Capacity Statistics - June 2023

CargoAi features the air cargo capacity statistics report for June 2023 extracted from the business intelligence tool CargoINTEL using the real-time facts and figures. Read on for the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month.

Highlights

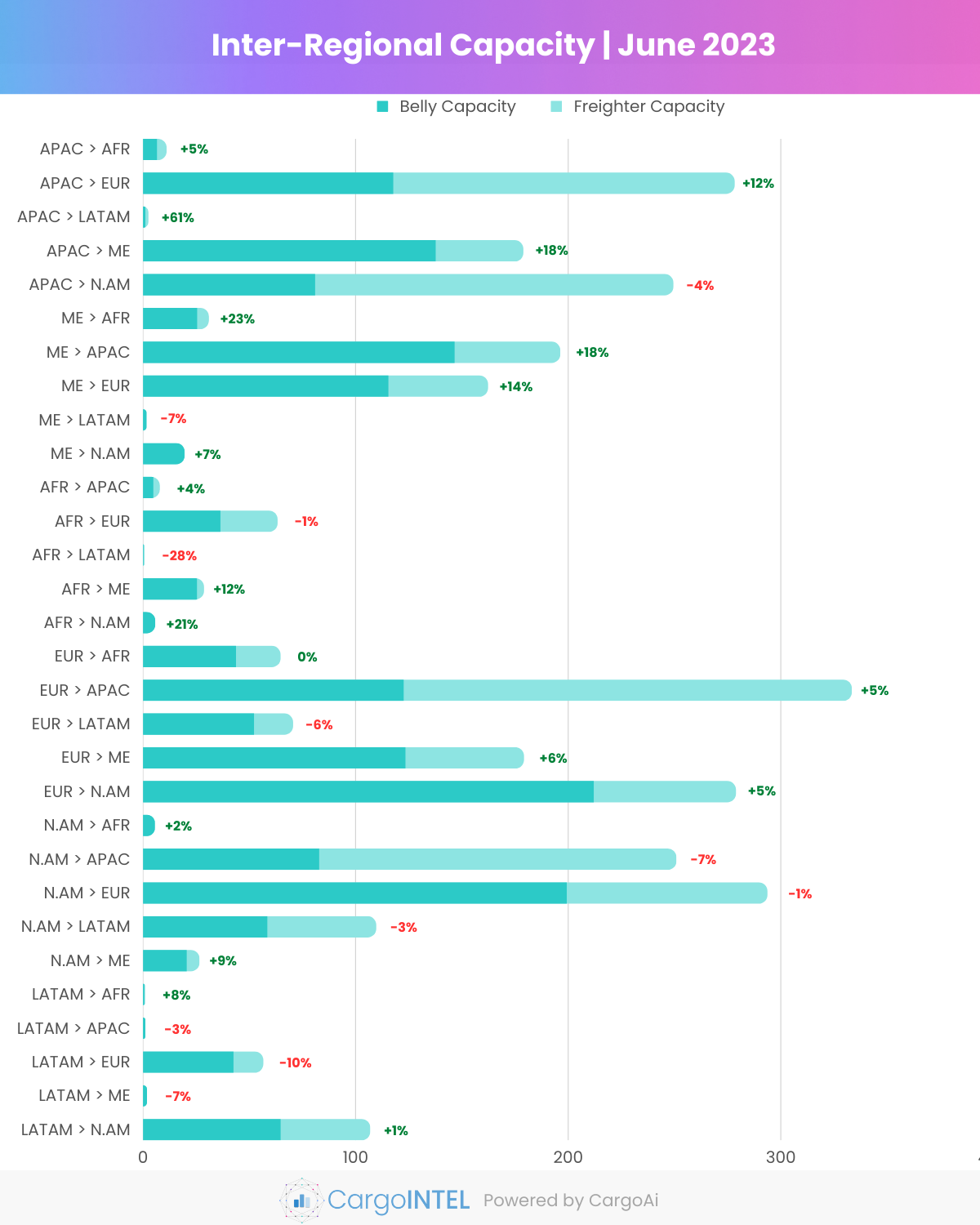

- The global air cargo capacity has been strengthening month-on-month since March 2023, surpassing the pre-COVID levels.

- The overall global outbound capacity indexed by CargoINTEL in June at 3013K MT has increased by 4% as compared to 2903K MT in May. The overall global intra-regional capacity rose up to 5913K MT, a double-digit surge by 12% from 5299K MT in May.

- While the worldwide outbound freighter capacity dropped by 2% month-on-month at 1260K MT, the outbound belly capacity has soared up by 9% to 1753K MT in June from 1611K MT in May.

- Contrastingly, the worldwide intra-regional belly capacity has remarkably increased by 15% to 3744K MT in June as compared to 3495K MT in May; and the freighter capacity within the regions has fairly remained equipoised since the beginning of Q2 of 2023, indexed at 1626K MT in June.

- The seasonal trend of decreasing global tonnages towards the end of second quarter of the year has stereotyped this year from most regions; and a consequent decreased of 2% month-on-month has been reported in June.

- On a year-on-year perspective, the global capacity has risen up by 11% as compared to June 2022.

Top Inter-Regional Cargo Capacity

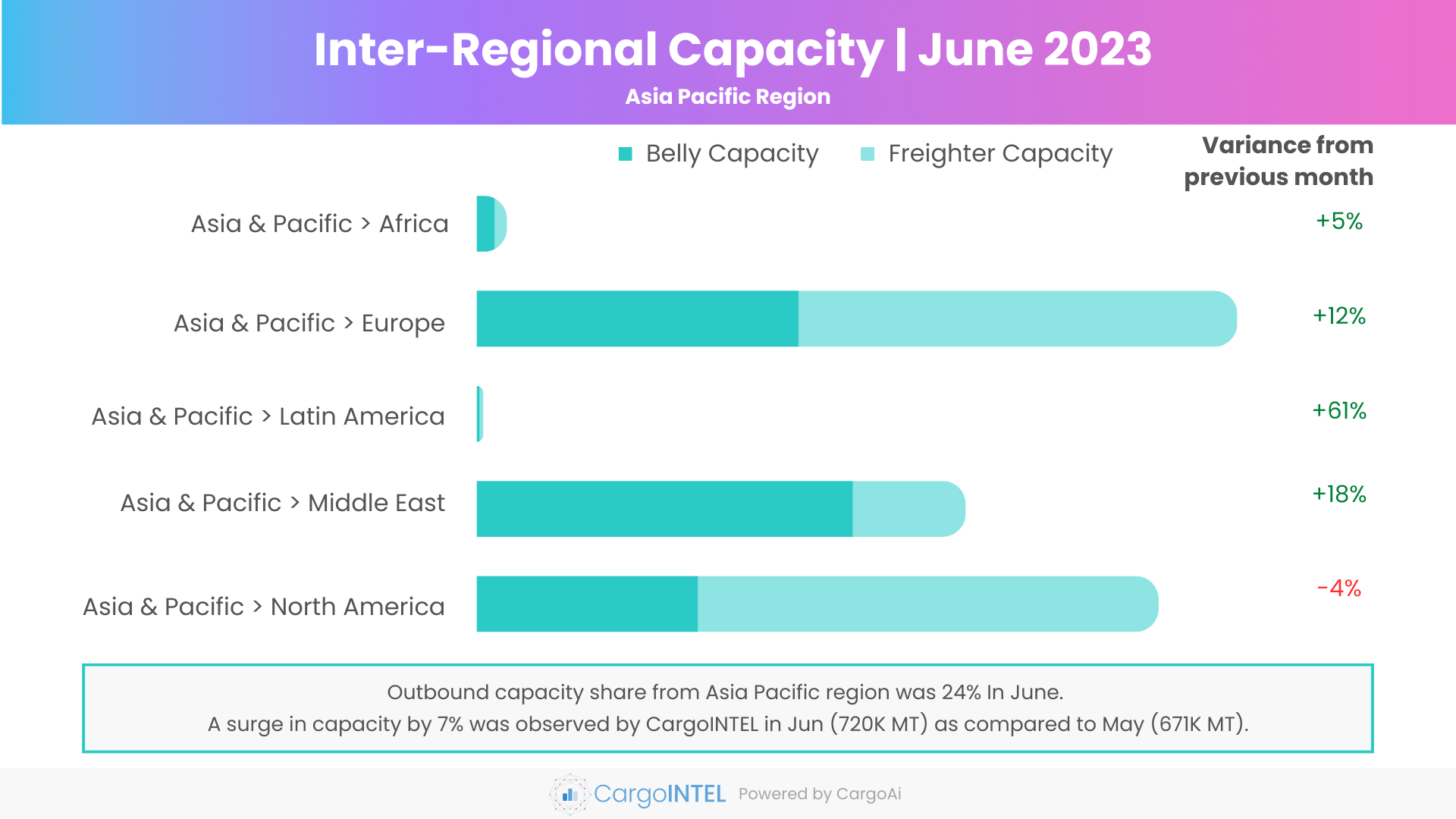

Asia Pacific Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Asia & Pacific | 11 | 5% |

| Asia & Pacific | 278.1 | 12% |

| Asia & Pacific | 2.3 | 61% |

| Asia & Pacific | 178.7 | 18% |

| Asia & Pacific | 249.4 | -4% |

Observations

- CargoINTEL had observed a marginal decline of outbound capacity from Asia Pacific region in May. However, the region has bounced back in June with a solid 7% hike in capacity at 720K MT vis-à-vis 671K MT in May.

- This is majorly impelled by an overall 13% surge in belly capacity at 344K MT as compared to 303K MT in May. The belly capacity from Asia Pacific to other regions has shown positive resurgence with carriers from the region like Air Asia, Indigo, Zipair, Air China boosting frequency of passenger flights and opening new routes.

- The belly capacity has eminently emerged between Asia Pacific to Middle-East by 23% and to Europe by 13%.

- The outbound freighter capacity has remained more or less even with a marginal increase by 2% in June to 376K MT.

- On a year-on-year perspective, the overall outbound capacity from Asia Pacific region has grown phenomenally by 32%, whereas chargeable weight has dropped by 3%.

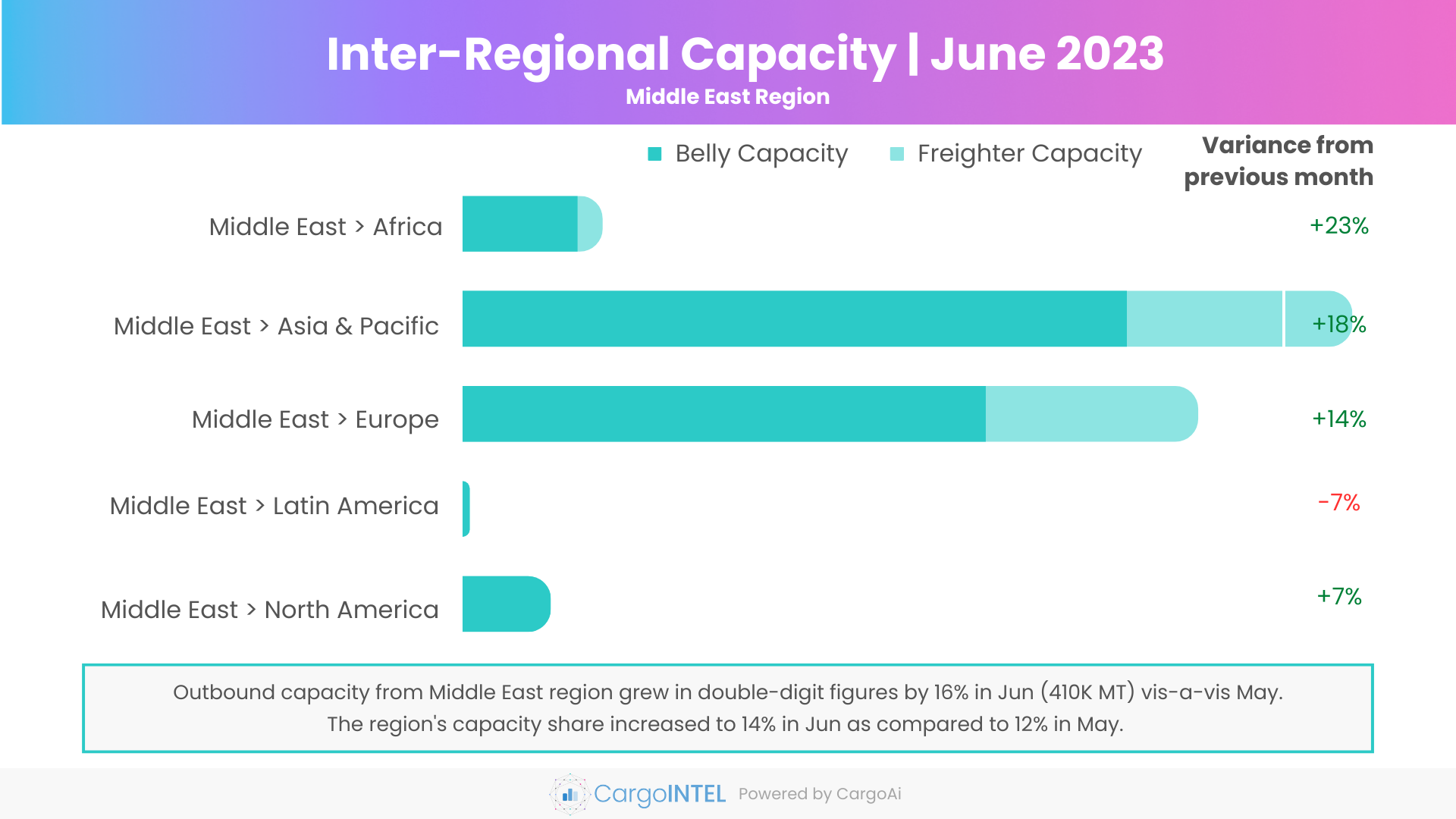

Middle East Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Middle East | 30.8 | 23% |

| Middle East | 196.1 | 18% |

| Middle East | 162 | 14% |

| Middle East | 1.5 | -7% |

| Middle East | 19.4 | 7% |

Observations

- The overall outbound capacity from Middle East region in June has increased by 16% month-on-month to 410K MT from 354K MT in May, again mobilized by a 21% increase in belly capacity from the region.

- The notable increase in belly capacity from Middle-East region have been exceedingly to Asia Pacific (+24%) and Europe (+19%).

- In June, most of the Middle-Eastern carriers like Air Arabia, Emirates, Etihad, Qatar Airways, Gulf Air, Fly Dubai, Jazeera Airways, Wizz Air have started new routes and ameliorated frequency, particularly to Europe and Asia Pacific. Eid travel during the month has also surged the frequency of passenger flights from, to and within the region.

- However, the freighter capacity has remained stable with no major change at 102K MT. This is indicative of the inertness of the global air cargo tonnages, as the big freighter carriers from the Middle East have remained dormant throughout Q2 of 2023.

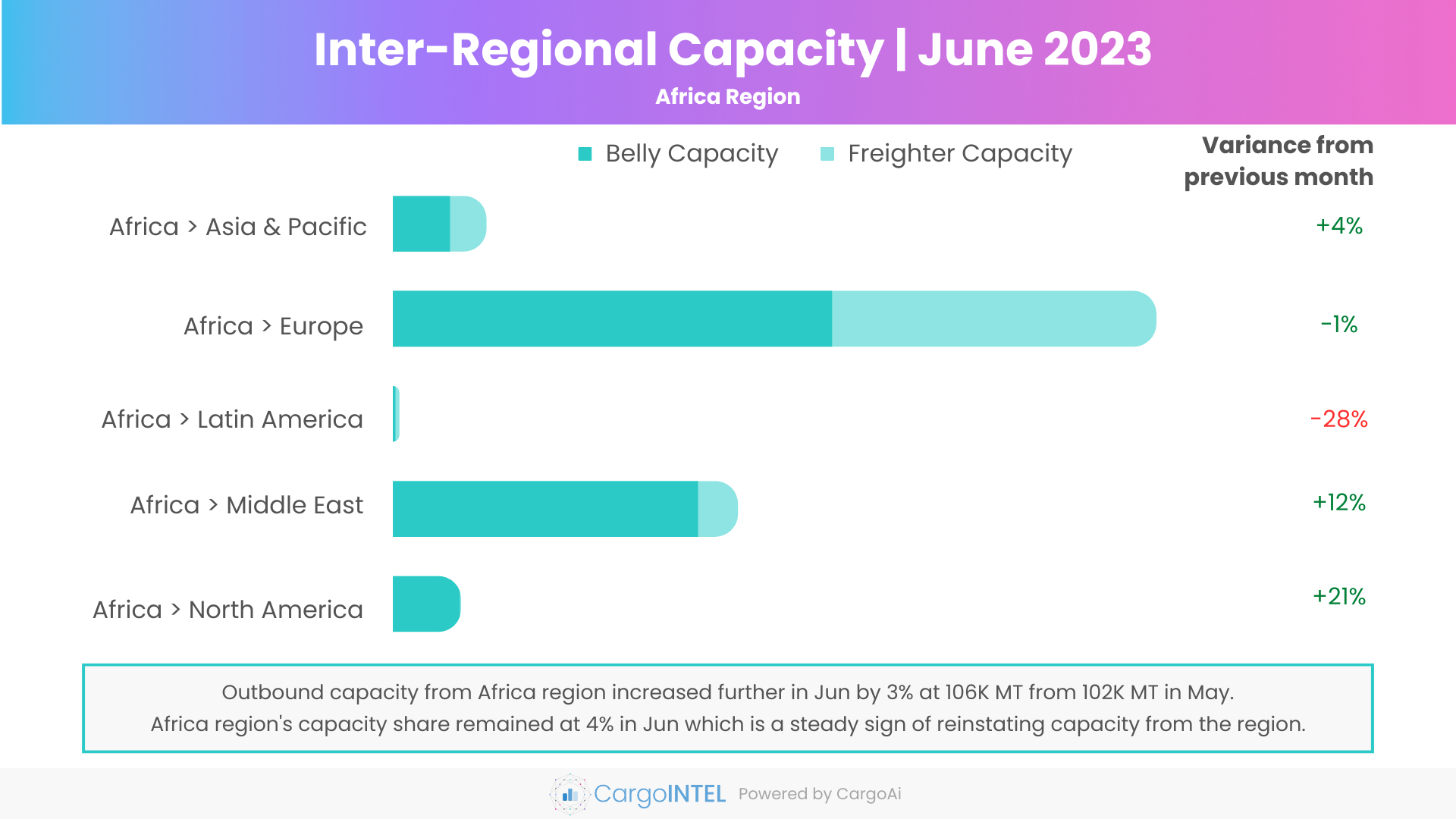

Africa Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Africa | 7.7 | 4% |

| Africa | 63.1 | -1% |

| Africa | 0.5 | -28% |

| Africa | 28.5 | 12% |

| Africa | 5.7 | 21% |

Observations

- Outbound capacity from Africa region has been steadily increasing at an average of 4% since Q2 of 2023 after a tumultuous Q1.

- CargoINTEL indexed an overall outbound capacity of 106K MT in June, modestly up by 3% from 102K MT in May.

- Both belly and freighter capacity from the region have maintained constancy since April. The only notable increase of belly capacity by 14% month-on-month could be attributed to the increased flights between the region due to Eid travel.

- The freighter carriers like Ethiopian, Kenya Airways, Astral Aviation have remained low key during the month, squaring the air cargo market scenario.

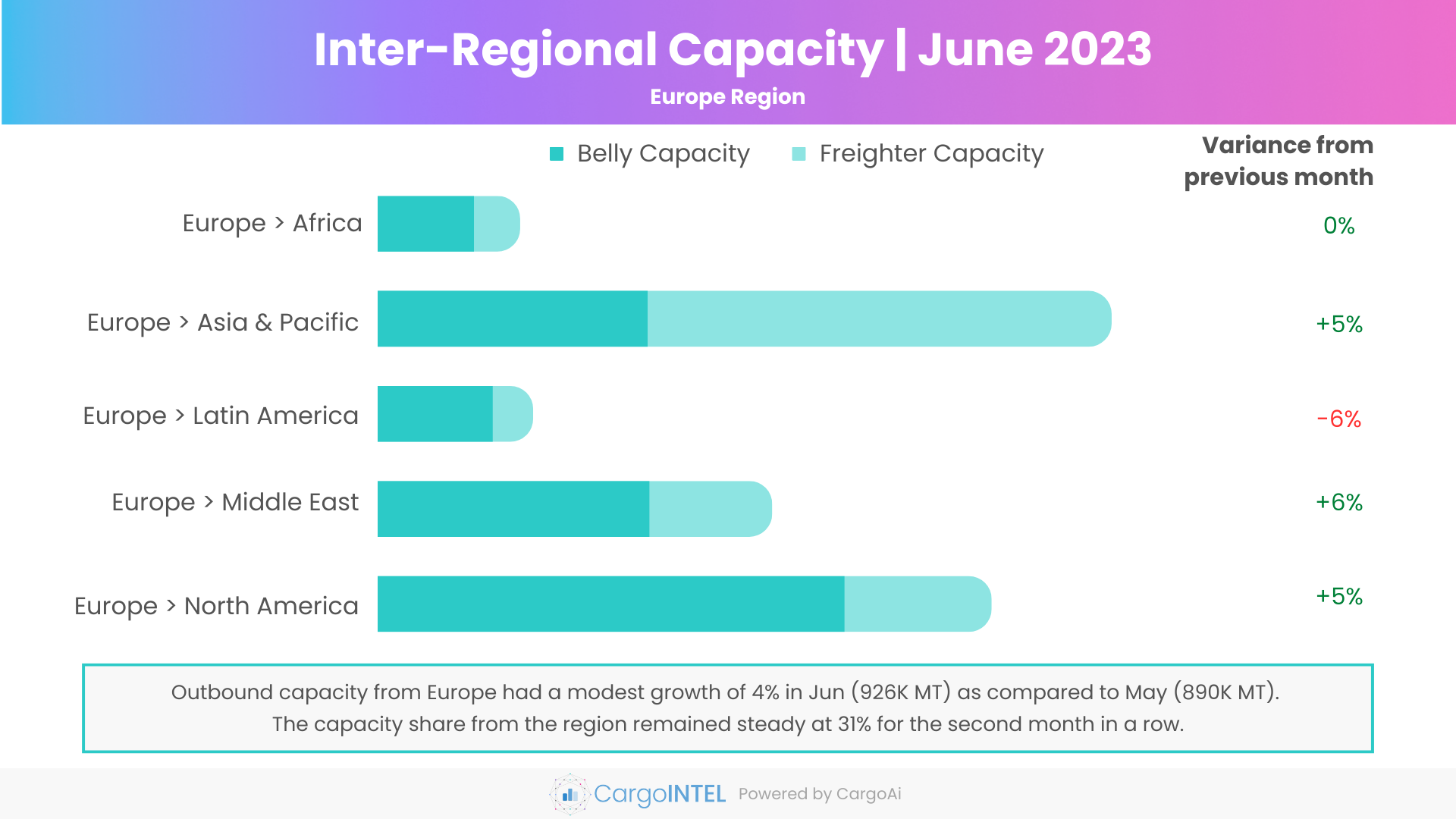

Europe Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Europe | 64.5 | 0% |

| Europe | 333.2 | 5% |

| Europe | 70.4 | -6% |

| Europe | 178.9 | 6% |

| Europe | 278.7 | 5% |

Observations

- Unlike the strikingly improving capacity dynamics from Europe for the first five months on the year, capacity in June has wound down.

- The overall outbound capacity from Europe region has austerely increased by 4% to 926K MT in June from 890K MT in May.

- While the freighter capacity has remained unchanged, belly capacity increased by 7% from 517K MT in May to 554K MT in June.

- The belly capacity from Europe has grown steadily to North America (7%), Asia Pacific (9%) and Middle-East (13%) for yet another month.

- The reinstating transatlantic capacity can be attributed to the new routes being launched by Air Canada, British Airways, Jet Blue Airways, Norse Atlantic, Air France. However, the pricing has reported to have gone down by 5% during the month between the regions.

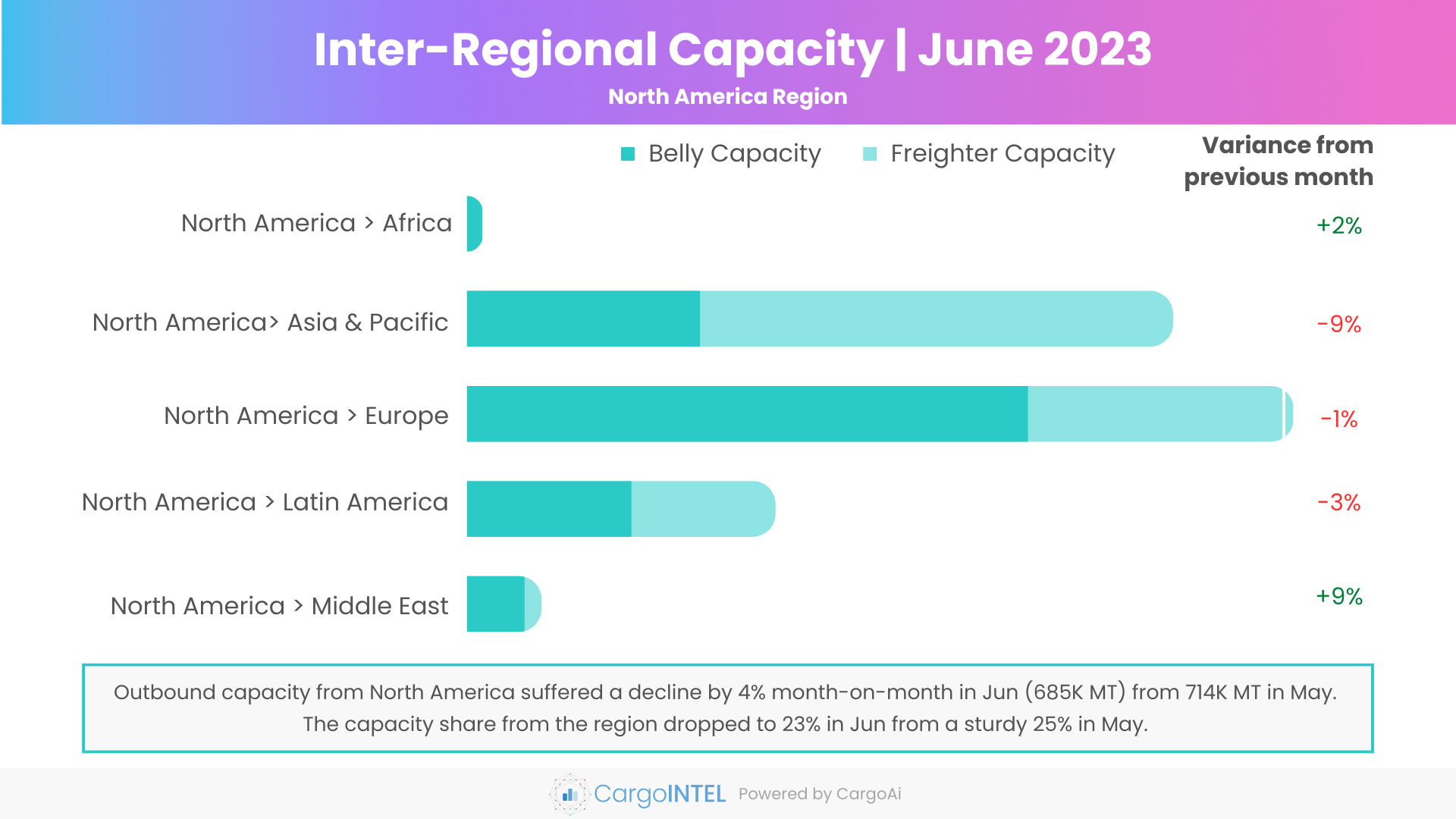

North America Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| North America | 5.4 | 2% |

| North America | 250.6 | -9% |

| North America | 293.4 | -1% |

| North America | 109.5 | -3% |

| North America | 26.4 | 9% |

Observations

- CargoINTEL observed a 4% dip in the overall outbound capacity from North America in June (685K MT) as compared to the previous month. This slump in outbound capacity has been recorded for the second month in a row since May.

- The freighter capacity from the region has slumped by 10% in June to 319K MT from 356K MT in May, impacting the overall capacity growth from the region.

- The belly capacity from North America region endured an upward trend to Latin America (+8%), Middle East (+13%), and Europe (+2%), whereas the freighter capacity to all regions downturned.

- The new routes in operation by carriers like Copa Airlines, Avianca, Air Canada, British Airways, Zipair have driven the increase in belly capacity to and from the region.

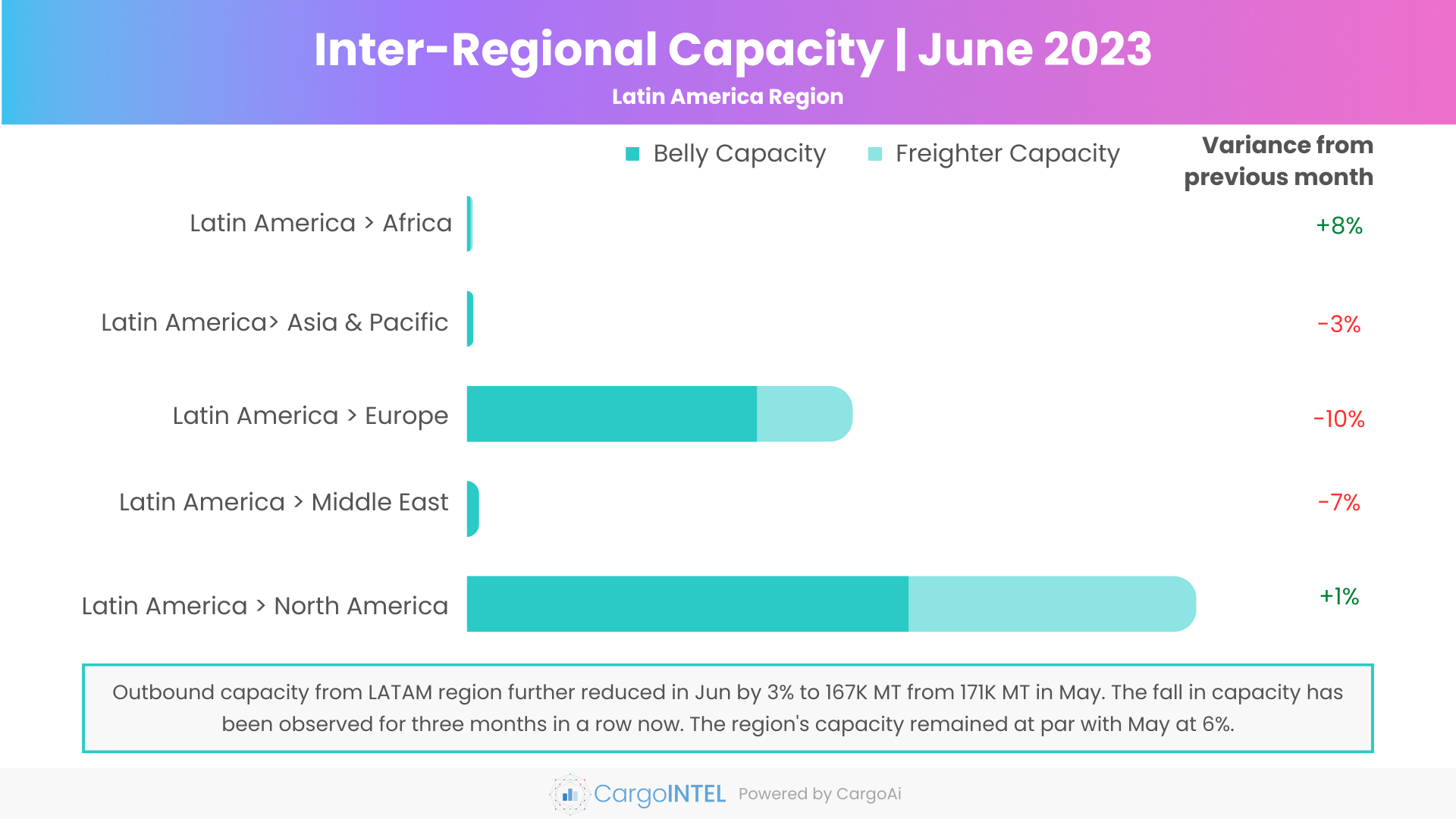

Latin America Region

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Latin America | 0.8 | 8% |

| Latin America | 0.9 | -3% |

| Latin America | 56.4 | -10% |

| Latin America | 1.7 | -7% |

| Latin America | 106.7 | 1% |

Observations

- The overall outbound capacity from Latin America region has again plummeted by 4% to 167K MT in June, closing Q2 of the year on a negative note.

- While the belly capacity has remained stable as compared to previous month, the freighter capacity from the region has gone down by 9% to 56K MT with the paucity of demand entering the slowest season of the year.

- The freighter and belly capacity from the Latin America has dwindled to all other regions, except a 6% growth in belly capacity to North America indexed at 65K MT.

- The new flight frequencies of Copa Airlines and Avianca to USA could be the driving factor for the upswing.

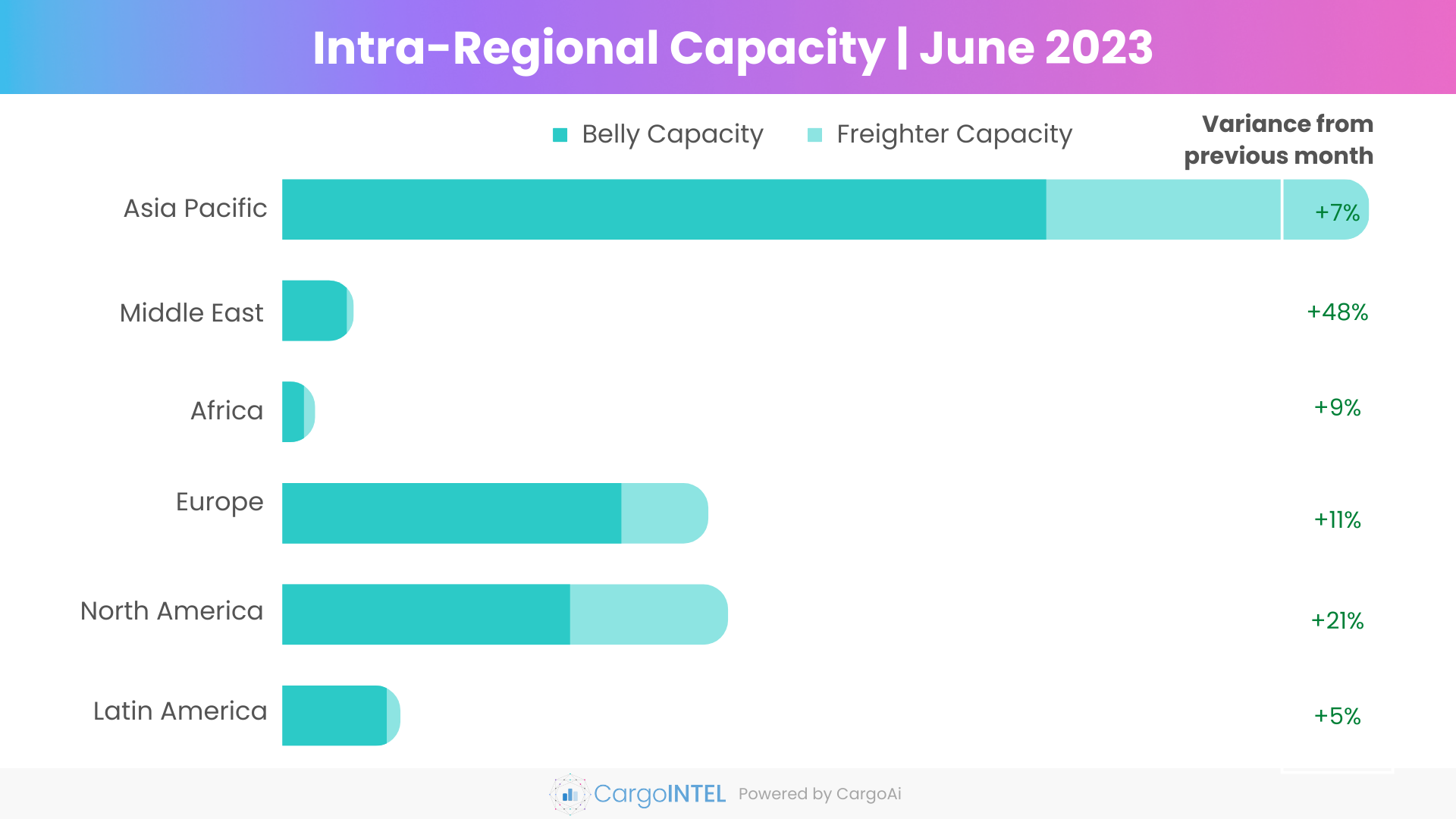

Top Intra-Regional Cargo Capacity

| Region | Capacity in June 2023 (100k tons) | Variance vis-a-vis June 2023 |

|---|---|---|

| Asia & Pacific | 2949.3 | 7% |

| Middle East | 192.6 | 48% |

| Africa | 87.7 | 9% |

| Europe | 1155.2 | 11% |

| North America | 1208.7 | 21% |

| Latin America | 319.3 | 5% |

Observations

- The capacity within Asia Pacific region increased month-on-month by 7% from 2748K MT in May to 2949K MT in June, primarily owing to a 11% growth in belly capacity. This could be attributed to the new routes launched in June by Air Asia, Vietjet, Air Busan, Air China, Spring Airlines.

- The upward trend of capacity growth within Middle East region has been noticed for yet another month to 193K MT in June from 130K MT in May. The passenger travel during Eid holidays in the region has facilitated a substantial spike in belly capacity to 174K MT in June.

- The capacity within Africa region has also grown by 9% from 81K MT in May to 88K MT in June, with a double-digit improvement in belly capacity by 13%.

- The intra-regional capacity in Europe has grown consistently since March this year. A month-on-month increase of 11% (1155K MT) in June as compared to 1039K MT in May. These are signs of steadying flight schedules within the region.

- In North America region, the capacity has grown to 1209K MT in June as compared to 997K MT in May, characterized by the new routes launched in June by carriers like American Airlines, United Airlines, Westjet.

- The intra-regional capacity within Latin America region has increased by 5% month-on-month to 319K MT in June from 304K MT in May. The freighter capacity within the region has reduced by 6% owing to the lack of demand.

Air Cargo Global chargeable weight analysis

Observations

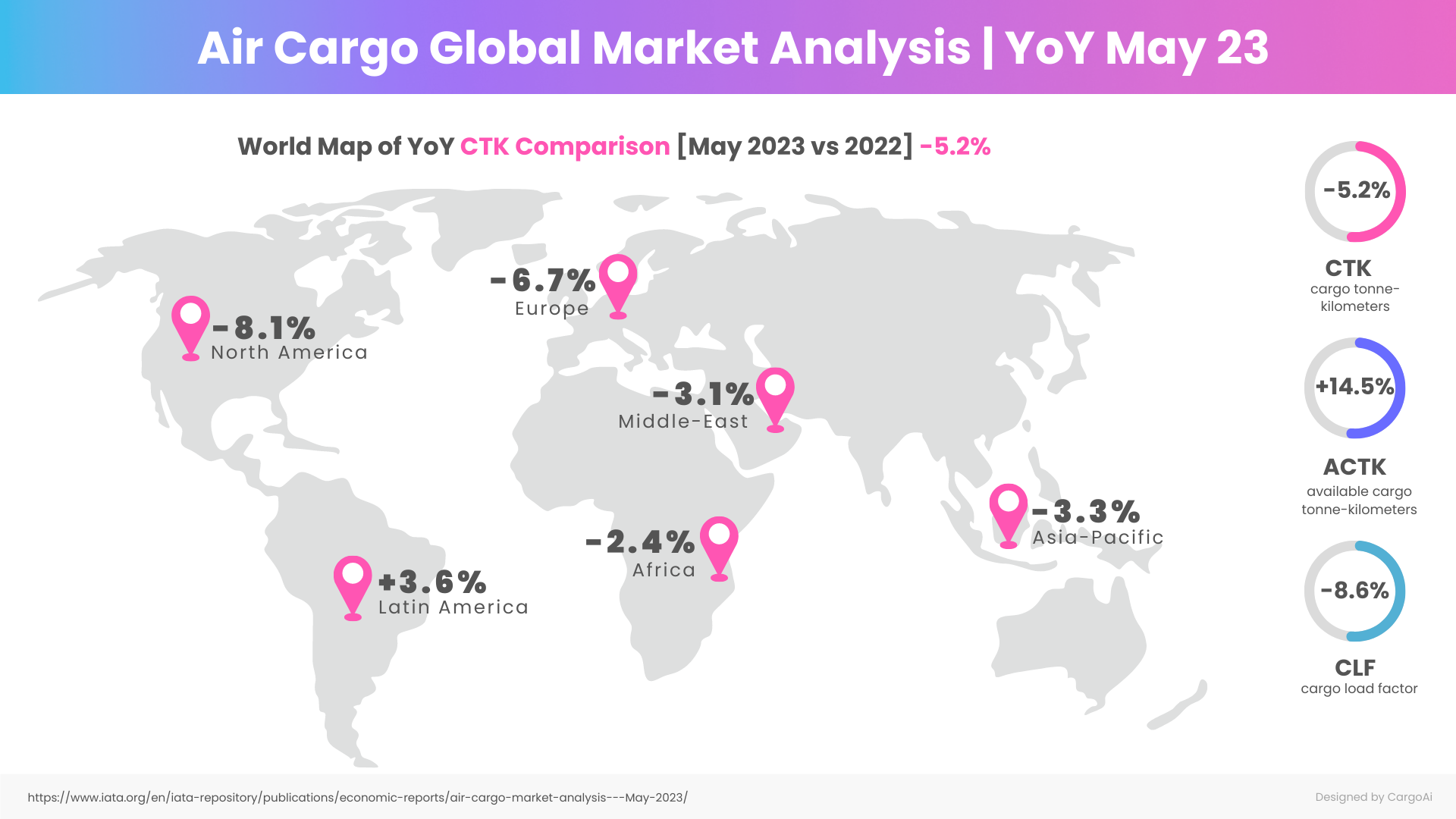

- CTK (Cargo Tonne-Kilometres) in May 2023 has dropped by 5.2% year-on-year which is an improvement as compared to -6.6% in April.

- The available capacity in ACTK (Available Cargo Tonne-Kilometres) has increased year-on-year substantially in May by a double-figure margin of 14.5% for yet another month after a 13.4% growth observed in April 2023, and higher by 5.9% when compared to the same period in 2019.

- The reducing tonnages and increasing capacity have resulted in the global cargo load factor to slip down to 42% causing a steep decline in the average rates.

Resources:

- www.worldacd.com

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis---May-2023/

- https://www.routesonline.com/news/

- https://aviationweek.com/air-transport/airports-networks/routes-brief-rolling-daily-updates-wc-june-12-2023

- https://www.travelnewsasia.com/news23/195-IndiGoFlights.shtml

- https://aviationsourcenews.com/middle-east-asia-pacific/

- https://www.maersk.com/news/articles/2023/06/21/asia-pacific-market-update-june

- https://aviationweek.com/air-transport/airports-networks/50-new-routes-starting-june-2023

RECENT POSTS