Capacity Statistics - December 2022

CargoAi features the air cargo capacity statistics report for December 2022 extracted from the business intelligence tool CargoINTEL using the real-time facts and figures. Read on for the most significant insights and analysis of inter-regional and intra-regional capacity in comparison to the previous month.

Highlights

- The trend of steeply declining capacity that started in November 2022 has protracted further in December 2022. The strong dip in global capacity and volumes during the holiday season in December is stereotypical.

- The global inter-regional capacity has seen an acute MoM reduction of 25%, from 2711K MT in November 2022 to 2041K MT in December 2022.

- The worldwide indexed belly capacity has reduced by 21% from 1390K MT in November to 1093 K MT December which can be attributed to the flight cancellations from Europe and US due to winter season and the year-end vacation in most parts of the world.

- The rampant decrease in the global freighter capacity by 28% from 1320K MT in November to 949 K MT in December corresponds to the double-digit MoM decline in worldwide tonnages by 10% in December due to severe drop in demand.

- As per WorldACD, the last week of December 2022 saw a major slump of 27% in flown tonnages as compared to the previous week. Also a YoY review shows a strong downfall of 22% in the global chargeable weight in December 2022 as compared to the same period in 2021.

Top Inter-Regional Cargo Capacity

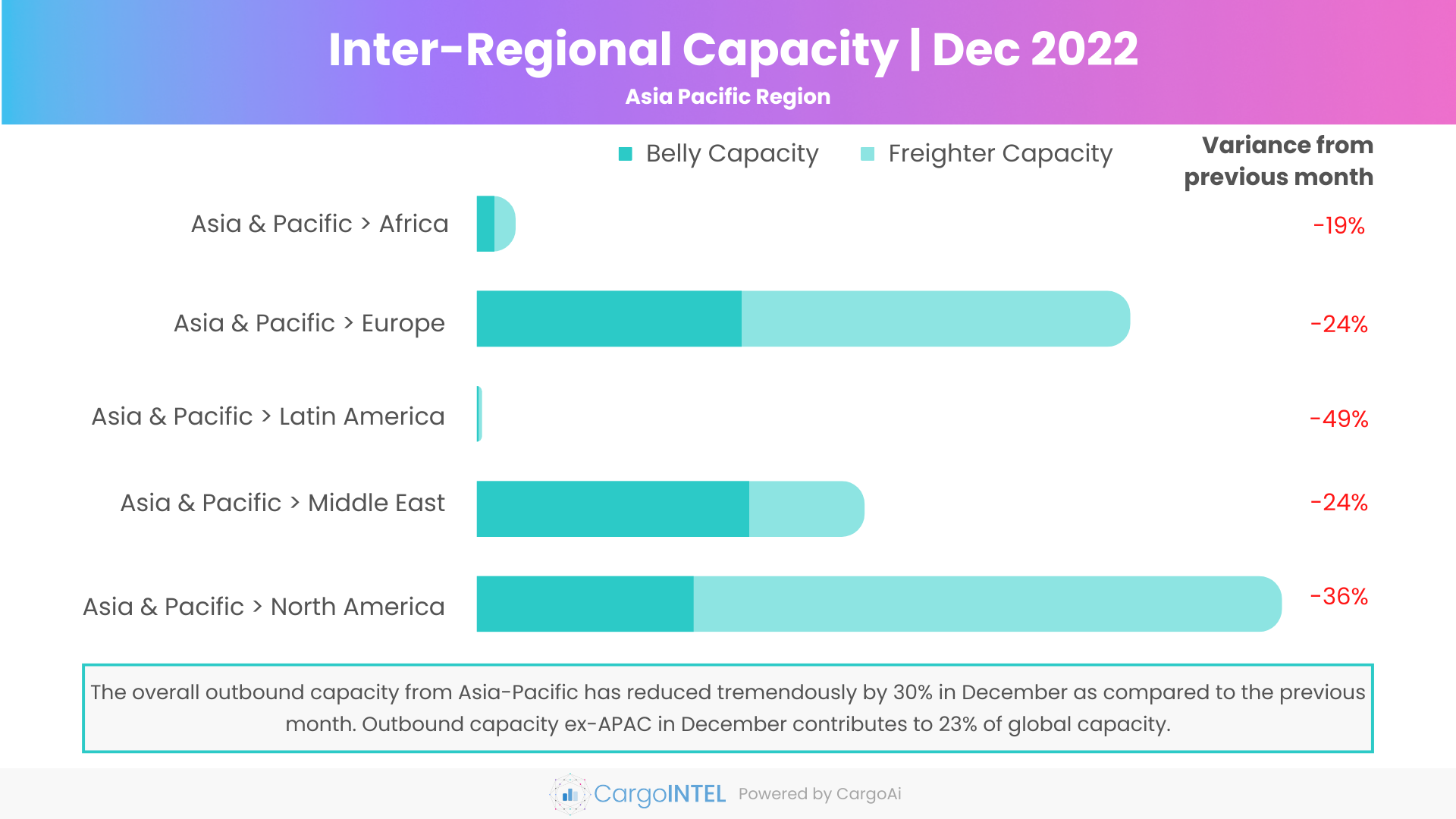

Asia Pacific Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Asia & Pacific | 9.4 | -19% |

| Asia & Pacific | 159.3 | -24% |

| Asia & Pacific | 1.2 | -49% |

| Asia & Pacific | 94.4 | -24% |

| Asia & Pacific | 196.3 | -36% |

Observations

- The month-on-month sharp fall in the overall outbound capacity from the Asia-Pacific by 30% from 657K MT in November to 461K MT December turns out to be the foremost reason for the abrupt fall in worldwide capacity.

- This severe reduction in capacity reciprocates the recorded reduction of 21% in outbound tonnages from the region in December as compared to the previous month.

- While we observed a MoM increase in capacity from Asia Pacific to North America in November as compared October, the MoM figures have taken a sharp flip of -36% from 309K MT in November to 196K MT in December.

- The seasonal holidays have led to the reduction and non-operation of scheduled freighter routes between the major trade lanes of Asia-Pacific to Europe and North America. The freighter capacity from Asia-Pacific to North America has almost halved MoM, a reduction of 39% from 235K MT in November to 143K MT in December.

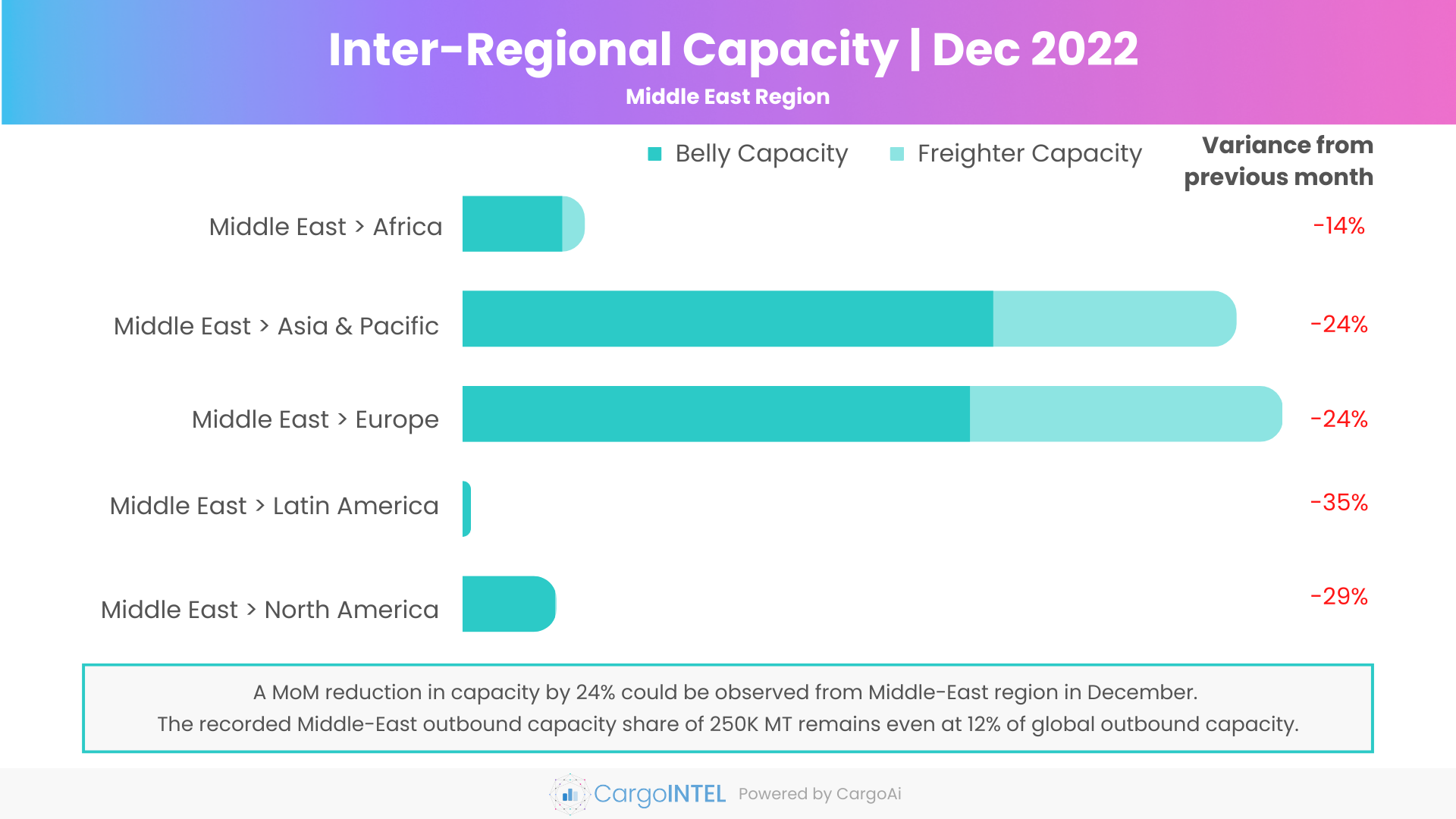

Middle East Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Middle East | 16.8 | -14% |

| Middle East | 106.6 | -24% |

| Middle East | 113 | -24% |

| Middle East | 1.1 | -35% |

| Middle East | 12.8 | -29% |

Observations

- The overall outbound capacity from the Middle-East had a major downfall by 24% from 329K MT in November to 250K MT in December.

- The Middle-Eastern carriers which are majorly catering to the Asia-Pacific, Europe and North America markets have had to curtail capacity due to year-end slowdown in demand and the flight cancellations to Europe and US.

- The overall freighter capacity from the region reduced to 80K MT in December from 107K MT in November.

- We observed a downward trend in capacity from Middle-East to Asia-Pacific in November which has continued to further reduce by 24% MoM in December to 107K MT from 141K MT in November.

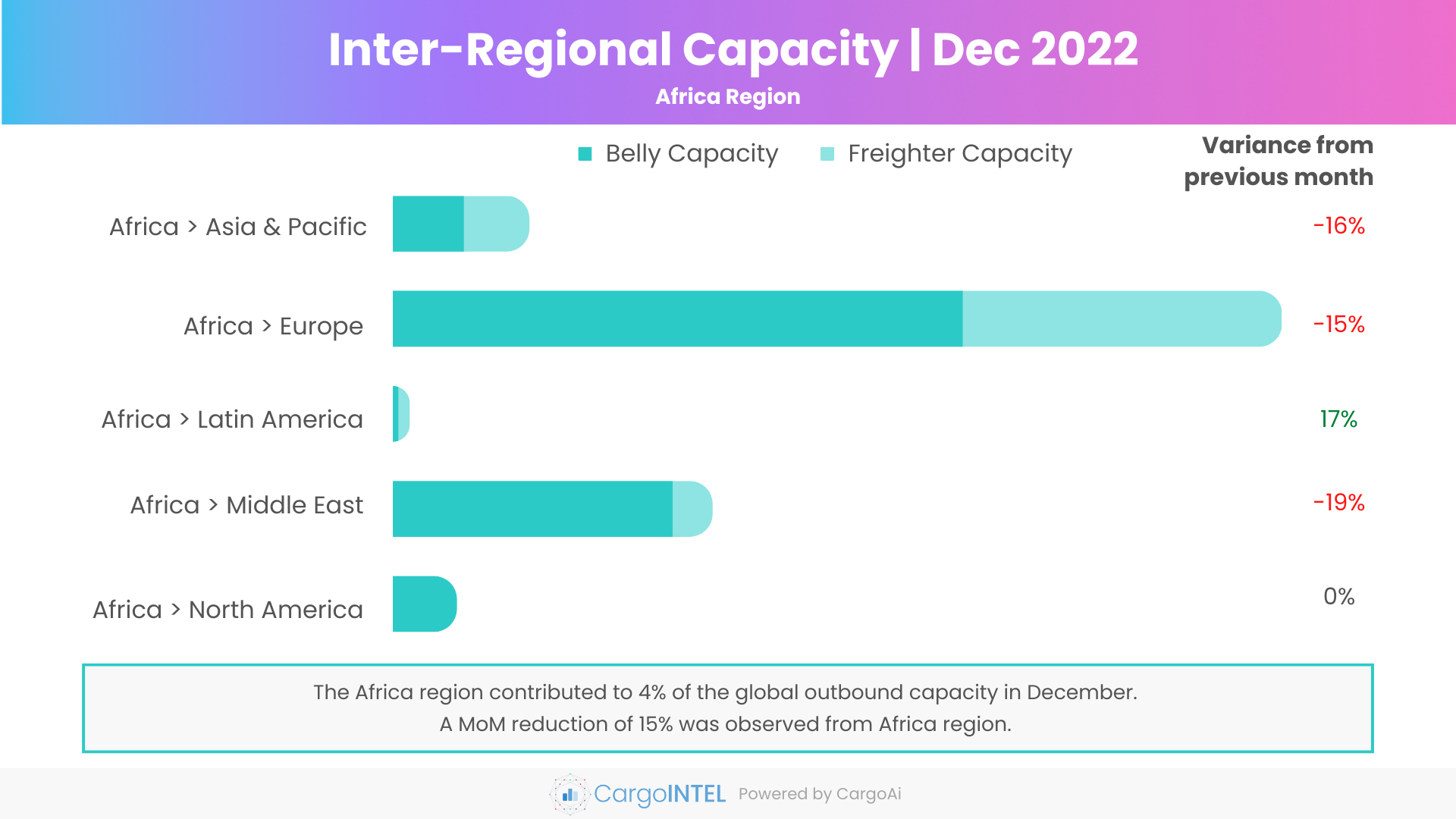

Africa Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Africa | 7.5 | -16% |

| Africa | 49 | -15% |

| Africa | 0.9 | 17% |

| Africa | 17.6 | -19% |

| Africa | 3.5 | 0% |

Observations

- The major capacity share from Africa region is Europe-bound which shows an average decline by 15% from 58 K MT in November to 49K MT in December.

- The overall average MoM reduction in outbound capacity of 15% from Africa is indicative of the lowering demand towards the year end.

- However, the year 2022 witnessed many airlines reinstating capacity into Africa like Emirates, Qatar, Virgin Atlantic, Delta Air Lines, United Airlines to name a few, after the severe restrictions we saw in 2021.

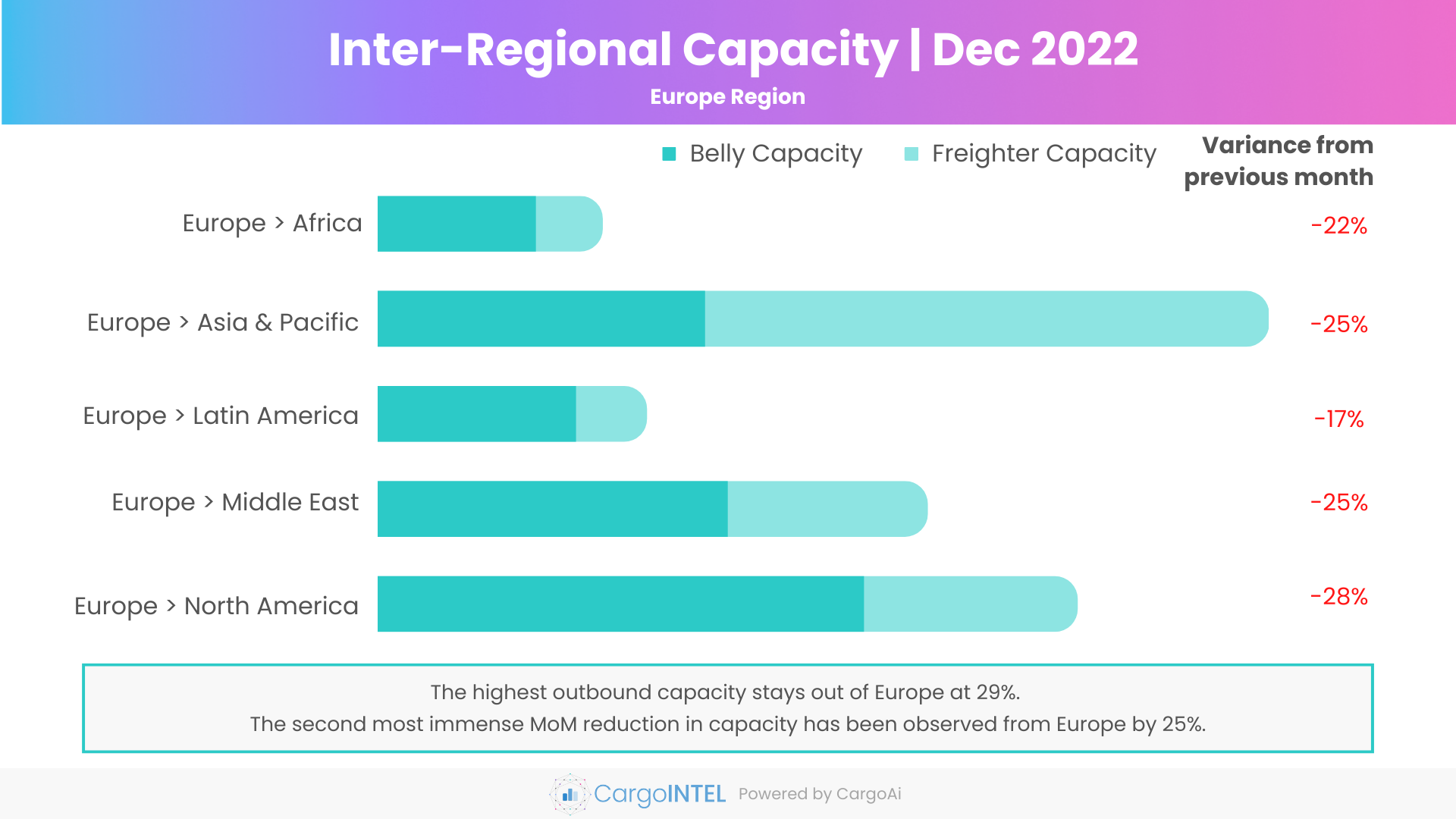

Europe Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Europe | 50.8 | -22% |

| Europe | 201.5 | -25% |

| Europe | 60.8 | -17% |

| Europe | 124.3 | -25% |

| Europe | 158.2 | -28% |

Observations

- The overall outbound capacity from Europe fell by 25% from 793K MT in November to 596K MT in December.

- While, several flights were cancelled from various parts of Europe were cancelled due to difficult winter weather travel conditions, the industrial strikes by aviation unions across Europe have also led to numerous flights cancellations during the festive season.

- A severe slump in belly capacity from Europe to North America by 29% from 155K MT to 110K MT is due to the fallout of the cancelled flights during December. The tonnages from Europe to North America fell by 32% MoM in December as per WorldACD.

- The flight cancellations and the seasonal plunge in demand and tonnages have also led to 28% downslide in the freighter capacity from Europe to Asia-Pacific and to Middle-East.

- The freighter capacity from Europe to Asia-Pacific fell from 177K MT in November to 128K MT in December.

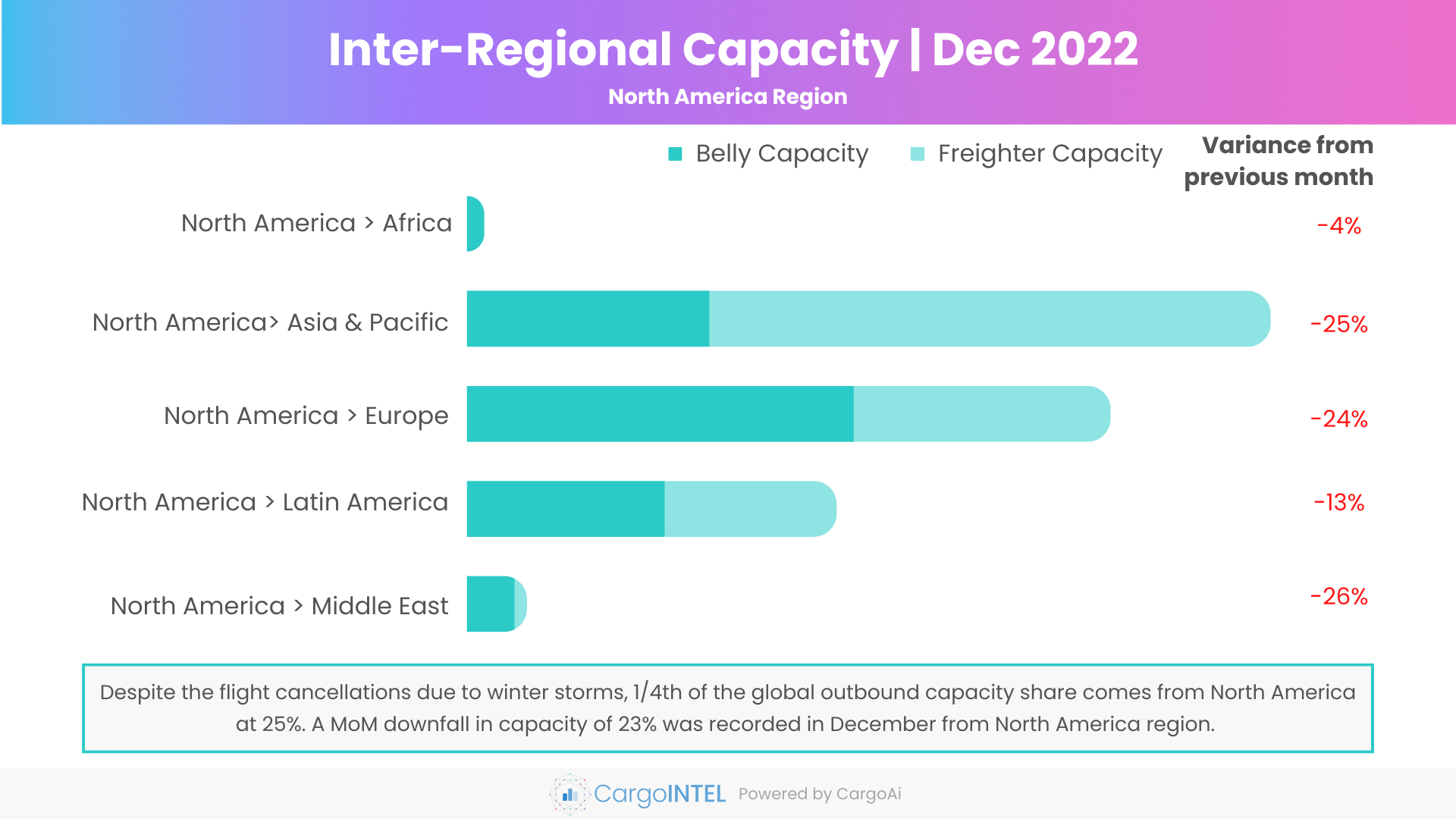

North America Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| North America | 4.5 | -4% |

| North America | 213.8 | -25% |

| North America | 171.1 | -24% |

| North America | 98.3 | -13% |

| North America | 16 | -26% |

Observations

- CargoINTEL registered a sharp fall in the overall outbound capacity from North America in December for the second consecutive month. The capacity further fell in December by 23% MoM to 504K MT from 650K MT in November.

- While it was the Tropical Storm Nicole that caused the flights cancellations from the US in November, the winter storm ‘Elliott’ and cold weather conditions led to cancellation of more than 12,000 flights in December.

- The capacity to the three major regions trade lanes from North America to Europe, Asia-Pacific and Latin America were indexed at 624K MT in November fell to 483K MT in December, a sharp decline by 21%.

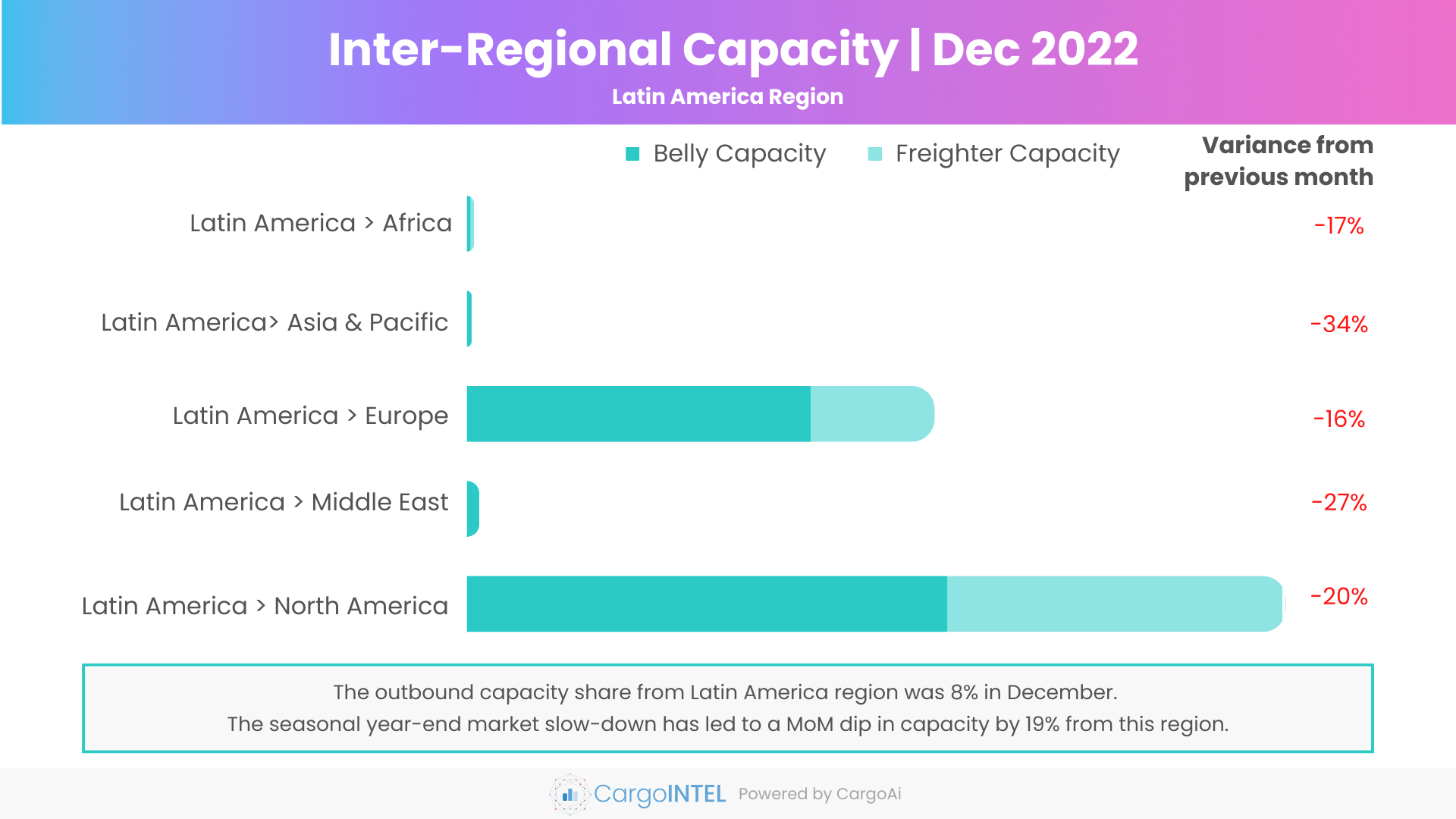

Latin America Region

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Latin America | 0.8 | -17% |

| Latin America | 0.5 | -34% |

| Latin America | 54.7 | -16% |

| Latin America | 1.4 | -27% |

| Latin America | 95.9 | -20% |

Observations

- A double-digit reduction in outbound capacity by 19% has also been observed from Latin America region which has remained stable for most months in the second half of 2022.

- The overall capacity from the region reduced from 189K MT in November to 153K MT in December.

- The major difference was observed due to the severe reduction in freighter capacity from Latin America to North America by 31% and Europe by 22%. The overall freighter capacity from Latin America reduced by 29% from 76K MT in November to 55K MT in December.

- The decrease in freighter capacity is in synch with the 37% decline in tonnages recorded for December, owing to the Christmas and New Year holidays.

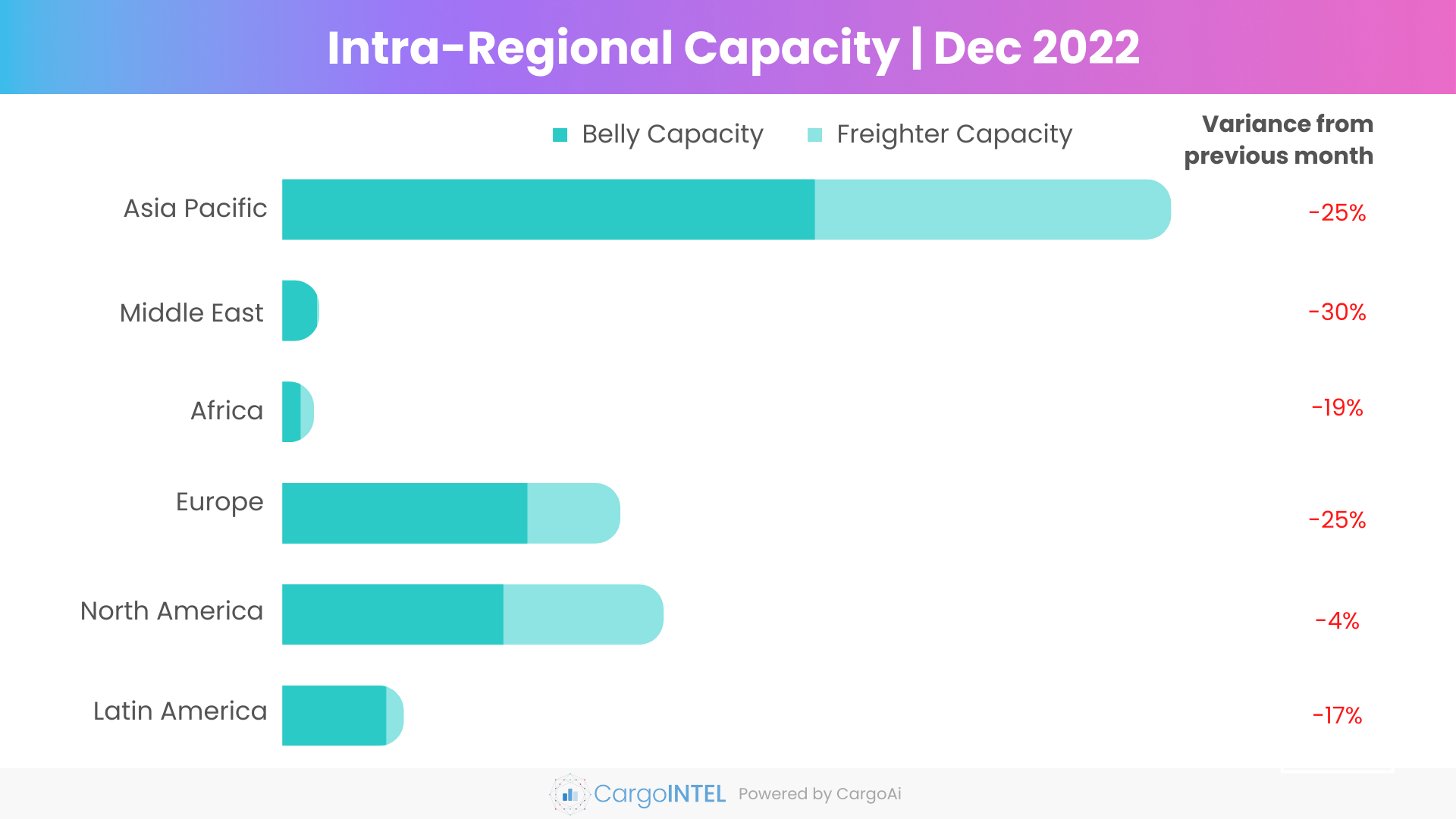

Top Intra-Regional Cargo Capacity

| Region | Capacity in Dec 2022 (100k tons) | Variance vis-a-vis Dec 2022 |

|---|---|---|

| Asia & Pacific | 1607.9 | -25% |

| Middle East | 65.9 | -30% |

| Africa | 56.5 | -19% |

| Europe | 611.1 | -25% |

| North America | 218.9 | -17% |

| Latin America | 689.3 | -4% |

Observations

- The intra-regional capacity within all major regions have reduced significantly in December as compared to the positive signs seen in the previous month, caused by the reducing demand and volumes.

- The capacity slumped within Asia-Pacific by 14% in December to 2144K MT from 2480K MT in October, as a result of the non-operation of flights by most widely used Chinese carriers within the region like Air China.

- The Tropical Storm Nicole in early December causing several flight cancellations, and the flight disruptions recorded during the Thanksgiving rush, led to major reduction in capacity within the region. CargoINTEL recorded a MoM reduction by 41% from 1220K MT in October to 717K MT in December.

- Europe region continues to suffer reduction in demand and cargo volumes due to the Ukraine war. The overall capacity recorded in December (814K MT) is down by 29% as compared October (1152K MT).

- The intra-regional capacity within Middle-East also recorded an all-time low during the year of -40% due to the decreasing volumes.

Air Cargo Global chargeable weight analysis

Observations

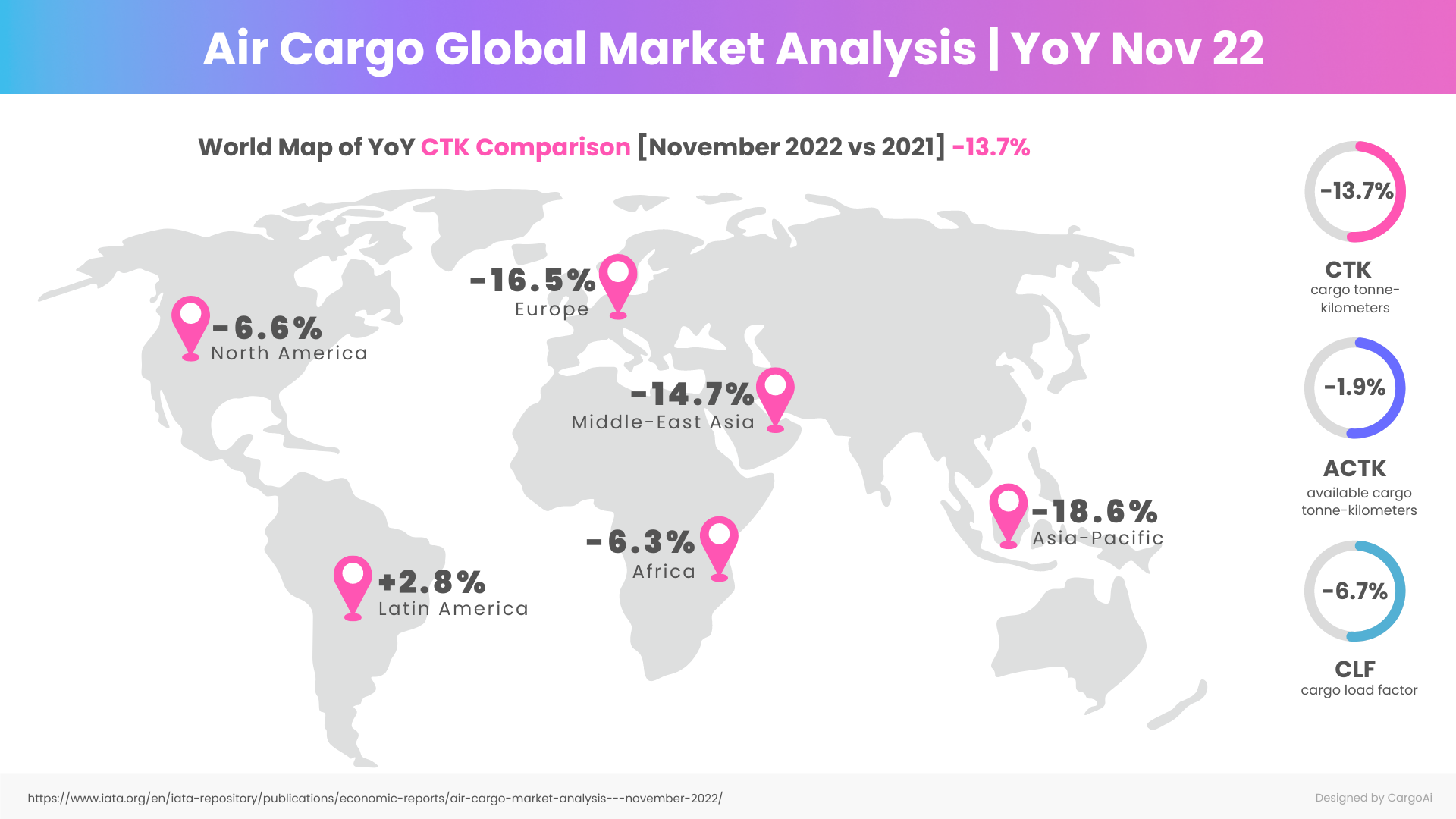

- The air cargo demand measured in CTK (Cargo Tonne-Kilometres) recorded by IATA in November 2022 was 20.6 billion as compared to 21.0 billion in October. The demand fell by 13.7% YoY when compared to the same period in 2021.

- The ACTK (Available Cargo Tonne-Kilometres) was low by 1.9% November as compared to the same period previous year, and has fallen for the second consecutive month since April 2022.

- The new export orders remained below 50 line for major economies which is a worrying factor for air cargo. Globally the export orders are continually decelerating on an average.

- The reduced capacity globally corresponds to the demand and supply imbalance.

- The seasonally adjusted cargo load factor (CLF) is going down month-on-month for the fourth month since August, which was recorded 47.2% in November.

- www.worldacd.com

- https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis---november-2022/

- https://www.cnbc.com/2022/12/24/winter-storms-force-airlines-to-cancel-10000-flights.html

- https://www.cnbc.com/2022/12/22/winter-storm-forces-airlines-to-cancel-hundreds-of-flights-christmas-week.html

- https://www.forbes.com/sites/ceciliarodriguez/2022/12/16/christmas-in-europe-travel-chaos-looms-as-air-and-rail-strikes-spread-full-list/?sh=292551175d7a

- https://www.euronews.com/travel/2022/12/28/a-full-list-of-the-strikes-set-to-cause-travel-disruption-across-europe-in-december

- https://www.euronews.com/travel/2022/12/14/flights-to-and-from-the-uk-face-continued-disruption-due-to-snow-here-are-the-latest-cance

- https://www.businessinsider.in/international/news/southwest-airlines-holiday-meltdown-turns-apocalyptic-as-2-out-of-every-3-southwest-flights-get-cancelled-leaving-thousands-stranded/articleshow/96530319.cms

- https://simpleflying.com/african-aviation-2022/

- https://edition.cnn.com/2022/12/24/business/travel-delays-holidays/index.html

RECENT POSTS