Capacity Statistics - March 2023

CargoAi features the air cargo capacity statistics report for March 2023 extracted from the business intelligence tool CargoINTEL using the real-time facts and figures. Read on for the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month.

Highlights

- March 2023 has closed Q1 of 2023 on a positive note showing signs of stability in terms of global capacity, tonnages as well as air freight yields.

- The global capacity has remained quite tumultuous towards the end of Q4 of 2022 and in the initial few weeks of 2023 due to reduction in global capacity, flight cancellations and delays caused by various reasons like bad winter weather conditions in various parts of the world, industry strikes in Europe; Lunar New Year holidays in Asia, and so on.

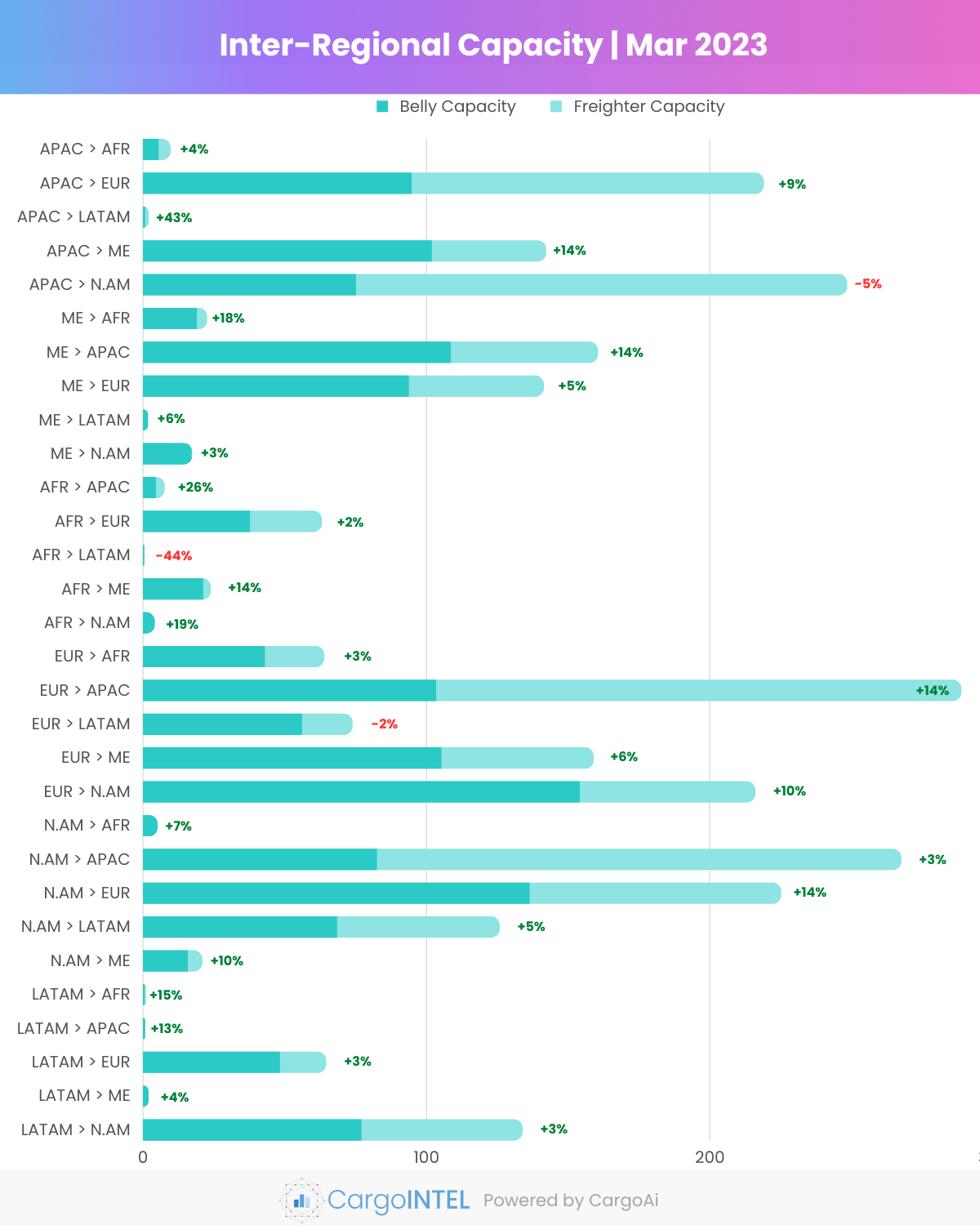

- CargoINTEL comparison shows the overall global capacity in the first 28 days of March grown at 7% month-on-month than that of February.

- The inter-regional capacity registered by CargoINTEL in March stands at 2709K MT as compared to 2537K MT in February.

- In February, the aviation sector underwent various disruptions in belly and freighter capacity. While bad weather conditions affected flights in many parts of US and Europe during winters; Africa bound flights were affected by tropical cyclone Freddy. The prolonged strike in the Europe and the IT system failure, especially in Germany caused disarray of scheduled operation of passenger flights.

- The indefinite industry strikes in Germany and other parts of Europe has also led to significant carriers like Lufthansa to announce cancellation of almost 500 flights a day in the whole of summer schedule.

- The overall global belly freight capacity has increased by 9% in March to 1482K MT from 1364K MT in February. The global freighter capacity has also marginally surged up by 5% to 1227K MT in March from 1173K MT in February.

- The stability in capacity seen in March are good signs of stability in demand mobilized in Q1 of 2023, which is also reiterated by WorldACD which has recorded firm average rates around 50% higher than pre-COVID levels and YoY tonnages down in single digit figure of -8%.

Top Inter-Regional Cargo Capacity

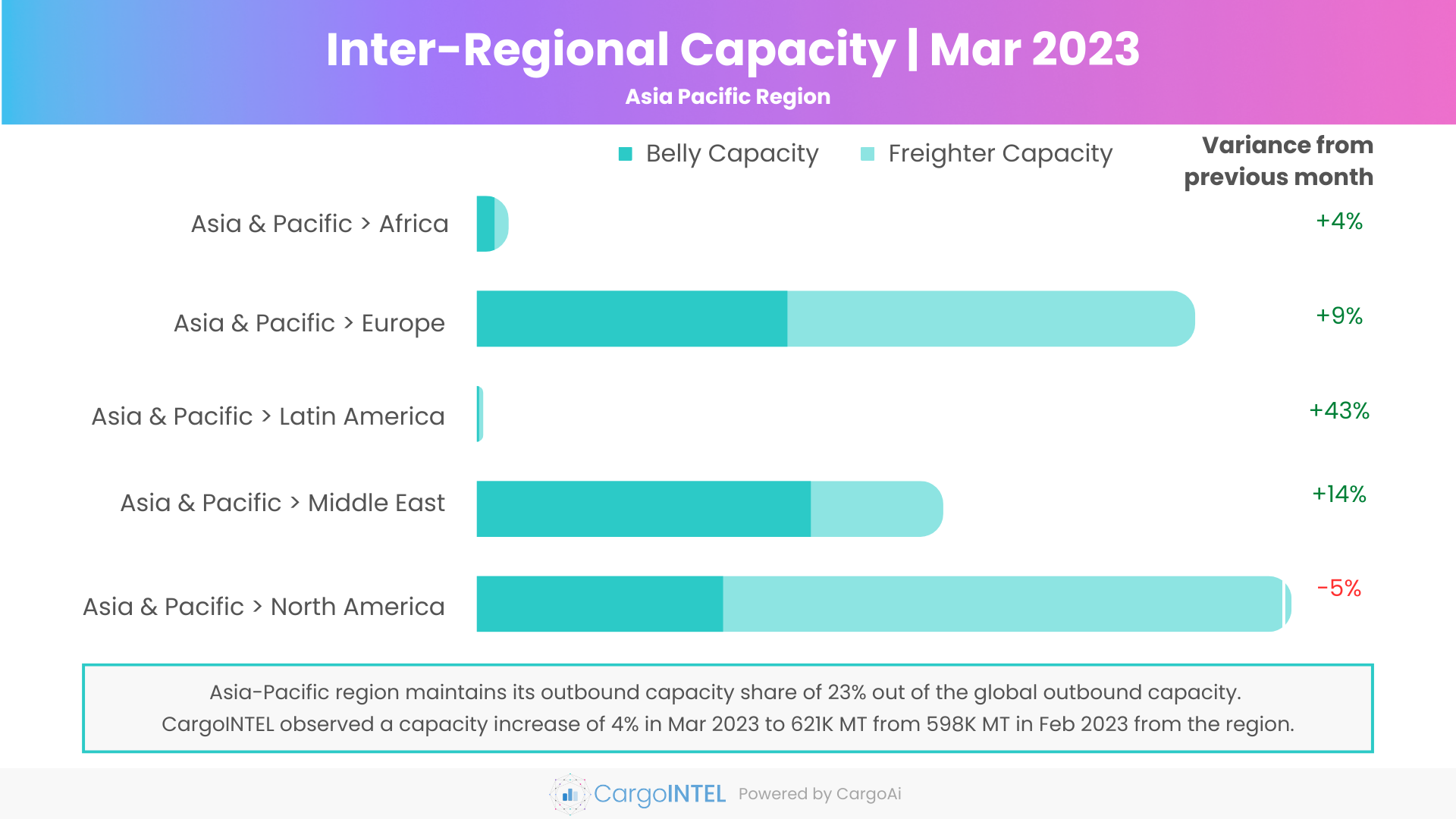

Asia Pacific Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Asia & Pacific | 9.6 | 4% |

| Asia & Pacific | 218.9 | 9% |

| Asia & Pacific | 1.9 | 43% |

| Asia & Pacific | 142.1 | 14% |

| Asia & Pacific | 248.3 | -5% |

Observations

- The total outbound capacity from Asia Pacific region increased by 4% in March to 621 K MT from 598K MT in February.

- The belly capacity rebounded to the levels of Q3 of 2022 to 278K MT in March and has remained stable throughout Q1 of 2023. A 10% surge in belly capacity could be observed in March at 278K MT from 252K MT in February.

- The freighter capacity recorded at 343K MT reduced slightly by 1% in March as compared to 345K MT in February. The major reduction in freighter cargo capacity by 8% was noticed from Asia Pacific to North America. However, as per WorldACD, the demand for air cargo has remained stable in March for the region.

- A year-on-year comparison for the same period shows a 25% increase in capacity from Asia Pacific, whereas the chargeable weight has gone down by 4%.

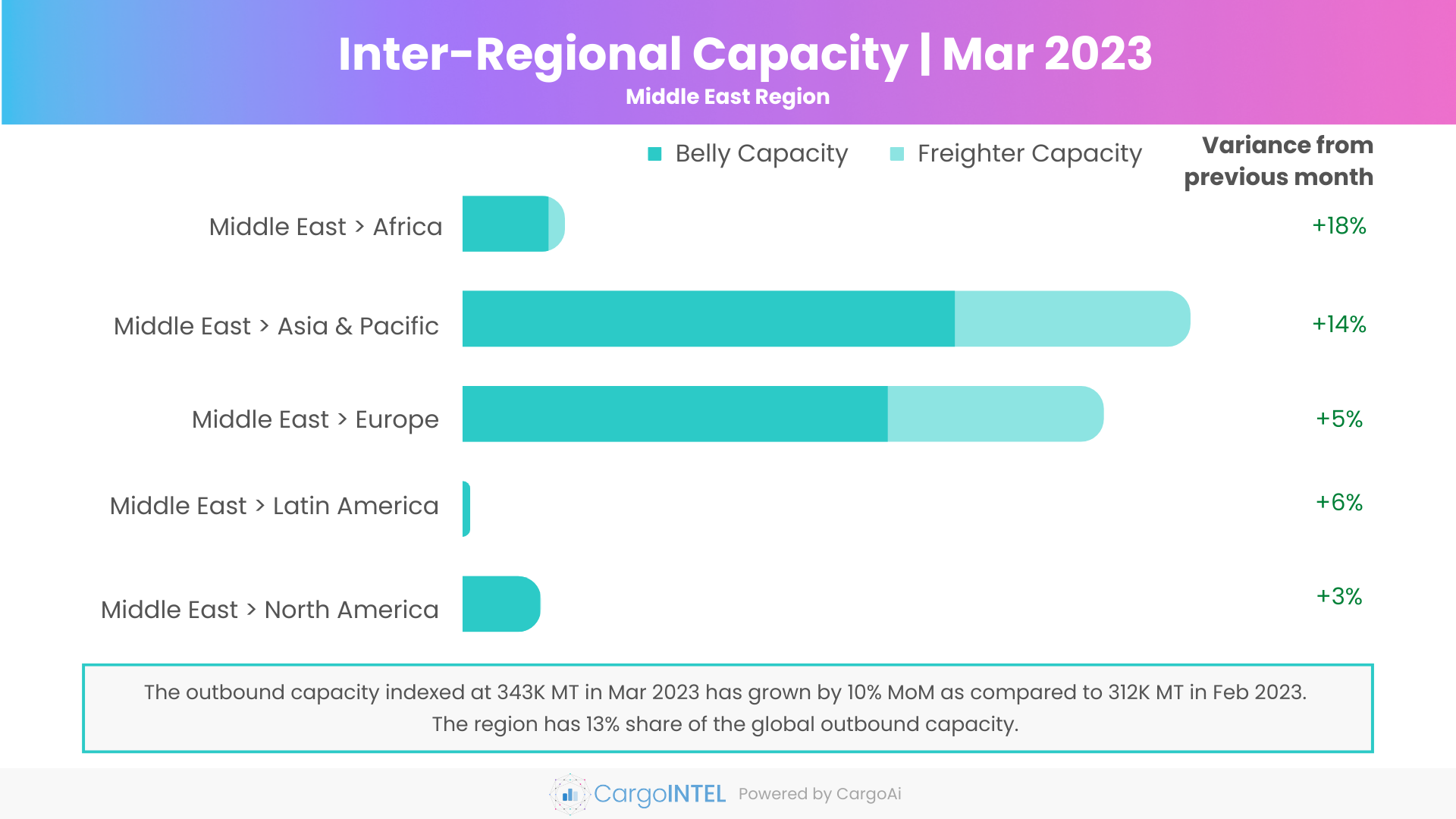

Middle East Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Middle East | 22.5 | 18% |

| Middle East | 160.3 | 14% |

| Middle East | 141.3 | 5% |

| Middle East | 1.6 | 6% |

| Middle East | 17.2 | 3% |

Observations

- A healthy 10% rise in the overall outbound capacity from the Middle-East has been recorded in March at 343K MT as compared to 312K MT in February. The capacity trend from the region has remained quite stable throughout Q1 of 2023.

- The overall belly freight capacity has increased MoM by 11% in March impelled by a strong 15% increase from Middle East region to Asia Pacific, owing to the regularizing scheduled passenger flights of Middle-Eastern carriers like Saudia, Etihad to various significant destinations in South Asia and ISC.

- The freighter capacity from Middle East region has remained stable to the key markets in Asia Pacific and Europe with an average increase of 8% from 93K MT in February to 100K MT in March.

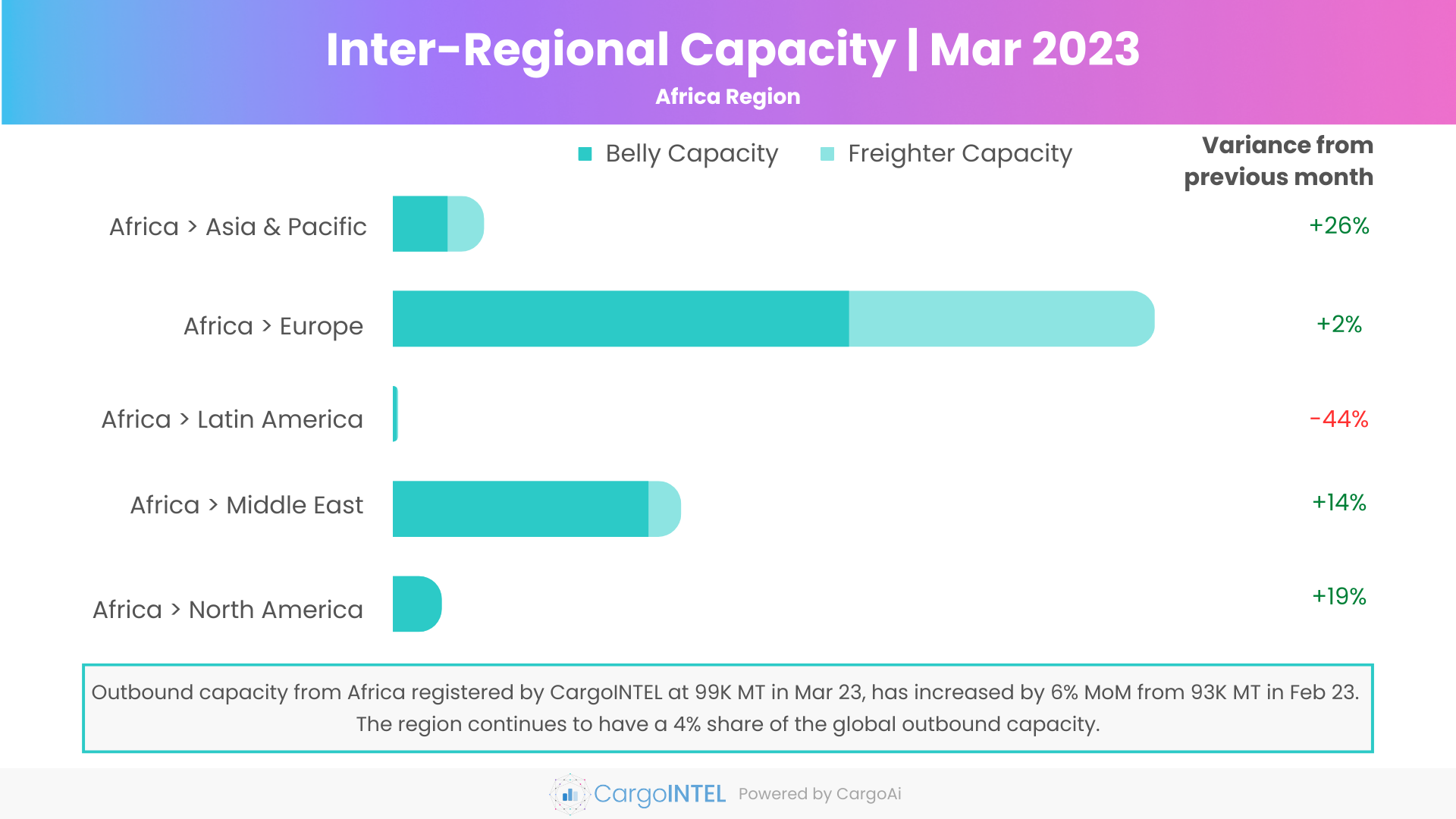

Africa Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Africa | 7.4 | 26% |

| Africa | 63 | 2% |

| Africa | 0.4 | -44% |

| Africa | 23.8 | 14% |

| Africa | 4 | 19% |

Observations

- The total outbound capacity from Africa has remained steady in March with a marginal increase on 6% MoM to 99K MT from 93K MT in February.

- We observed some flight cancellations majorly from the North African origins due to bad weather and poor visibility in February which caused the slight slump in capacity.

- With the sturdy demand for belly and freighter cargo capacity to and from North and Central African points like Lagos, Kano, Addis Ababa, Nairobi by the Middle-East and African carriers, the capacity from Africa to Middle East, has grown by 14% MoM in March.

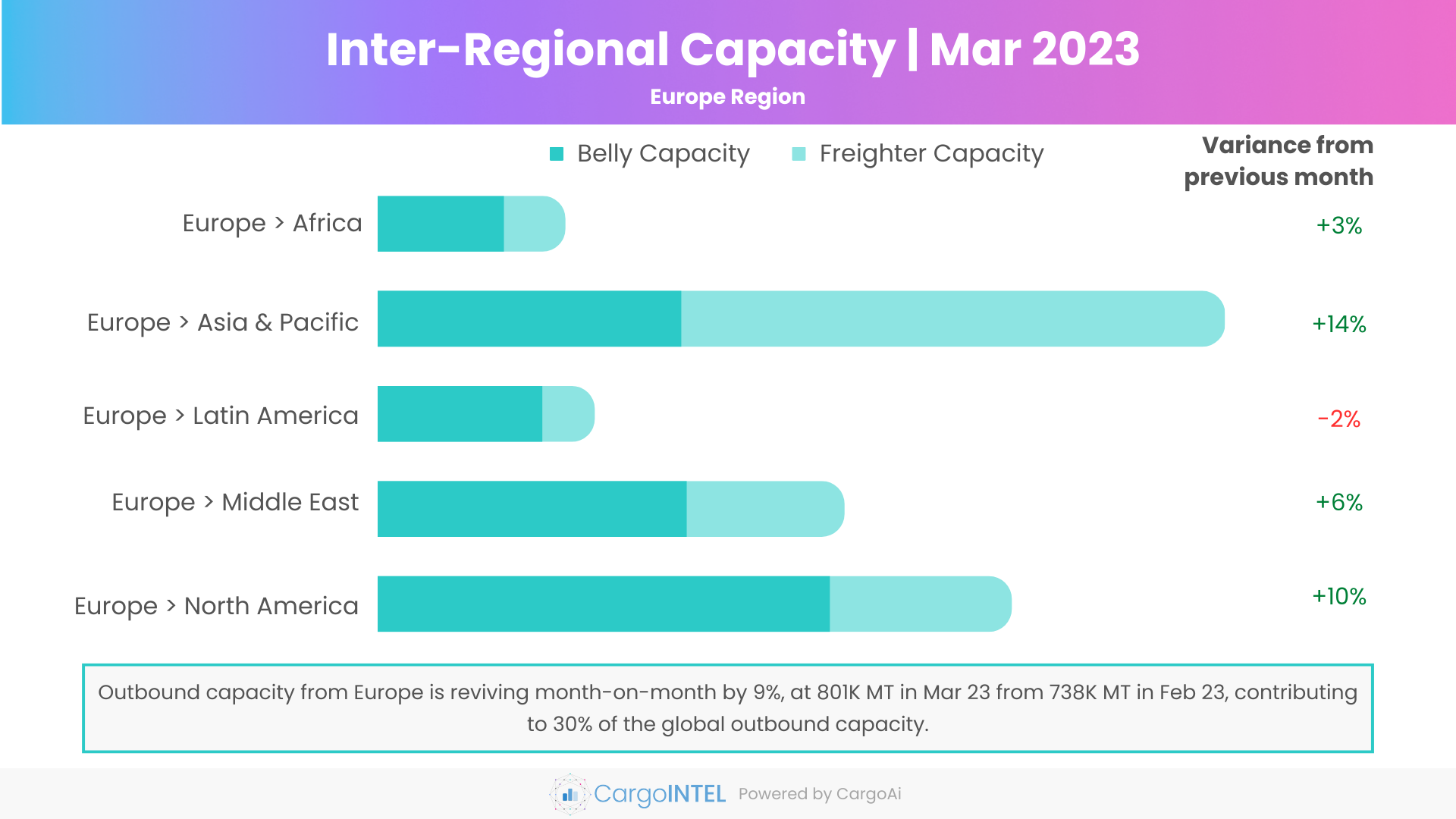

Europe Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Europe | 63.8 | 3% |

| Europe | 288.6 | 14% |

| Europe | 73.8 | -2% |

| Europe | 158.9 | 6% |

| Europe | 215.9 | 10% |

Observations

- Despite the flight disruptions from some of the major countries in Europe, the overall outbound capacity has remained stable since January 2023.

- The outbound capacity recorded at 801K MT in 28 days of March is 9% higher than that of February and at par with the capacity in January.

- A double-digit growth by 11% in freighter capacity ex Europe in March at 340K MT as compared to 305K MT in February is indicative of the increasing air cargo demand at a healthy yield, featured by a 19% increase in freighter capacity from Europe to Asia Pacific.

- The overall belly freight capacity ex-Europe registered at 461K MT is 7% higher MoM pretty much at par with the belly capacity recorded in January 2023 and October 2022.

- The belly capacity ex Europe to Asia Pacific and Middle East has grown at 6% MoM in March, a double-figure growth of 12% from Europe to North America (154K MT) shows improving signs of passenger flight operation between the regions.

- From a YoY perspective, as per WorldACD the overall capacity ex Europe has increased by 13%.

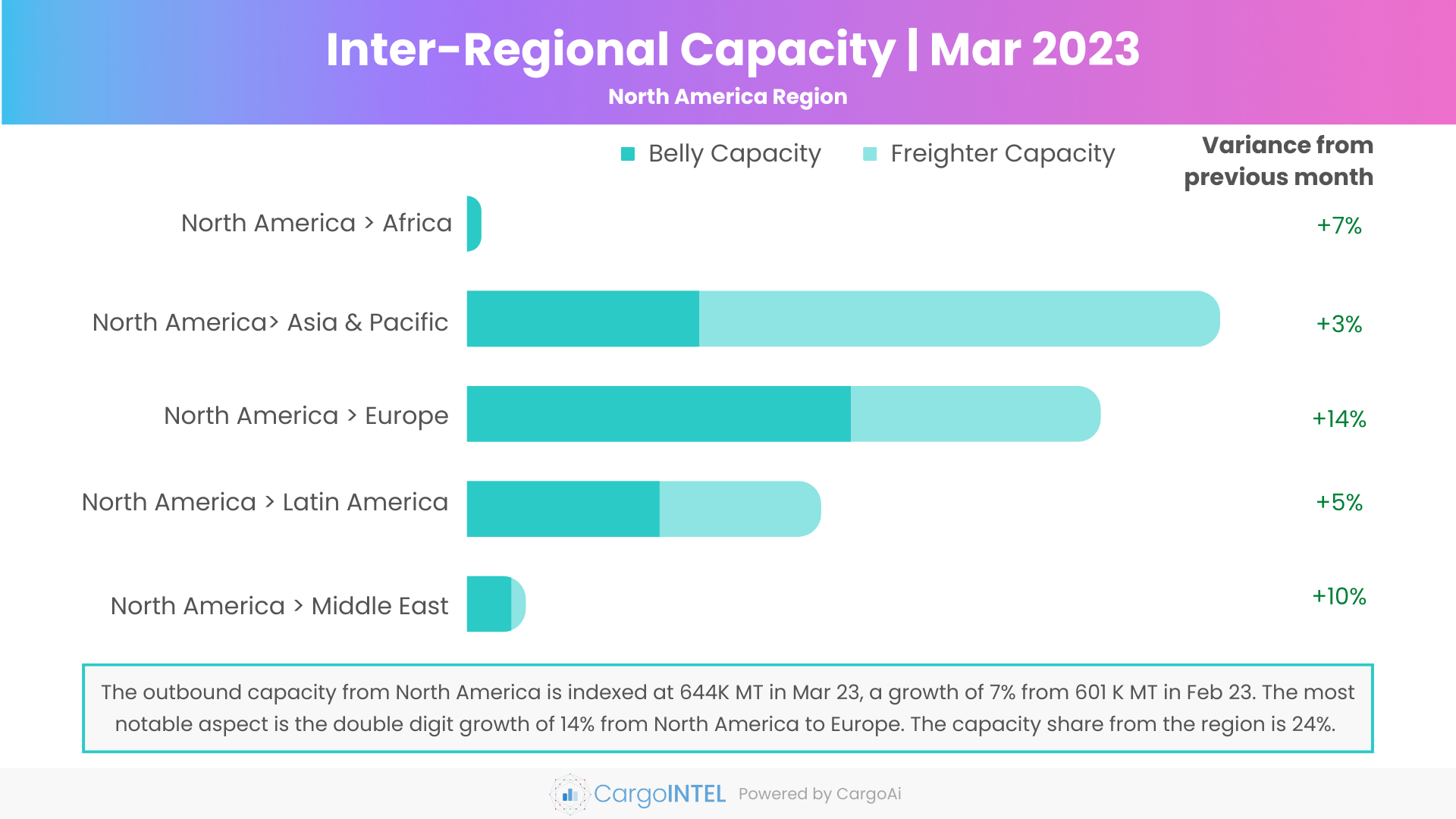

North America Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| North America | 5 | 7% |

| North America | 267.4 | 3% |

| North America | 225 | 14% |

| North America | 125.8 | 5% |

| North America | 20.8 | 10% |

Observations

- Overall outbound capacity ex North America has remained quite resilient in Q1 of 2023, closing at a recorded capacity of 644K MT in March, an increase by 7% MoM.

- Two-digit growth of 10% in belly capacity was observed ex North America region in March at 308K MT as compared to 279K MT in February.

- This increase is majorly surfaced by a 19% surge in belly capacity ex North America to Europe in March (136K MT) as compared to 115K MT in February, which may be attributed to the increasing demand of passenger travel between the regions and additional routes and flights rolled out by carriers like Delta Airlines, Air Canada among other operators.

- Other notable fact is the regularizing freighter and belly capacity from North America to Latin America which has increased MoM by 5% to 126K MT in March.

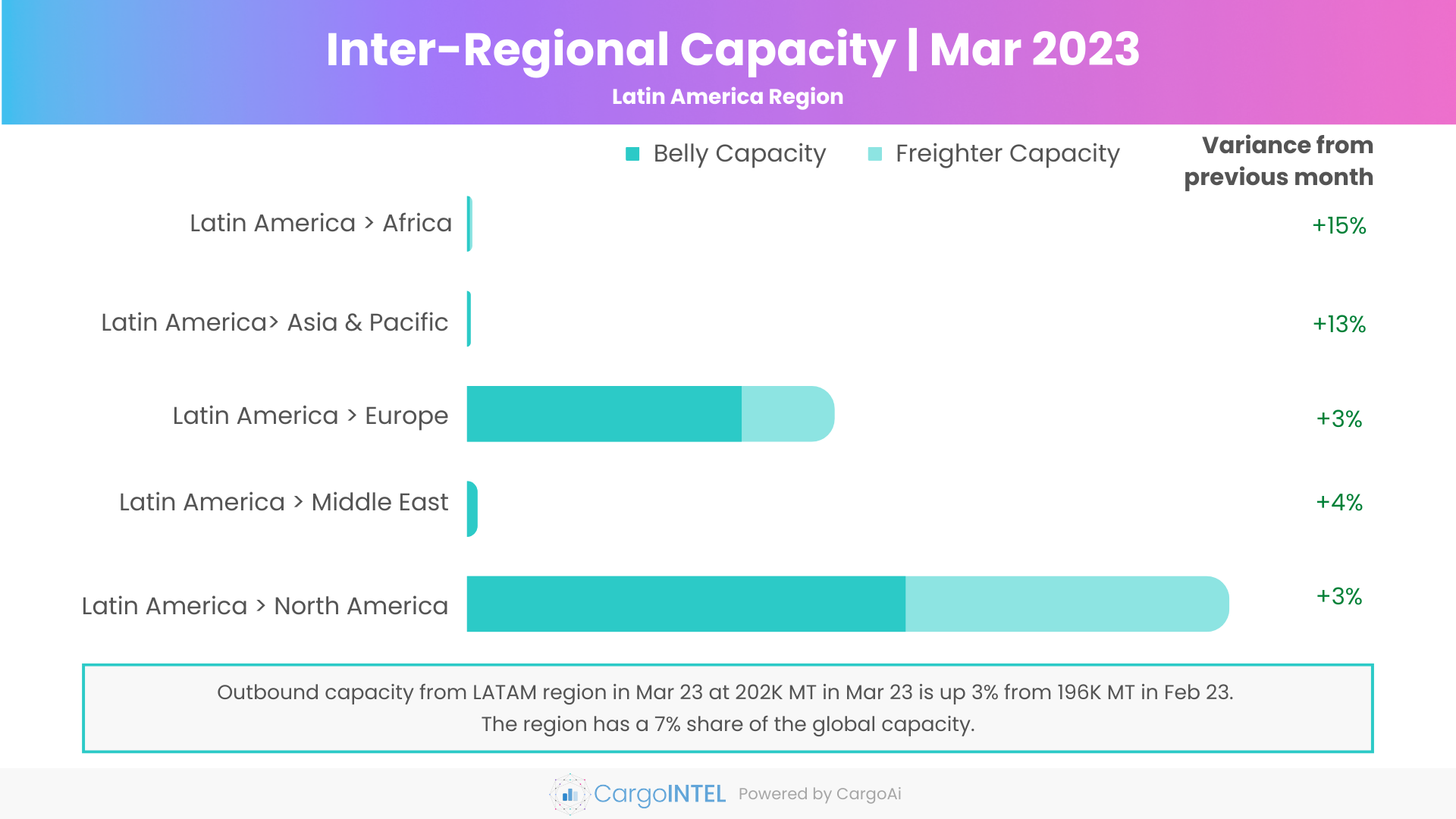

Latin America Region

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Latin America | 0.9 | 15% |

| Latin America | 0.6 | 13% |

| Latin America | 64.5 | 3% |

| Latin America | 1.8 | 4% |

| Latin America | 133.9 | 3% |

Observations

- The overall outbound capacity from the region was indexed at 202K MT in March, a MoM increase by 3% and has remained at par with the registered capacity in January.

- While the belly freight capacity from the region has increased MoM by 6% in March to 128K MT, the freighter capacity has gone down by 2% as compared to February.

- The additional routes made operational by airlines like AeroMexico, Iberia, TAP, LATAM, Air Europa for the summer schedule in 2023 are positive signs anticipating a surge in the overall capacity to and from Latin America region.

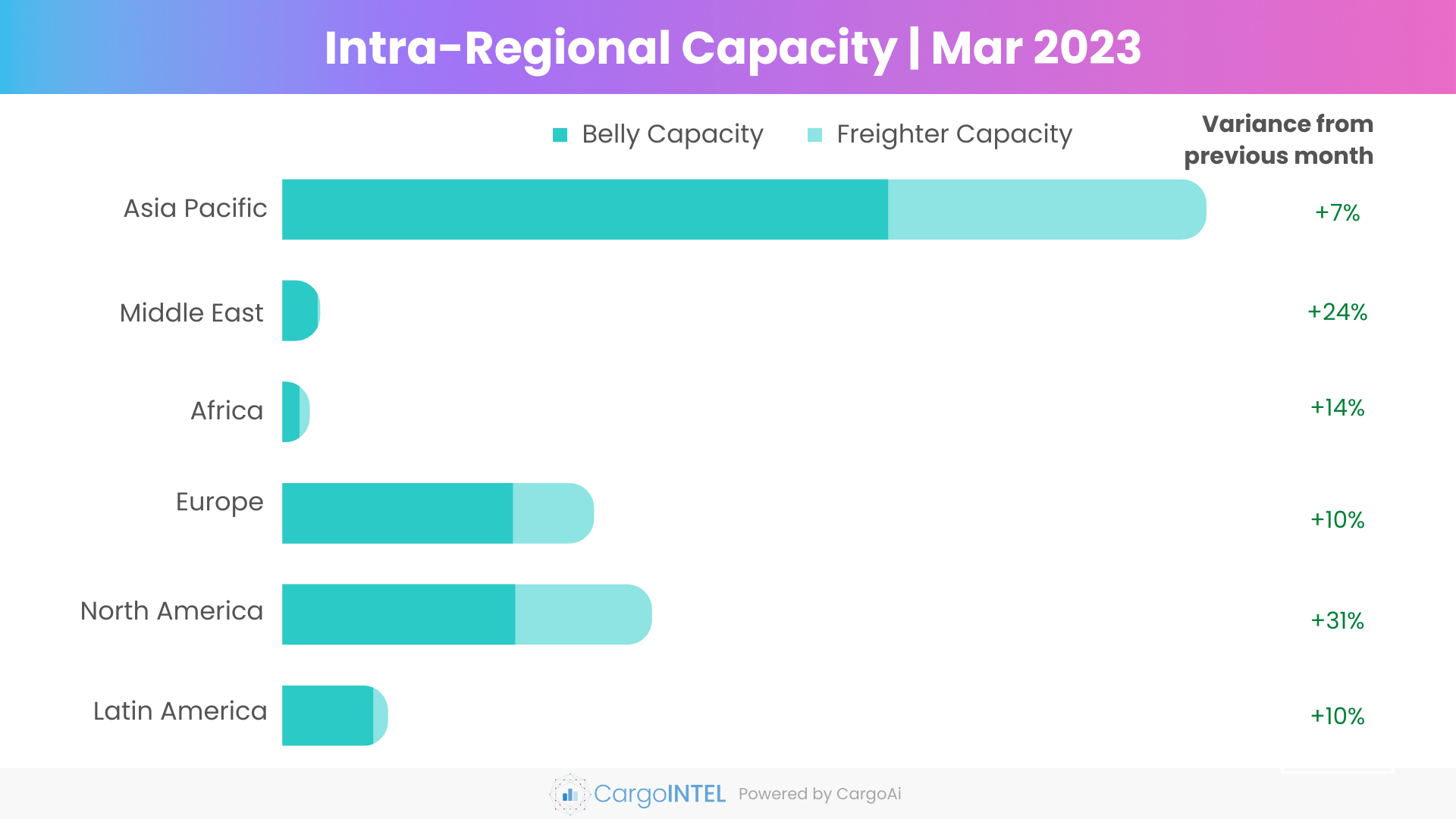

Top Intra-Regional Cargo Capacity

| Region | Capacity in Mar 2023 (100k tons) | Variance vis-a-vis Mar 2023 |

|---|---|---|

| Asia & Pacific | 2507.7 | 7% |

| Middle East | 101.6 | 24% |

| Africa | 73.3 | 14% |

| Europe | 845.1 | 10% |

| North America | 1002.5 | 31% |

| Latin America | 285.8 | 10% |

Observations

- The overall capacity indexed within the Asia Pacific region has gone up by 7% MoM to 2507K MT from 2334K MT, with an increase in belly capacity by 10%. The additional passenger flights routes within the region by operators like Indigo, Vietjet, China Airlines, Thai AirAsia etc are inciting the upswing of capacity.

- A MoM two-digit increase in capacity by 24% has been observed within Middle-East region to 102K MT in March from 82K MT in February.

- The belly freight capacity within North America region registered at 632K MT in March, an increase by 27% are signs of increasing summer travel leading to additional routes and flights by North American operators like Flair Airlines, Avelo Airlines, Spirit Airlines, Canada Jetline among the big carriers like American Airlines, United and Delta.

- The capacity within Europe also shows a double-digit MoM increase of 10% in March indexed at 845K MT. The new routes within Europe launched in March by carriers like TUI Fly, Air Europa, Finnair, Ryan Air, Condor, and so on have outlined the boost in capacity.

Air Cargo Global chargeable weight analysis

Observations

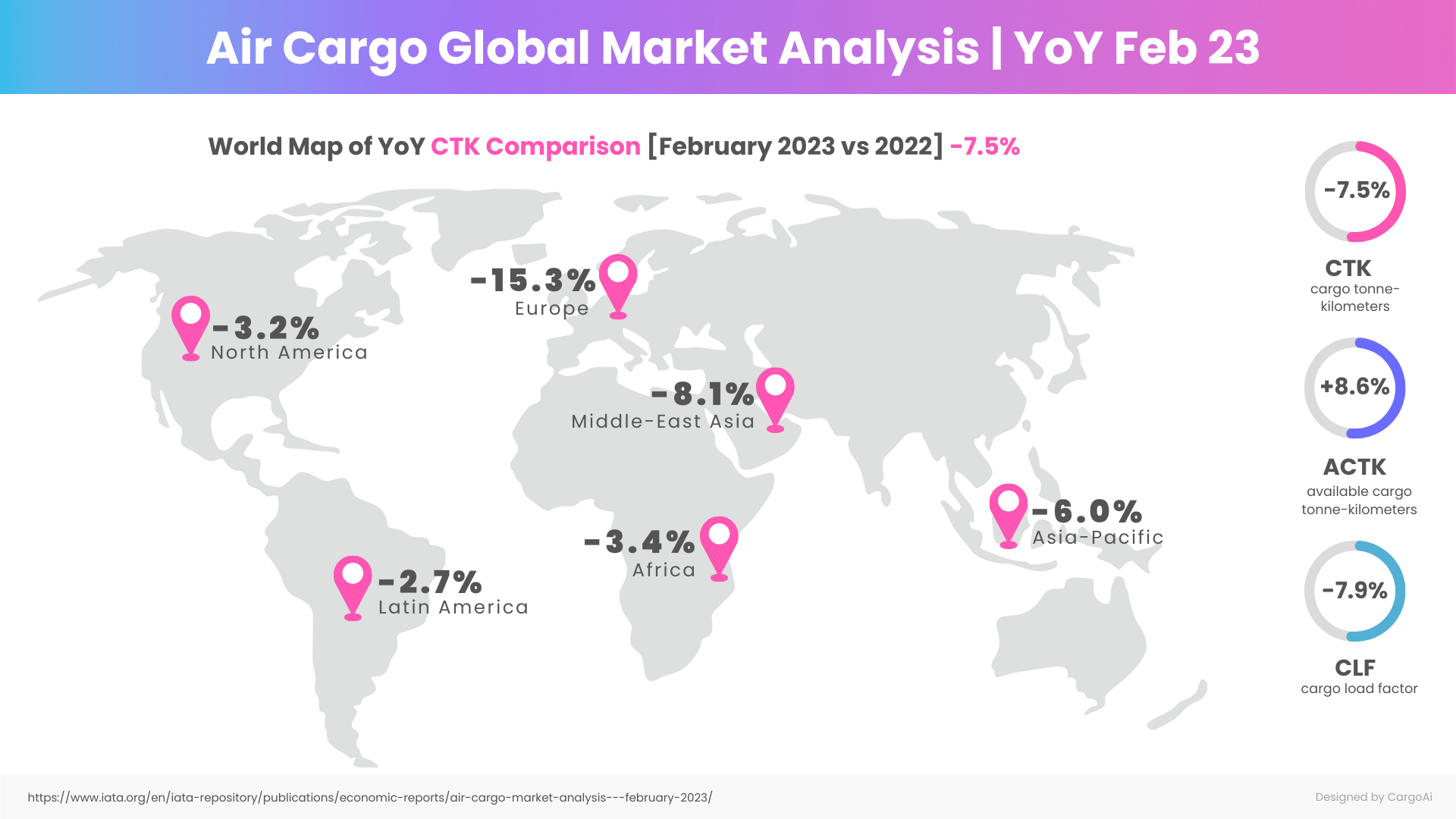

- The air cargo demand, CTK (Cargo Tonne-Kilometres) indexed by IATA in February 2023 was quite resilient in February which was only -7.5% lower than the same period YoY, as compared to 14.9% YoY decline seen in January.

- The available capacity in ACTK (Available Cargo Tonne-Kilometres) in February 2023 grew by 8.6% YoY, characterized by the increasing belly capacity globally, that shot up by 57% and attained three-fourth level of the pre-pandemic belly capacity.

- Overall the regions like Africa, Asia Pacific, Europe and Middle-East have shown healthy signs of stability in terms of tonnages and CTK.

Resources:

- https://www.worldacd.com

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis---february-2023/

- https://www.routesonline.com/news/29/breaking-news/299446/routes-in-brief-rolling-daily-updates-wc-march-13-2023/

- https://www.routesonline.com/news/29/breaking-news/299394/new-routes-50-services-being-launched-in-march-2023/

- https://timesofindia.indiatimes.com/business/india-business/indigo-announces-new-one-stop-flights-to-european-countries-via-istanbul/articleshow/97747810.cms?from=mdr

- https://airlines.iata.org/analysis/european-2023-delays-must-be-tackled-now

- https://www.reuters.com/business/aerospace-defense/demand-transatlantic-flights-soars-americans-cant-get-enough-europe-2023-03-21/

- https://www.routesonline.com/news/29/breaking-news/299416/routes-in-brief-rolling-daily-updates-wc-march-6-2023/

- https://asianaviation.com/airlines-ramping-up-operations-within-asia-pacific-europe/

- https://simpleflying.com/qatar-airways-unveils-seven-new-destinations-11-resumptions/

- https://simpleflying.com/31-airports-south-america-served-from-europe/

- https://punchng.com/airlines-divert-cancel-flights-over-poor-weather/

- https://www.euronews.com/travel/2023/02/27/hundreds-of-flights-cancelled-as-german-airport-workers-strike-over-pay

- https://www.airmauritius.com/news/press-communiqu%C3%A9-19-feb-23--flight-disruptions-due-to-intense-tropical-cyclone-freddy---bulletin-2

RECENT POSTS