Capacity Statistics - May 2023

CargoAi features the air cargo capacity statistics report for May 2023 extracted from the business intelligence tool CargoINTEL using the real-time facts and figures. Read on for the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month.

Highlights

- The global air cargo capacity dwells steadily in May 2023, reasserting the stability observed since March this year.

- The overall global outbound capacity registered in May stands at 2903K MT, 2% dip month-on-month as compared to 2949K MT in April. The overall global intra-regional capacity is recorded at 5299K MT which is 5% higher as compared to 5034K MT in April.

- The outbound belly capacity has marginally increased by 2% in April recorded at 1611K MT, whereas the intra-regional belly capacity has hiked by 7% to 3744K MT from 3495K MT.

- The global outbound freighter capacity has reduced by 5% in May to 1292K MT from 1363K MT in April. The intra-regional freighter capacity recorded in May has remained even with April, at 1555K MT.

- The capacity evolution between Europe and North America regions has protracted further in May showing worthy signs of stabilizing flight schedules.

- The overall global capacity in May has increased by about 12% year-on-year.

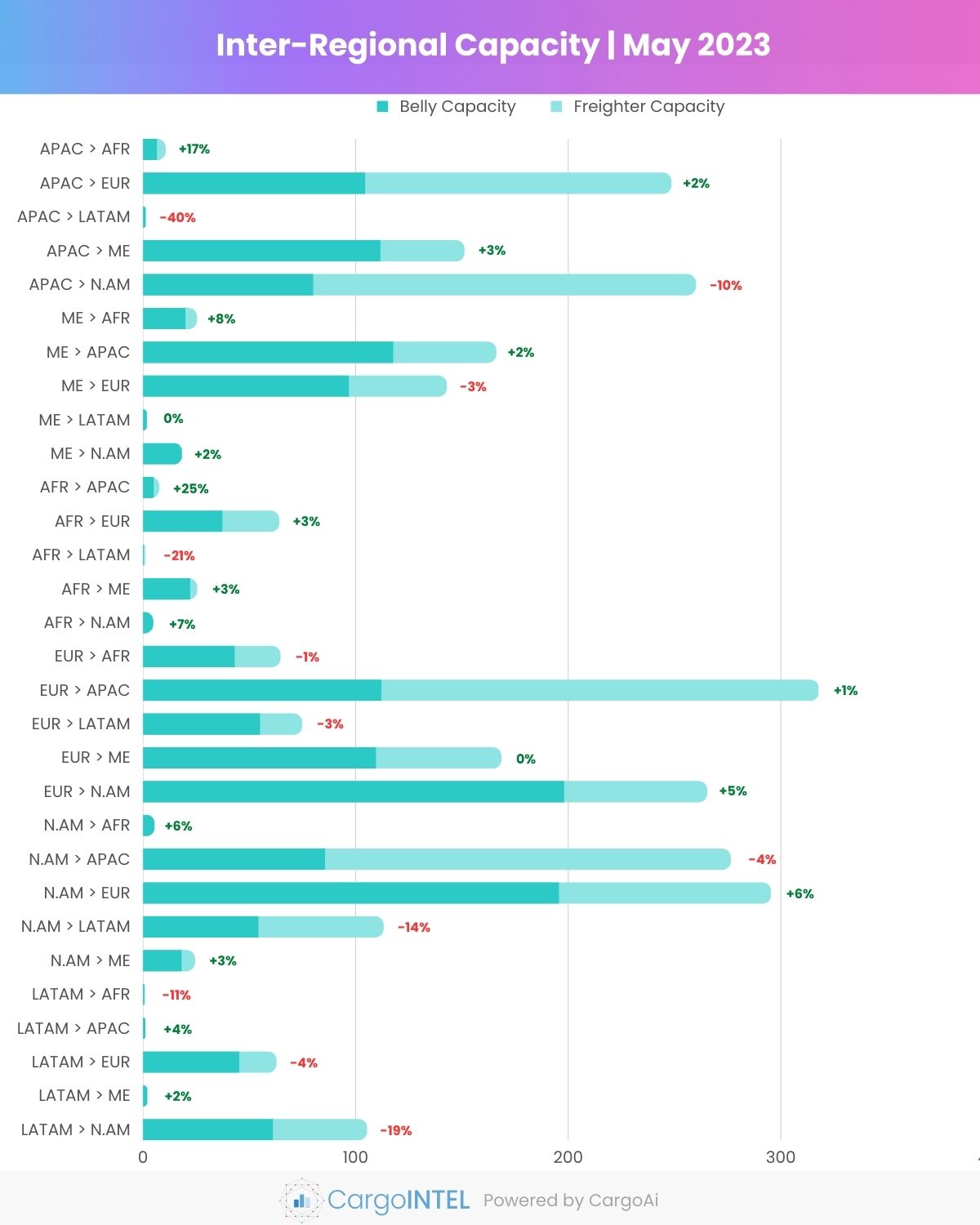

Top Inter-Regional Cargo Capacity

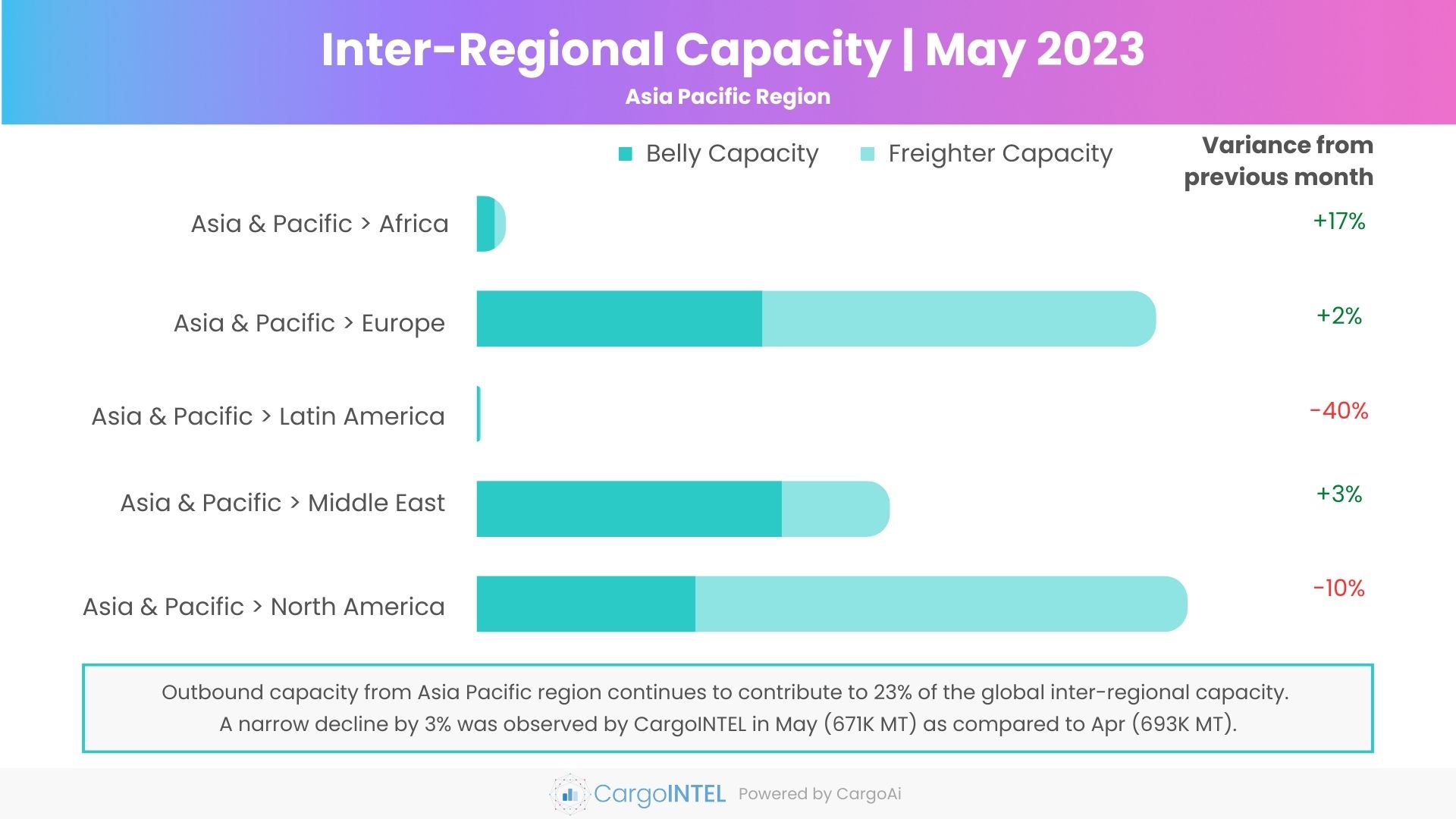

Asia Pacific Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Asia & Pacific | 10.5 | 17% |

| Asia & Pacific | 248.3 | 2% |

| Asia & Pacific | 1.4 | -40% |

| Asia & Pacific | 151.1 | 3% |

| Asia & Pacific | 259.9 | -10% |

Observations

- Contrary to the marginally increasing trend of outbound capacity from Asia Pacific region observed in the last quarter, CargoINTEL registered a small dip in May by 3% to 671K MT from 693K MT in April.

- This comes off as a result of the -8% slump in outbound freighter capacity from the region, falling to 368K MT in May as compared to 400K MT in April.

- Freighter capacity from Asia Pacific to Middle-East and Americas has gone down to 220K MT in May from 250K MT in April.

- The outbound belly capacity from Asia Pacific region has grown by 3% month-on-month to 303K MT, due to the reinstating flight schedules majorly to Africa, Europe, Latin America and Middle East.

- On a year-on-year perspective, the overall capacity from Asia Pacific region has increased by almost 38%.

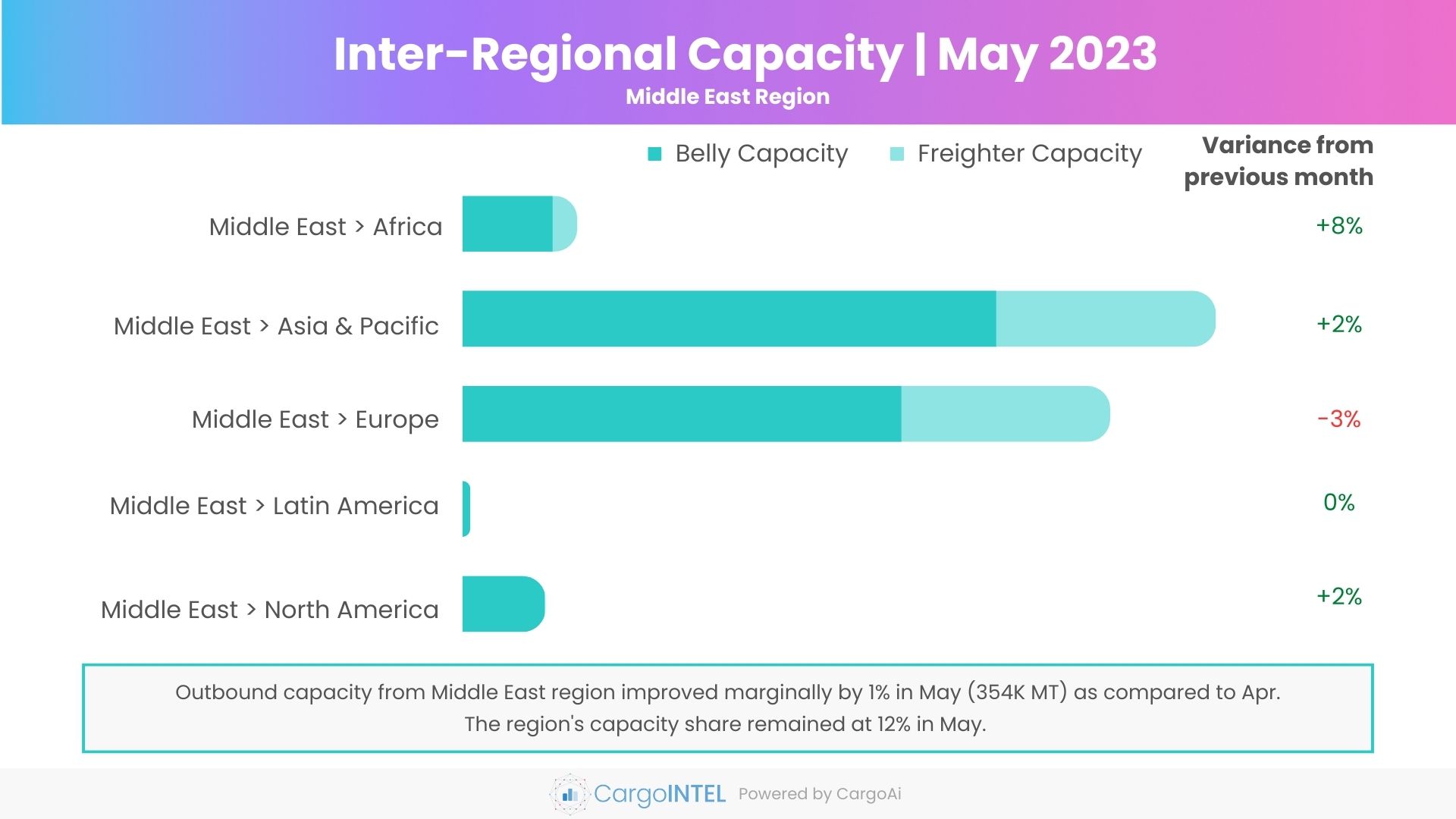

Middle East Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Middle East | 25.2 | 8% |

| Middle East | 166.1 | 2% |

| Middle East | 142.6 | -3% |

| Middle East | 1.6 | 0% |

| Middle East | 18.2 | 2% |

Observations

- The overall outbound capacity from Middle East region in May (354K MT) has remained somewhat similar to that recorded in April (352K MT)

- While the belly capacity has increased by a small margin of 3% to 254K MT from 246K MT in April, the freighter capacity has reduced by 5% to 100K MT in May from 106K MT in April.

- The belly capacity from Middle East to Africa and Asia Pacific has increased by 6% each, most likely attributed to the increase in frequency of flights and new routes additions to China, Thailand, Australia, New Zealand, South Africa, Tanzania, Nigeria by airlines like Emirates, Saudia, Air Arabia in their summer schedule.

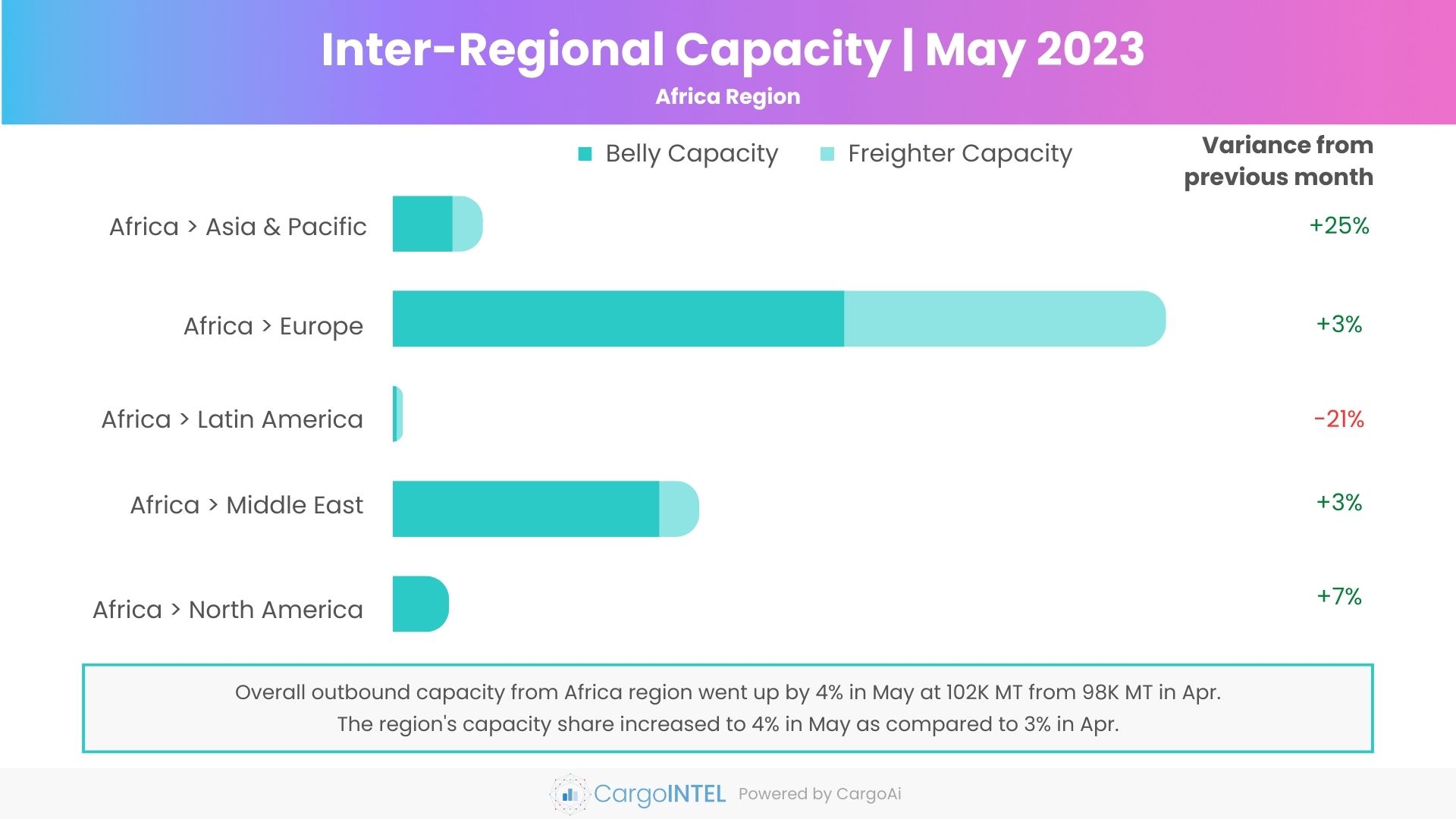

Africa Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Africa | 7.4 | 25% |

| Africa | 63.9 | 3% |

| Africa | 0.8 | -21% |

| Africa | 25.4 | 3% |

| Africa | 4.7 | 7% |

Observations

- The total outbound capacity from Africa region showed steady signs of improvement rising by 4% in May to 102K MT vis-à-vis 98K MT in April.

- The bad weather conditions in various parts of the continent in March and April that badly impacted scheduled operation of flights seems to have regularized in May.

- While the overall freighter capacity from the region increased narrowly by 2% in May, the belly capacity spiked by 5% to 69K MT in May from 66K MT in April.

- The increase in capacity majorly to Asia Pacific, Middle East, Europe, and North America regions may be attributed to the increasing frequency of flights and new routes by Ethiopian Airlines to Atlanta, New York, Copenhagen, Karachi, Singapore, Kuala Lumpur. Also, Middle-eastern carriers like Emirates and Saudia are increasing their capacity to and from African hubs like Kano, Djibouti, Dar-e-Salaam, Johannesburg.

- The outbound capacity from Africa in May shows a double-digit increase of about 14% when compared to the same period previous year.

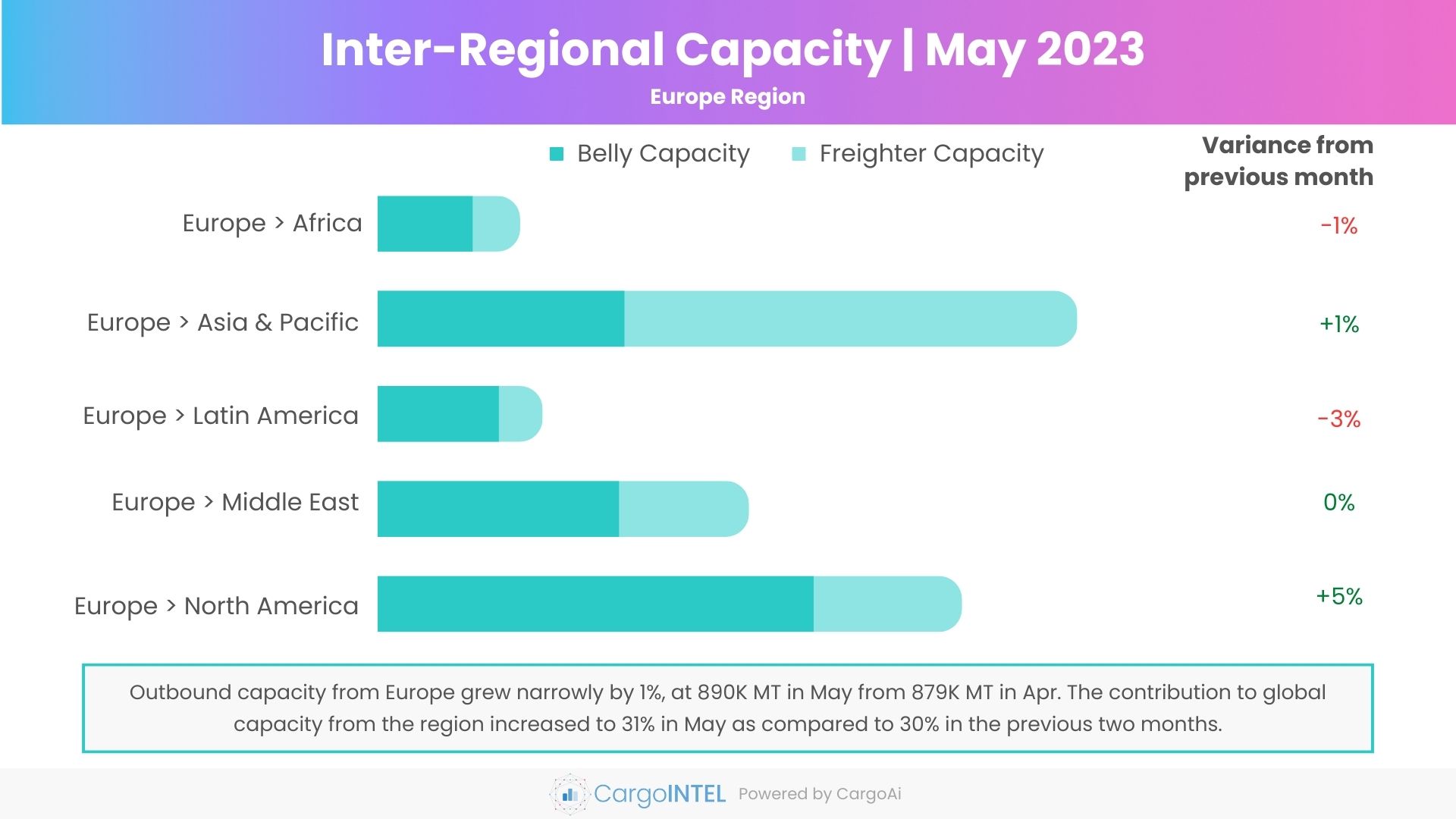

Europe Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Europe | 64.5 | -1% |

| Europe | 317.7 | 1% |

| Europe | 74.7 | -3% |

| Europe | 168.4 | 0% |

| Europe | 265.2 | 5% |

Observations

- The overall outbound capacity from Europe exhibits constant signs of improvement for the fifth month in a row since January this year, even though there was only a modest spike of 1% month-on-month in May indexed at 890K MT.

- The overall belly capacity from the region increased by 2% to 517K MT in May as compared to 509K MT in April, emanated majorly due to a healthy surge by 8% from Europe to North America (184K MT in April to 198K MT in May). This indicates the increasing frequencies and restoring passenger flight schedules between the regions.

- The increased belly capacity from Europe to North America by European carriers like SAS, Air France, KLM, Air Serbia; coupled with new routes and increased frequencies planned in the coming months by carriers like British Airways, Norse Atlantic, Aer Lingus will further ameliorate the belly capacity.

- The outbound freighter capacity from Europe surged narrowly by 1% month-on-month to 373K MT, sprang by an increase of 2% to Asia Pacific (205K MT) and 3% to Middle-East (59K MT), in comparison to the previous month.

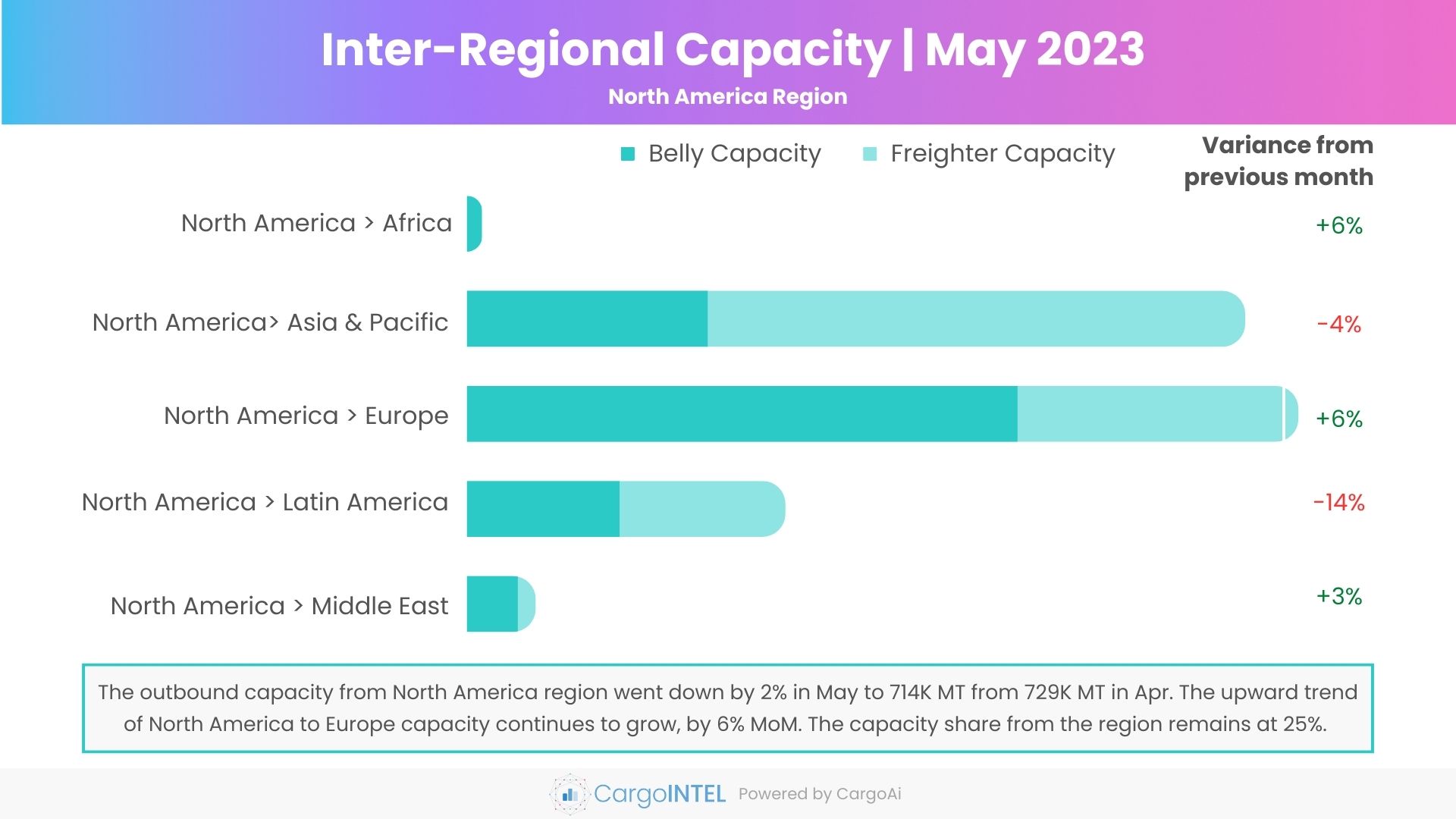

North America Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| North America | 5.3 | 6% |

| North America | 276.3 | -4% |

| North America | 295.2 | 6% |

| North America | 112.9 | -14% |

| North America | 24.3 | 3% |

Observations

- The reviving outbound capacity from the North America region observed in the last two months, has taken a nosedive in May plummeting by 2%, from 729K MT in April to 714K MT in May.

- The overall decline in capacity has been largely caused by a reduction in freighter capacity by 7% to 356K MT in May from 383K MT in April, hastened by -15% to Latin America, and -5% each to Europe and Asia Pacific.

- The belly capacity remained steady in May with a surge by 4% to 358K MT from 346K MT in April, an upswing was observed from North America to all regions except to Latin America with a crucial fall by 13%.

- The upturn of belly capacity from North America to Europe being observed since the last couple of months has abided in May too, with yet another month-on-month double-digit increase by 12%, indexed at 196K MT in May from 174K MT in April.

- The spree of new and increased transatlantic capacity additions has continued in May by carriers like Delta Airlines, United Airlines, Air Canada, Westjet.

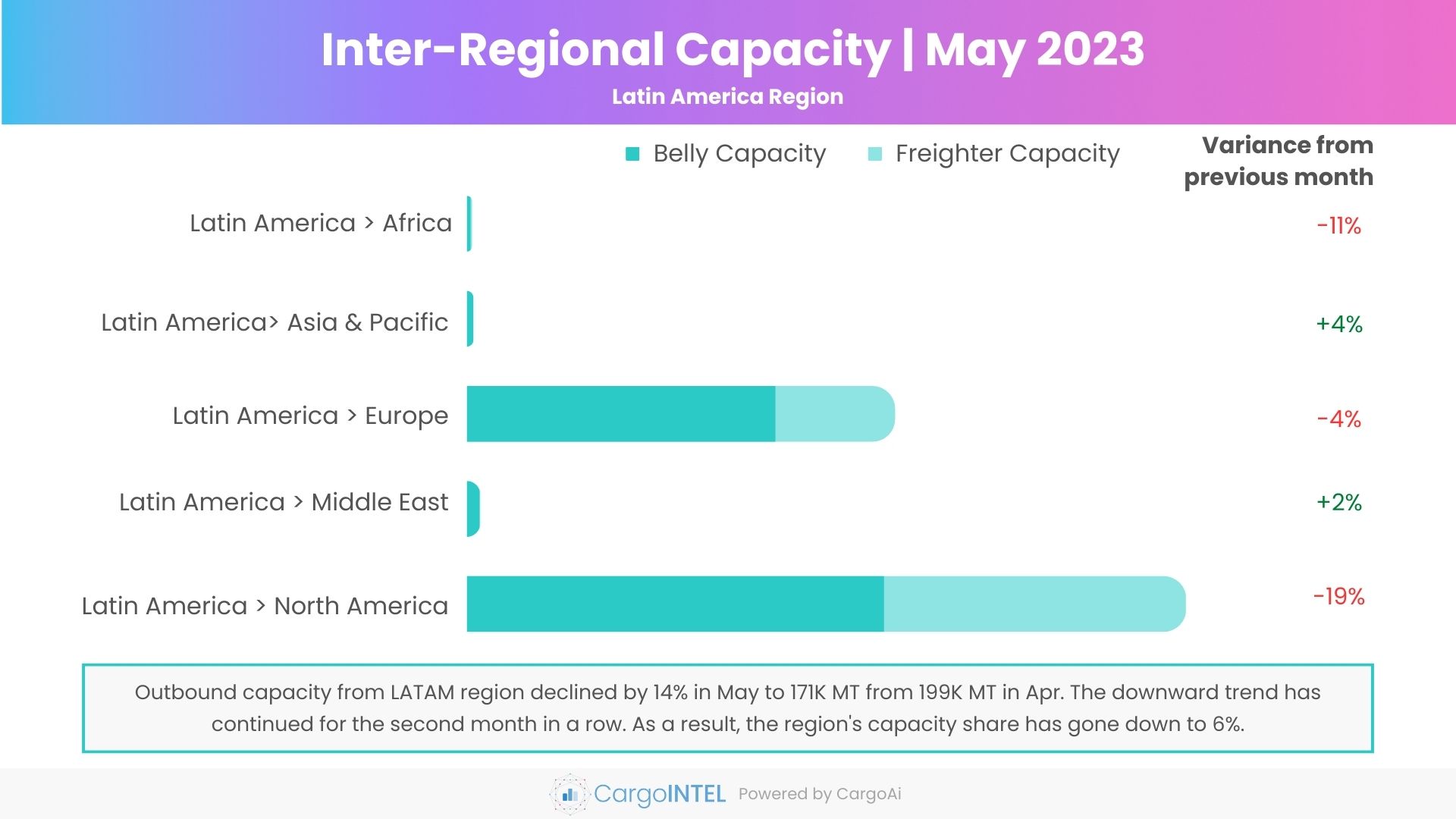

Latin America Region

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Latin America | 0.7 | -11% |

| Latin America | 0.9 | 4% |

| Latin America | 62.5 | -4% |

| Latin America | 1.9 | 2% |

| Latin America | 105.2 | -19% |

Observations

- The downward trend of outbound capacity from Latin America region that started in April has continued in May with a gross decline of -14% as compared to April.

- The overall outbound capacity fell from 200K MT in April to 171K MT in May, staging acute reduction in belly capacity by -12% and freighter capacity by -16%.

- One of the reasons for the decline in capacity is corresponding to the decrease in tonnages as the seasonal flowers and perishables movement from the region has receded.

- The most evident fall in both freighter and belly capacity from the region has been observed to North America. While the belly capacity went down by 18% from 74K MT in April to 61K MT in May, the freighter capacity plummeted by 21% to 44K MT in May from 56K MT in the previous month.

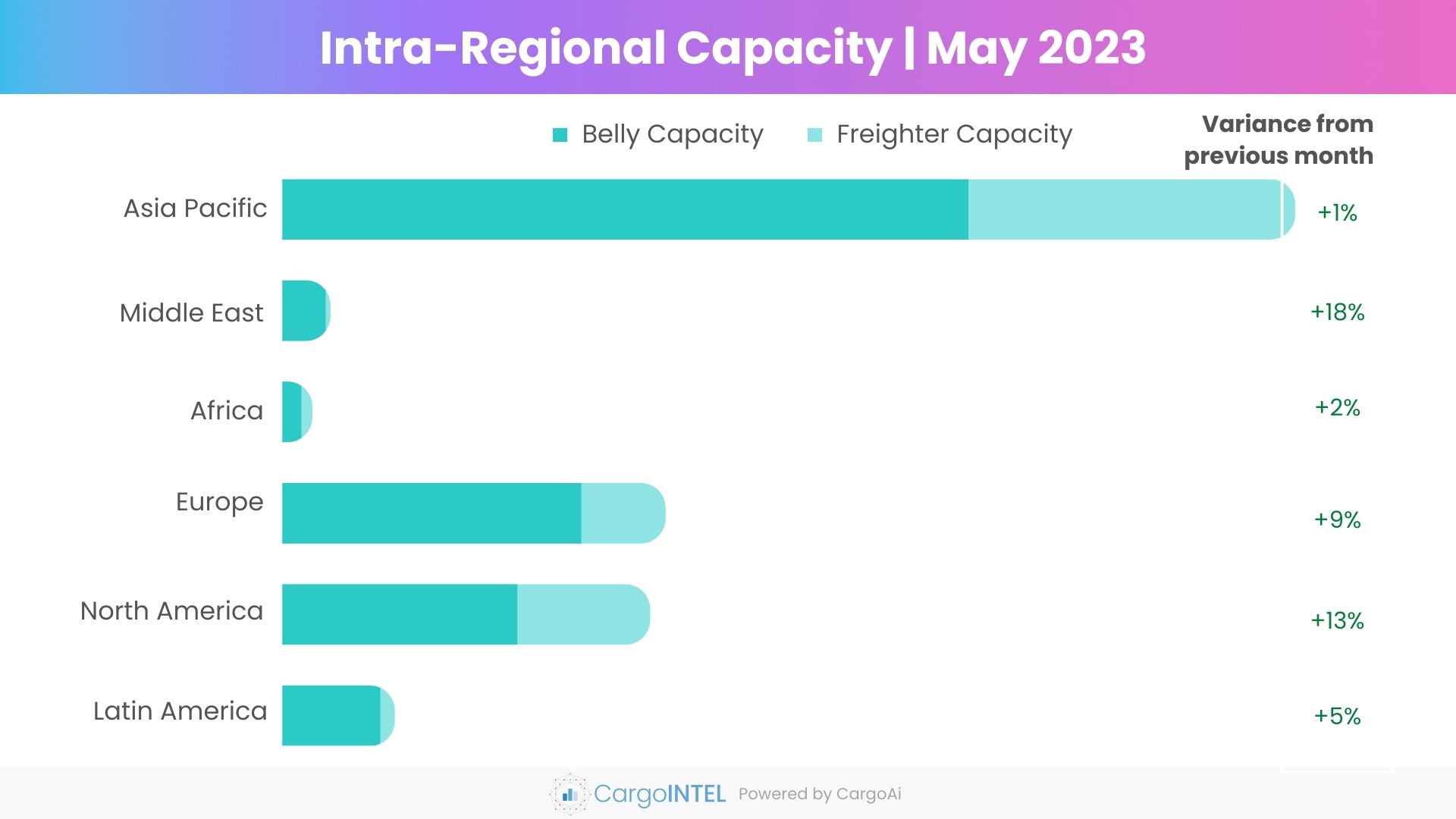

Top Intra-Regional Cargo Capacity

| Region | Capacity in May 2023 (100k tons) | Variance vis-a-vis May 2023 |

|---|---|---|

| Asia & Pacific | 2748.2 | 1% |

| Middle East | 129.7 | 18% |

| Africa | 80.4 | 2% |

| Europe | 1039.3 | 9% |

| North America | 997.3 | 13% |

| Latin America | 304.3 | 5% |

Observations

- The capacity within Asia Pacific region remained status quo in May at 2748K MT as compared to 2716K MT in April. A marginal increase of 4% was observed in terms of belly capacity within the region triggered by the increase in passenger flights by Korean Air, Air Asia, Indigo, Shenzhen Airlines, Tiger Air, Vietnam Airlines in May.

- An 18% spike in capacity has been observed within the Middle-east region, due the increase in frequency of fights by Emirates, Air Arabia, Fly Dubai facilitating the post Eid travel in the region.

- The intra-regional capacity in Africa region has also grown by 2% to 81K MT in May, endorsed by the route additions by carriers like Airlink and Ethiopian Airlines.

- The capacity within Europe is seen steadily increasing since March. A month-on-month increase of 9% was recorded at 1039K MT in May from 998K MT in April. A 10% spike in belly capacity is evidently due to new routes and frequencies started in May by carriers like Condor, Iberia, Aegean Airlines, Air Baltic, Finnair, Flyone, TUI Fly, Ryan Air to name a few.

- The intra North America capacity has rebounded positively by 13% in May (997K MT) after a -17% month-on-month slump in April due to the flight cancellations. New routes addition in May by carriers like American Airlines, Delta Airlines, United Airlines, Breeze Airways, JetBlue have led to the month-on-month increase in belly capacity by 12%.

- Even though the outbound capacity from Latin America has toppled badly in May, the intra-regional capacity showed positive growth by 5% from 290K MT in April to 304K MT in May. The belly capacity increase by 7%, ought to be the result of increase in routes by carriers like LATAM, JetBlue, Aeromexico, and Frontier Airlines in May.

Air Cargo Global chargeable weight analysis

Observations

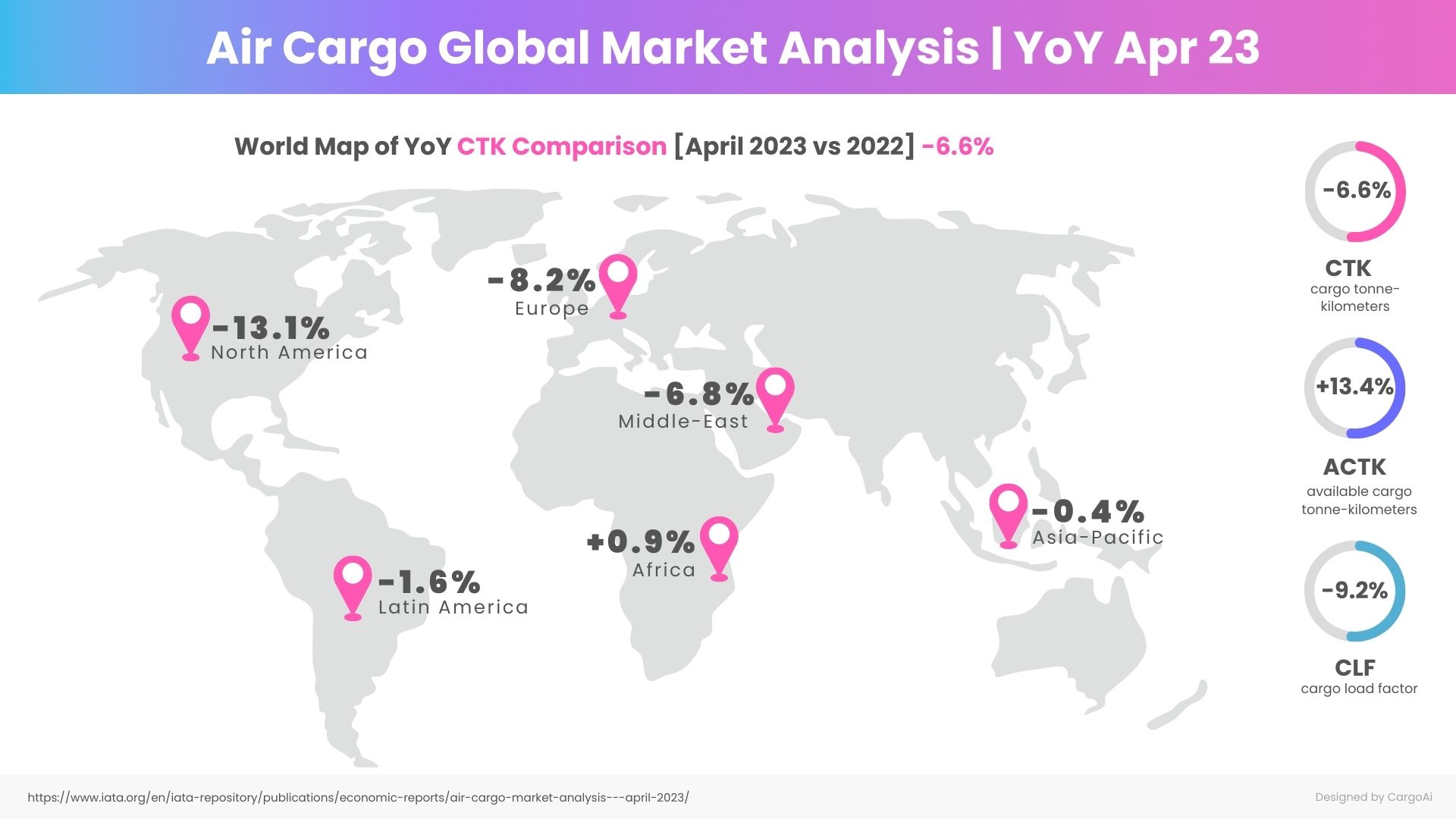

- The year-on-year comparison of global air cargo demand, CTK (Cargo Tonne-Kilometres) in April 2023 shows a fall by 6.6%. The reduction is getting slower month-on-month since February this year.

- The lessening demand for air cargo is mainly observed from North America and Europe whereas the capacity supply is increasing. The demand from Asia Pacific and Africa shows an upward trend.

- The available capacity in ACTK (Available Cargo Tonne-Kilometres) has grown by a double-figure margin of 13.4% YoY in April 2023, and higher by 3.2% when compared to the same period in 2019.

- The air cargo capacity (ACTK) in April has almost fully recovered to the pre-COVID levels, but the worrying factor remains the Cargo load factors (CLF) which has gone down to 42.8% in April.

Resources:

- www.worldacd.com

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis---april-2023/

- https://aviationweek.com/air-transport/airports-networks/50-new-routes-starting-may-2023

- https://aviationweek.com/air-transport/airports-networks/routes-brief-rolling-daily-updates-wc-may-22-2023

- https://www.travelnewsasia.com/news23/195-IndiGoFlights.shtml

- https://www.koreanair.com/sy/en/footer/about-us/newsroom/list/230525-korean-air-launches-cargo-services-to-zhengzhou--china

- https://www.maersk.com/news/articles/2023/05/22/asia-pacific-market-update-may

- https://www.srilankan.com/en_uk/corporate/news-details/490

- https://www.saudia.com/travel-with-saudia/book-with-us/offers-and-featured-destinations/featured-destinations/saudia-destinations-in-2023

- https://www.ethiopianairlines.com/aa/new-destinations

- https://www.aeroroutes.com/eng/230505-etmay23gou

- https://airspace-africa.com/2023/05/19/ethiopian-airlines-expands-north-american-presence-with-new-addis-ababa-atlanta-route/

- https://www.traveloffpath.com/12-new-transatlantic-flights-launching-in-2023/

- https://www.routesonline.com/news/29/breaking-news/299637/50-new-routes-starting-in-may-2023/

- https://www.emirates.com/media-centre/emirates-increases-flights-across-the-gcc-and-middle-east-ahead-of-eid-al-fitr/

RECENT POSTS