Capacity Statistics - August 2022

The air cargo capacity statistics report of August 2022 is ready with the key facts and figures of inter-regions and intra-regions in comparison to the previous month. CargoINTEL provides you with the real-time market and industry intelligence data, to empower you to make informed decisions.

Highlights

- The conclusions drawn for the first half of the year states that the global capacity and volumes have generally remained healthy, despite some setbacks from major hubs like the lockdowns in China and the disruptions caused by Russia-Ukraine war.

- The year 2021 was relatively a robust year for cargo, after the pandemic slump. Looking at the trend and the positive signs like reinstating of scheduled flights by most airlines globally in 2022 and the increasing demand, the year should have grown YOY. However, except for the first quarter of 2022, the consequent months until August have shown a downward shift in terms of volumes as per WACD data. Unlike last year, this year there seems to be an increase in supply but a dip in demand.

- The most notable deviations are from Asia Pacific to Europe, Middle East and North America. The reduction in capacity is most significantly proportional to the downward trend of volumes from North Asian countries like China, Hong Kong, Taiwan, Japan, South Korea.

- The downswing of volumes from North Asia may be attributed to reasons like China’s prolonged shutting down, sanctions arising due to Russia-Ukraine war, easing of ocean freight congestion leading to preference of movement by ocean, and most importantly the seasonal plummeting of the markets.

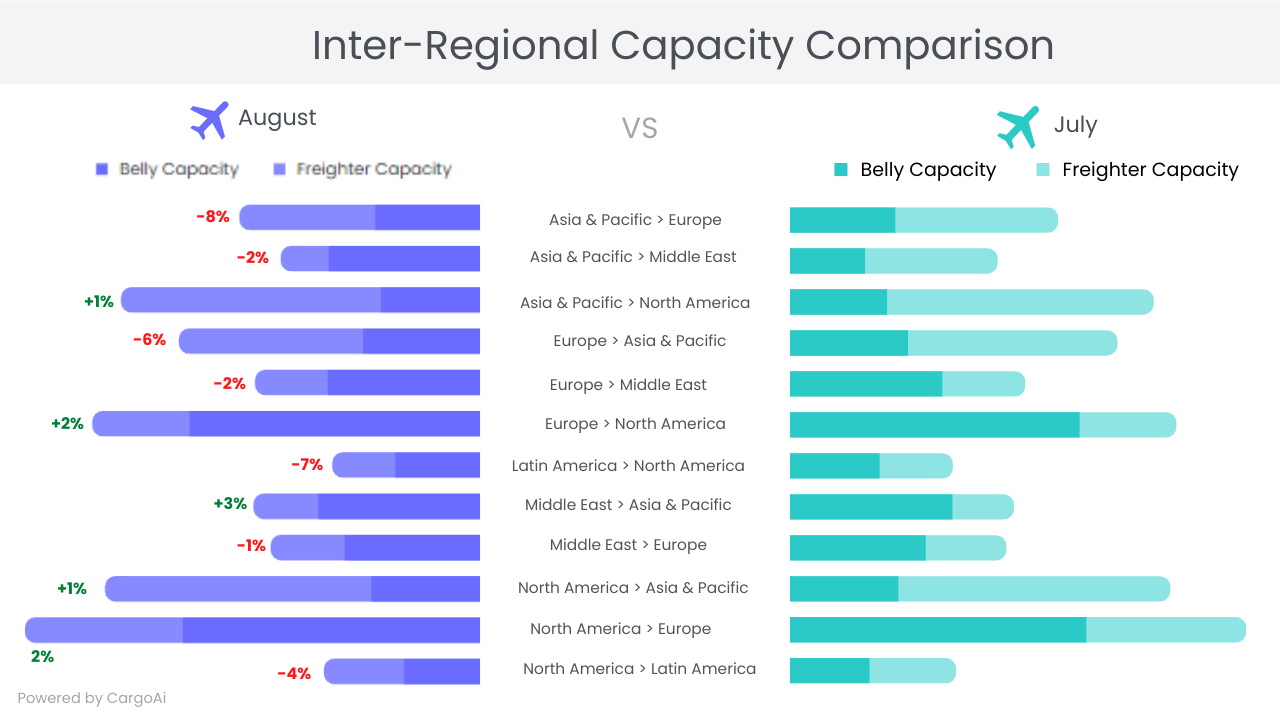

Top Inter-Regional Cargo Capacity

| Region | Capacity in August 2022 (100k tons) | Variance vis-a-vis August 2022 |

|---|---|---|

| Asia & Pacific | 184.17 | -0.08% |

| Asia & Pacific | 152.5 | -0.02% |

| Asia & Pacific | 274.84 | 0.01% |

| Europe | 230.51 | -0.06% |

| Europe | 172.2 | -0.02% |

| Europe | 296.83 | 0.02% |

| Latin America | 112.9 | -0.07% |

| Middle East | 173.4 | 0.03% |

| Middle East | 160.2 | -0.01% |

| North America | 287.13 | 0.01% |

| North America | 348.47 | 0.02% |

| North America | 119.4 | -0.04% |

Observations

- In August 2022, MOM downshift in capacity has been observed for most inter-regions.

- There is a phenomenal increase in belly capacity from Asia Pacific to Middle East from 56.3 MT in July 2022 to 115.7 MT in Aug 2022. Also, there is a capacity increase of 3% vice versa from the Middle-East to Asia Pacific.

- The lifting of travel restrictions from most parts of Asia Pacific and the increasing passenger travel measured in revenue passenger kilometers (RPK) which is growing MOM, has made way for scheduled flights between the regions being reinstated.

- This has led to many Middle-Eastern carriers increasing their frequency from the Asia Pacific regions. Some of the notable additions are from BKK-JED daily flights of Thai Airways, BOM-BAH daily by Indigo, BOM-JED by Vistara to mention a few.

- On the other hand, the freighter capacity from Asia Pacific to Middle-East has reduced MOM from to 36.8 MT from 99.4 MT in July 2022, and from Asia Pacific to Europe has gone down from 122 MT in July 2022 to 104 MT in August 2022.

- This is mainly due to the falling air freight rates, decreasing yields and increasing fuel prices in August 2022, that is hampering cost-factor for the operation of cargo aircraft.

- The capacity from Middle-East to Europe has remained stable from July to August 2022. However, we can expect some increase in capacity in September 2022 with airlines like Wizz Air launching 20 new routes from Saudia to Europe; Flynas and Iraq-based airline FlyErbil rolling out new routes in Europe.

- Meanwhile, more freighter purchase and additions by airlines like Singapore Airlines (SIA) and their recent B777 freighter capacity addition in partnership with DHL Express from Singapore to US, will lead to increase of freighter capacity from Asia Pacific to US.

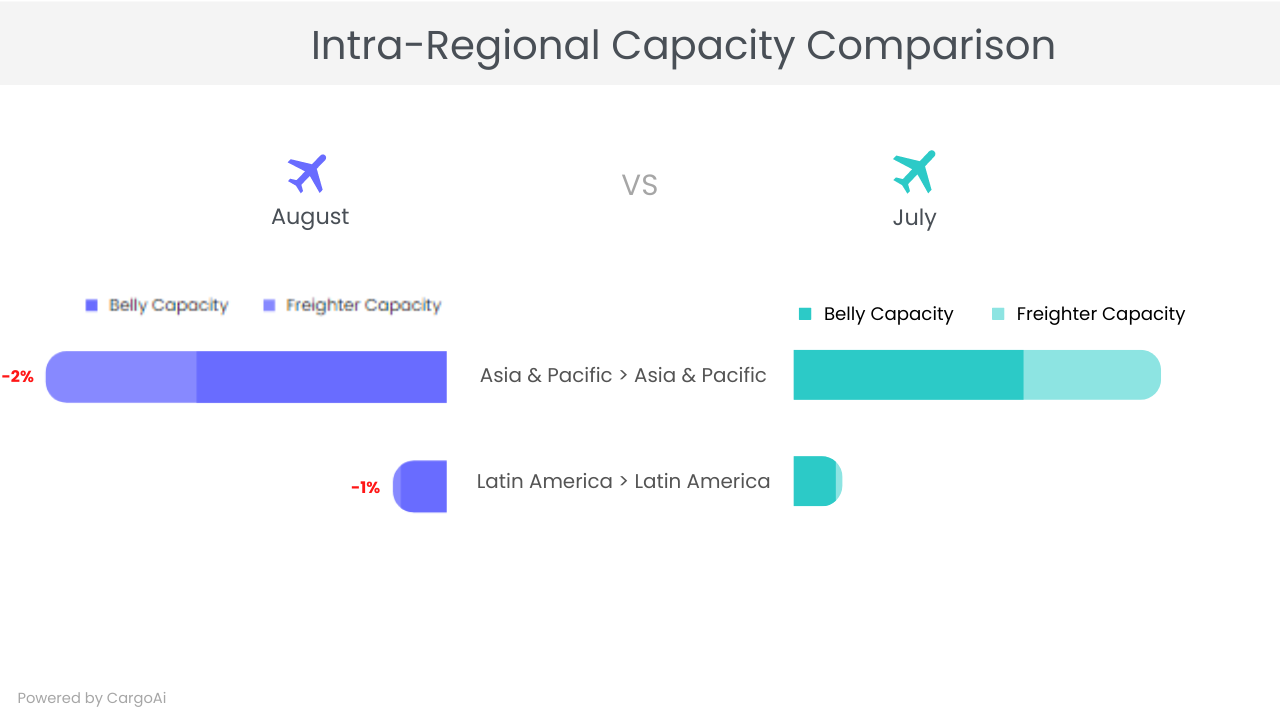

Top Intra-Regional Cargo Capacity

| Region | Capacity in August 2022 (100k tons) | Variance vis-a-vis August 2022 |

|---|---|---|

| Asia & Pacific | 2472 | -0.02% |

| Latin America | 328.9 | -0.01% |

Observations

- The biggest overall intra-regional capacities that are within Asia Pacific and Latin America have remained practically the same as compared to the previous month.

- There is slight reduction in belly capacity month-on-month within the Asia Pacific region from 1585MT in July 2022 to 1542MT in August 2022 and freighter capacity from 948 MT in July 2022 to 930 MT in Aug 2022; mainly caused by the flight cancellations and other unplanned change of aircrafts.

- Within the Latin American region, while the belly capacity remains nearly unchanged, the freighter capacity has increased from 44.7 MT in July 2022 to 48.5 MT in August 2022; which can be attributed to the high demand in volumes from Mexico to Brazil and the increase in load factor of freighter carriers like LATAM Cargo by almost 55%.

- We can expect the capacity to increase in September 2022, due to the increasing demand of cargo within Latin American region and also with the increase in scheduled belly capacity like the addition of flights and frequency by Brazil’s GOL, LATAM Cargo and Costa Rica Green Airways.

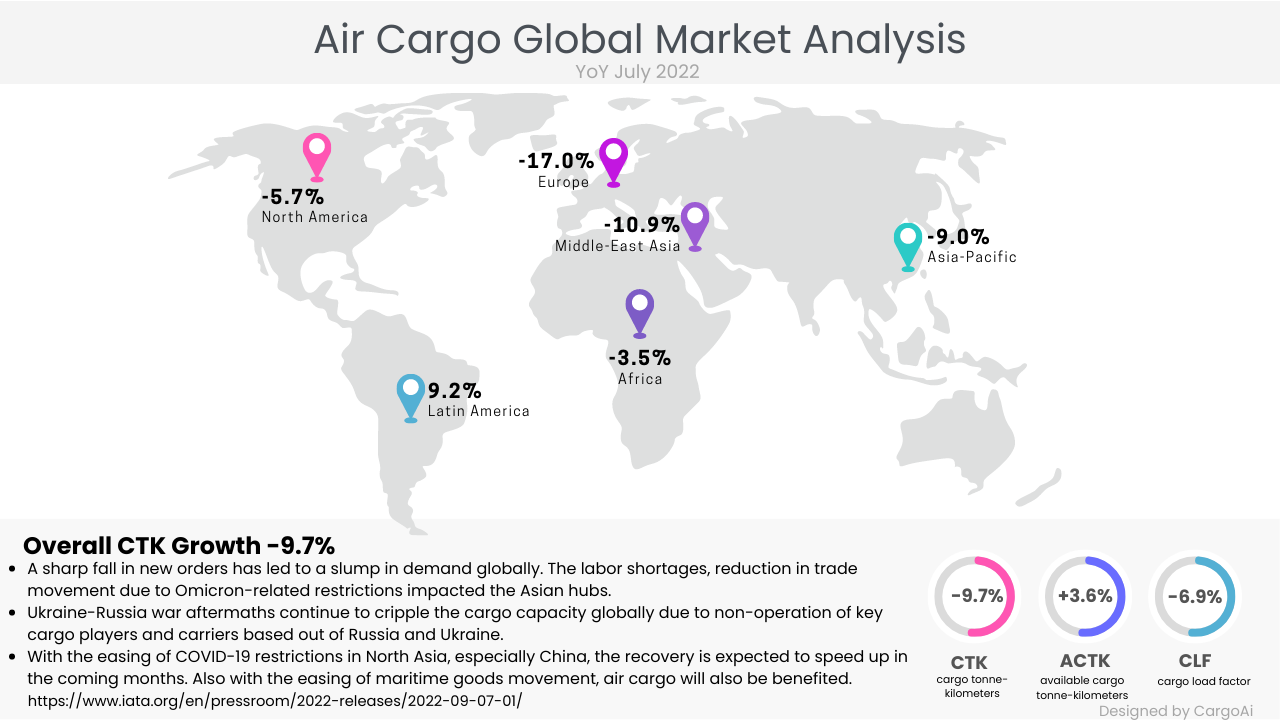

Air Cargo Global chargeable weight analysis

Observations

- Cargo tonne-kilometers (CTKs) contracted by 2.3% in July as compared to June 2022, whereas it declined by 9.7% YoY as compared to July 2021. On the other hand, Available cargo tonne-kilometers (ACTKs) hiked by 3.6% YoY, thereby impacting the load factors in July 2022.

- CTK in Asia Pacific fell by 9% YoY in July 2022. As fallout to the Omicron related lockdowns, the trend in CTK can be noted in the consecutive months as well. The only region that showed a YoY increase in air cargo volumes was Latin America in July 2022, up by 9.2%.

- The next few months of the year are anticipated to have mixed effects. On one hand, the easing of restrictions in China giving way to streamlining of maritime cargo movement would facilitate improvement in global supply chains, thus supportive for air cargo volumes in coming months. On the other hand, high inflation and surging interest rates are anticipated to have a negative impact on demand and a price war leading to dampening of yields.

Resources:

- https://www.aircargonews.net/airlines/freighter-operator/dhl-express-and-singapore-airlines-partnership-grows-with-b777f/

- https://www.aircargonews.net/airlines/freighter-operator/emirates-skycargo-to-expand-freighter-capacity-and-launch-new-china-services/

- https://www.aircargonews.net/airlines/freighter-operator/etihad-airways-firms-up-order-for-seven-airbus-a350f-freighters/

- https://english.aawsat.com/home/article/3837646/saudi-arabia-launches-20-new-flight-routes-europe

- https://www.routesonline.com/news/29/breaking-news/298522/routes-in-brief-rolling-daily-updates-wc-aug-22-2022/

- https://tact.iata.org/aircargodashboards/carrier

- https://www.latamairlinesgroup.net/news-releases/news-release-details/latam-airlines-group-reports-preliminary-monthly-statistics-90

- https://www.iata.org/en/pressroom/2022-releases/2022-09-07-01/

RECENT POSTS