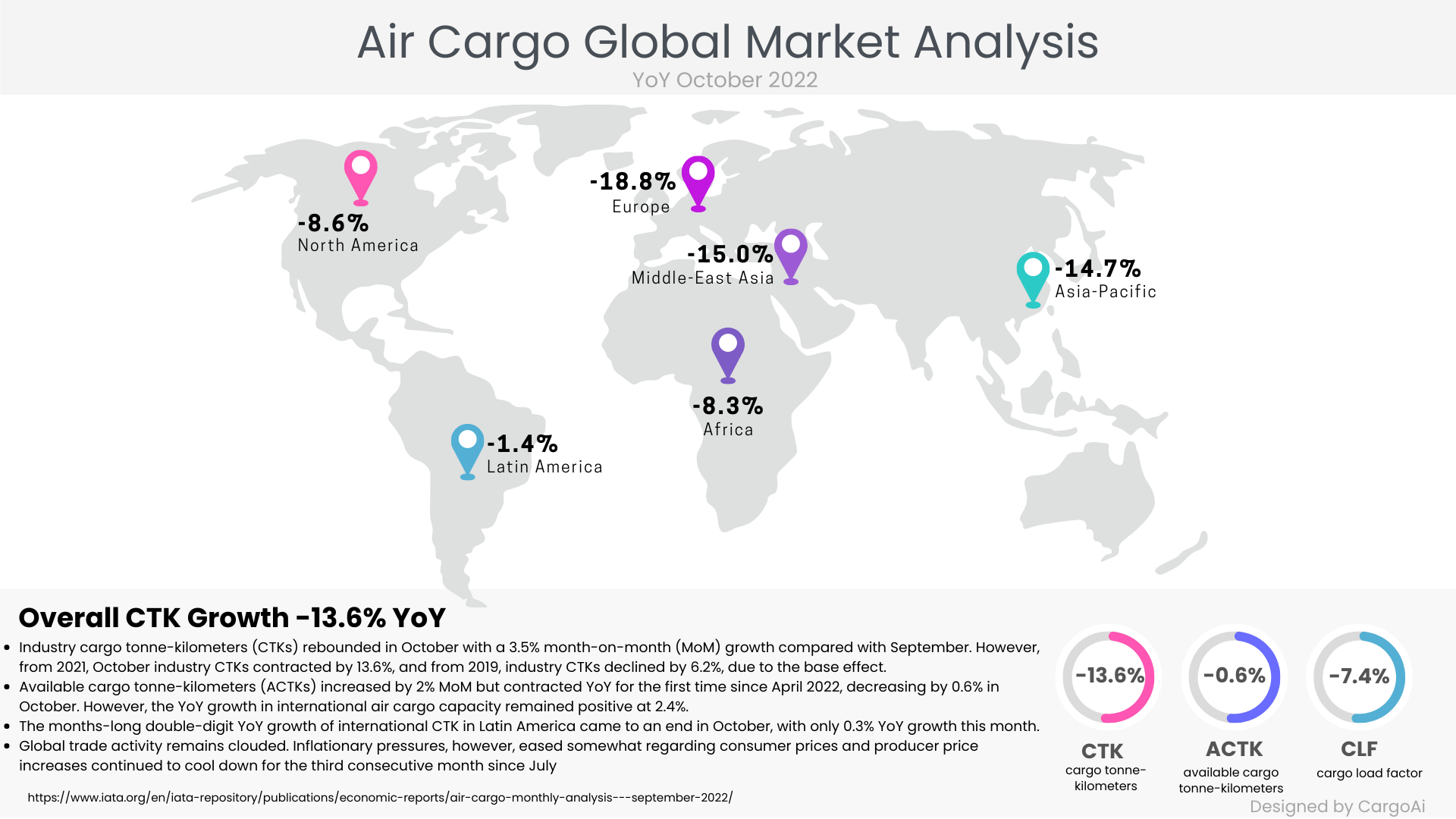

Air Cargo Global chargeable weight analysis

Observations

- IATA recorded positive numbers for October 2022, as the CTK (Cargo Tonne-Kilometres) recovered MoM by 3.5% at 21.1 billion as compared to September 2022, whereas it was down by 13.6% vis-a-vis the same period in 2021.

- Meanwhile, ACTK (Available Cargo Tonne-Kilometres) was 2% higher in October than the previous month. However, for the first time since April 2022, ACTK has fallen YoY marginally by 0.6% as per IATA.

- However, the non-promising signs of global trade due to the inflation in advanced economies, Ukraine war, the increasing value of US dollars and the reducing export orders are negatively impacting the air cargo movement.

- On the contrary, the maritime transport is increasing as compared to air cargo’s performance towards the end of Q4.

- IATA’s seasonally adjusted cargo load factor (SA-CLF) in October 2022 at 48%, is recorded to be 13% lower than the same period in 2021, and almost 1% lower than that of September 2022.

Resources:

- https://www.cargoai.co/products/cargointel/

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis---october-2022/

- https://www.worldacd.com/trends/weekly-trends/

- https://www.iata.org/en/pressroom/2022-releases/2022-11-30-01/

- https://www.airfreight-logistics.com/dhl-express-and-singapore-airlines-launch-new-boeing-freighter-aircraft/#:~:text=The%20second%20Boeing%20777%20freighter,planned%20for%20delivery%20throughout%202023.

- https://www.routesonline.com/news/29/breaking-news/299001/routes-in-brief-rolling-daily-updates-wc-nov-21-2022/

RECENT POSTS